☐ |

Preliminary Proxy Statement | |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

☒ |

Definitive Proxy Statement | |

☐ |

Definitive Additional Materials | |

☐ |

Soliciting Material under §240.14a-12 | |

☒ |

No fee required. | |||

☐ |

Fee paid previously with preliminary materials. | |||

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| Herbalife Ltd.

2024 Proxy Statement

|

Annual General Meeting of Shareholders

Our 2024 Annual General Meeting of Shareholders

will be held on Thursday, April 25, 2024 at 8:30 a.m., Pacific Daylight Time, at

800 W. Olympic Blvd., Suite 406

Los Angeles, CA 90015

Admission requirements

See Part 1 – “Information concerning solicitation and voting” for details on admission requirements to attend the Annual General Meeting.

Proxy voting options

Your vote is important!

All shareholders are cordially invited to attend the Annual General Meeting. However, in order to assure your representation at the Annual General Meeting, you are urged to vote promptly. You may vote your shares via a toll-free telephone number, over the Internet or by completing, signing and mailing the proxy card or voting instruction form provided to you. Please follow the instructions on the proxy card or voting instruction form.

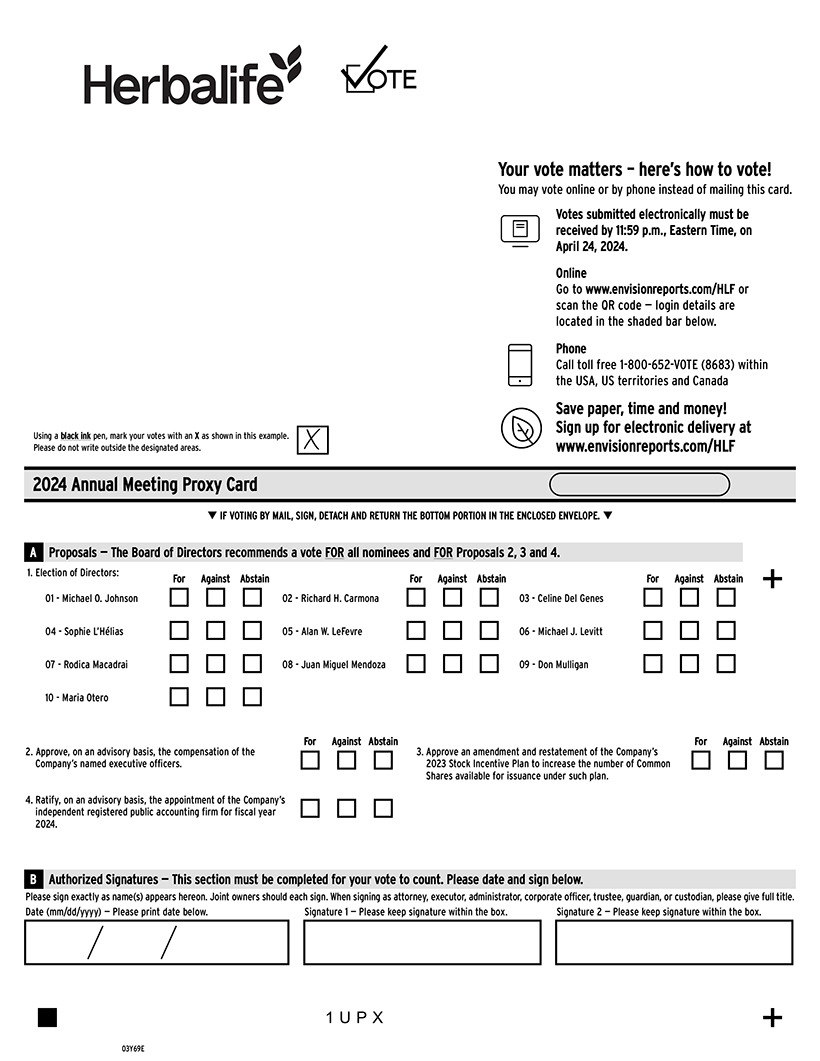

Proxies submitted by mail, the Internet or telephone must be received by 11:59 p.m., Eastern Time, on April 24, 2024.

Vote by internet

www.envisionreports.com/HLF

24 hours a day / 7 days a week

Instructions:

| 1. | Go to: www.envisionreports.com/HLF. |

| 2. | Follow the steps outlined on the secure website. |

Vote by telephone

1.800.652.VOTE (8683) via touch tone phone

toll-free within the USA, US territories & Canada 24 hours a day / 7 days a week

Outside the USA, US territories & Canada, call 1.781.575.2300 via a touch tone phone. Standard rates will apply.

Instructions:

| 1. | Call toll-free 1.800.652.VOTE (8683) within the USA, US territories & Canada. Outside the USA, US territories & Canada, call 1.781.575.2300. |

| 2. | Follow the instructions provided by the recorded message. |

Herbalife Ltd.

Notice of Annual General Meeting of Shareholders

| Date: | Thursday, April 25, 2024 | |

| Time: | 8:30 a.m., Pacific Daylight Time | |

| Place: | 800 W. Olympic Blvd., Suite 406 Los Angeles, CA 90015 | |

| Record date: | February 27, 2024 | |

| Proxy voting: | All shareholders are cordially invited to attend the Annual General Meeting. See Part 1 — “Information concerning solicitation and voting” for details on admission requirements to attend the Annual General Meeting.

However, to assure your representation at the Annual General Meeting, you are urged to vote promptly. You may vote your shares via a toll-free telephone number, over the Internet or by completing, signing and mailing the proxy card or voting instruction form provided to you. Please follow the instructions on the proxy card or voting instruction form provided to you. | |

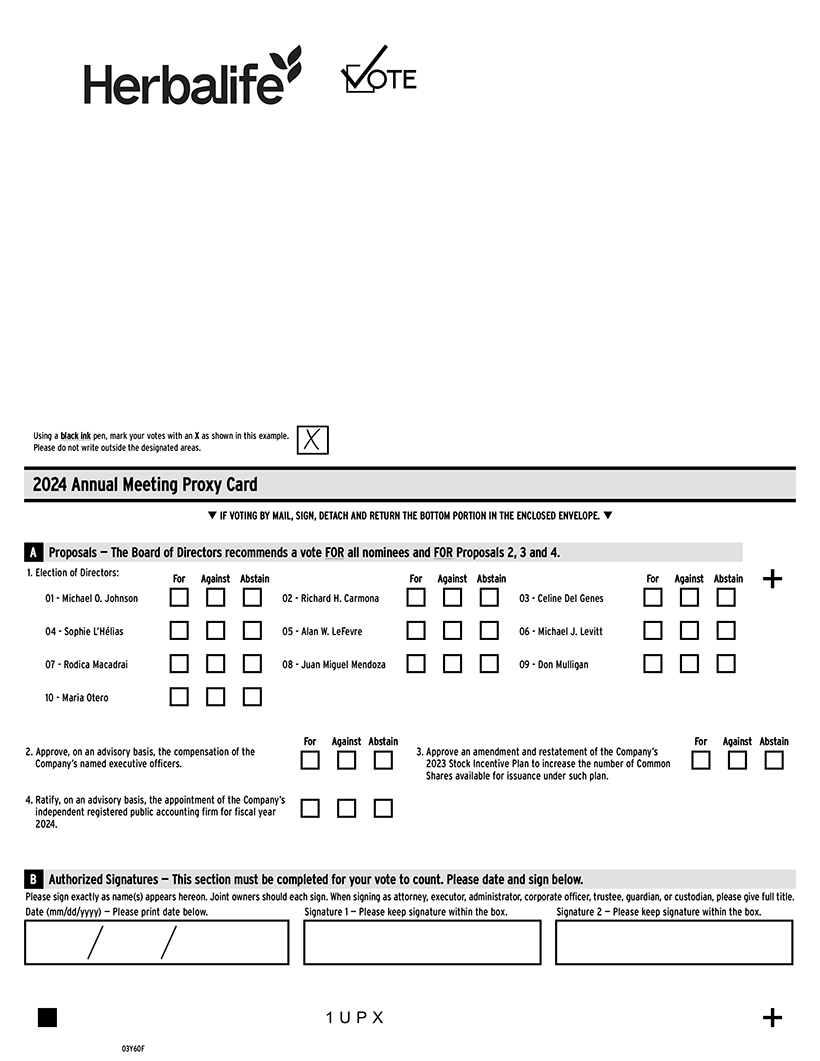

| Items of business: | 1. Elect each of the 10 director nominees named in the Proxy Statement to the Board of Directors to serve until the 2025 annual general meeting of shareholders of the Company or until their successors are duly elected and qualified;

2. Approve, on an advisory basis, the compensation of the Company’s named executive officers;

3. Approve an amendment and restatement of the Company’s 2023 Stock Incentive Plan to increase the number of Common Shares available for issuance under such plan; and

4. Ratify, on an advisory basis, the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year 2024.

Shareholders will also transact such other business as may properly come before the Annual General Meeting and at any adjournments or postponements of the Annual General Meeting. | |

| The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only shareholders of record at the close of business on February 27, 2024 are entitled to notice of, and to vote at, the Annual General Meeting and any subsequent adjournment(s) or postponement(s) thereof. | ||

| Availability of materials: |

On or about March 14, 2024, we began mailing a Notice of Internet Availability of Proxy Materials to our shareholders. The Proxy Statement and Annual Report to Shareholders are available at http://www.edocumentview.com/HLF. | |

NOTICE IS HEREBY GIVEN that the 2024 Annual General Meeting of Shareholders of Herbalife Ltd., a Cayman Islands exempted company incorporated with limited liability, will be held on Thursday, April 25, 2024 at 8:30 a.m., Pacific Daylight Time, at 800 W. Olympic Blvd., Suite 406, Los Angeles, CA 90015.

Sincerely,

HENRY C. WANG

General Counsel and Corporate Secretary

Los Angeles, California

March 12, 2024

Proxy summary

The following is a summary of certain key disclosures in our Proxy Statement. This is only a summary, and it does not contain all the information that is important to you. For more complete information, please review the Proxy Statement as well as our 2023 Annual Report, which includes our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. References to “Herbalife,” “the Company,” “we,” “us” or “our” refer to Herbalife Ltd.

| Proposals to be Voted on and Board Voting Recommendations | ||||||

| Proposals |

More Information |

Board’s Voting Recommendation | ||||

| Proposal 1 |

Election of Directors | Page 16 | FOR EACH NOMINEE | |||

| Proposal 2 |

Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers | Page 26 | FOR | |||

| Proposal 3 |

Approve an amendment and restatement of the Company’s 2023 Stock Incentive Plan to increase the number of Common Shares available for issuance under such plan | Page 27 | FOR | |||

| Proposal 4 |

Ratification, on an advisory basis, of PricewaterhouseCoopers LLP as the Company’s Independent Registered Public Accounting Firm for Fiscal Year 2024 | Page 34 | FOR | |||

2024 Director Nominees

| Committees | ||||||||||

| Name |

Independent | Audit | Compensation | Nominating and Corporate |

ESG | |||||

| Michael O. Johnson (Chairman and CEO) |

|

|

|

|

| |||||

| Richard H. Carmona |

|

|

|

Chair |

| |||||

| Celine Del Genes |

|

|

● |

|

| |||||

| Sophie L’Hélias |

|

● |

|

|

Chair | |||||

| Alan W. LeFevre (Lead Director) |

|

● |

|

● |

| |||||

| Michael J. Levitt |

|

|

|

|

| |||||

| Rodica Macadrai |

|

|

|

|

| |||||

| Juan Miguel Mendoza |

|

|

|

|

● | |||||

| Don Mulligan |

|

Chair | ● |

|

| |||||

| Maria Otero |

|

|

Chair | ● | ● | |||||

| Proxy summary |

Corporate Governance Highlights

|

All director seats stand for election annually |

|

Independent lead director with clearly defined duties and responsibilities |

|

One vote per share |

|

Majority voting standard for uncontested director elections |

|

ESG (Environmental, Social & Governance) Committee provides direct board oversight of environmental and social sustainability |

|

Robust share ownership guidelines for directors and named executive officers |

|

Annual board and committee assessments |

Executive Compensation Highlights

|

Incentive design links pay outcomes to Company share price performance and against preset goals |

|

Balanced mix between fixed and variable compensation and short- and long-term incentives |

|

Annual say-on-pay advisory vote |

|

Compensation risk assessment |

|

Robust share ownership guidelines for named executive officers |

|

“Double trigger” change in control |

|

Clawback policy applicable to Section 16 officers applicable to cash and equity incentives |

|

Anti-hedging and anti-pledging policies applicable to all employees |

This proxy statement includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts, including statements regarding our environmental and other sustainability plans and goals, made in this document are forward-looking. We use words such as anticipates, believes, expects, future, intends, and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Actual results or outcomes could differ materially for a variety of reasons. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our 2023 Annual Report on Form 10-K. In addition, historical, current, and forward-looking sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future. Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

| Proxy summary |

Proxy Statement table of contents

| Part 1. Our annual general meeting of shareholders | ||||

| 1 | ||||

| Part 2. Corporate governance | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 8 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 14 | ||||

| 15 | ||||

| Part 3. Proposals to be voted on at the meeting | ||||

| 16 | ||||

| 26 | ||||

| 27 | ||||

| 34 | ||||

| Part 4. Executive compensation | ||||

| 36 | ||||

| 37 | ||||

| 37 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 39 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 42 | ||||

| Role of executive officers in executive compensation decisions |

42 | |||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 49 | ||||

| 49 | ||||

| 51 | ||||

| 51 | ||||

| 51 | ||||

| 52 | ||||

| 53 | ||||

| Narrative disclosure to summary compensation table and grants of plan-based awards |

54 | |||

| 55 | ||||

| i |

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 61 | ||||

| 62 | ||||

| Part 5. Security ownership of certain beneficial owners and management | ||||

| 66 | ||||

| Part 6. Certain relationships and related transactions | ||||

| 68 | ||||

| 69 | ||||

| Part 7. Additional information | ||||

| 70 | ||||

| 70 | ||||

| 71 | ||||

| 71 | ||||

| 71 | ||||

| 72 | ||||

| ii | Table of Contents |

| Part 1

|

Our annual general meeting of |

Information concerning solicitation and voting

Place, time and date of meeting. This Proxy Statement is being furnished to the Company’s shareholders in connection with the solicitation of proxies on behalf of our Board of Directors, or the Board, for use at the 2024 Annual General Meeting of Shareholders, or the Meeting, to be held on Thursday, April 25, 2024 at 8:30 a.m., Pacific Daylight Time, and at any subsequent adjournment(s) or postponement(s) thereof, for the purposes set forth herein and in the accompanying Notice of Annual General Meeting of Shareholders. The Meeting will be held at 800 W. Olympic Blvd., Suite 406, Los Angeles, CA 90015. Our telephone number is (213) 745-0500. On or about March 14, 2024, we began mailing a Notice of Internet Availability of Proxy Materials to our shareholders. The Proxy Statement and Annual Report to Shareholders are available at http://www.edocumentview.com/HLF.

Record date and voting securities. Only shareholders of record at the close of business on February 27, 2024, or the Record Date, or duly authorized proxy holders of such shareholders of record, are entitled to notice of, and to vote at, the Meeting. The Company has one series of common shares, or Common Shares, outstanding. Each owner of record on the Record Date is entitled to one vote for each Common Share held by such shareholder. On February 27, 2024, there were 99,786,663 Common Shares issued and outstanding.

Voting. Each shareholder is entitled to one vote for each Common Share held on the Record Date on all matters submitted for consideration at the Meeting. A quorum, representing the holders of not less than a majority of the issued and outstanding Common Shares entitled to vote at the Meeting, must be present in person or by proxy at the Meeting for the transaction of business. Common Shares that reflect abstentions are treated as Common Shares that are present and entitled to vote for the purposes of establishing a quorum, but will have no effect determining the outcome of any proposal.

If you are a beneficial owner of Common Shares held in street name and do not provide the bank, broker or other nominee that holds your shares with specific voting instructions, the nominee may generally vote in its discretion on “routine” matters. However, if the nominee that holds your Common Shares does not receive instructions from you on how to vote your shares on a “non-routine” matter, it will be unable to vote your shares on that matter, and in some cases may elect not to vote on any of the proposals unless you provide voting instructions. If you do not provide voting instructions and the broker elects to vote your shares on some but not all matters, it is generally referred to as a “broker non-vote” for the matters on which the broker does not vote. Common Shares that reflect “broker non-votes” are treated as Common Shares that are present and entitled to vote for the purposes of establishing a quorum. However, for the purposes of determining the outcome of any matter as to which the broker or nominee has indicated on the proxy that it does not have discretionary authority to vote, those Common Shares will be treated as not present and not entitled to vote with respect to that matter, even though those Common Shares are considered present and entitled to vote for the purposes of establishing a quorum and may be entitled to vote on other matters.

See “Meaning of shareholder of record” below for additional information regarding the different ways you may hold your Common Shares.

Votes required for proposals and Board recommendations. The following table details information regarding the proposals to be voted on at the Meeting, the Board’s recommendation on how to vote on each proposal, the votes required to approve each proposal and the effect of abstentions and broker non-votes.

| Our annual general meeting of shareholders | 1 |

| Proposal |

Voting Options | Board

|

Vote Required

|

Effect of

|

Effect of

| |||||

| Item 1: Elect each of the 10 director nominees named in the Proxy Statement to the Board of Directors to serve until the 2025 annual general meeting of shareholders of the Company or until their successors are duly elected and qualified |

For, Against or Abstain on each nominee | FOR each nominee | Majority of votes cast with respect to each nominee |

No effect |

No effect | |||||

| Item 2: Approve, on an advisory basis, the compensation of the Company’s named executive officers |

For, Against or Abstain | FOR | Majority of shares represented in person or by proxy and entitled to vote and which do vote |

No effect |

No effect | |||||

| Item 3: Approve an amendment and restatement of the Company’s 2023 Stock Incentive Plan to increase the number of Common Shares available for issuance under such plan |

For, Against or Abstain | FOR | Majority of shares represented in person or by proxy and entitled to vote and which do vote |

No effect |

No effect | |||||

| Item 4: Ratify, on an advisory basis, the appointment of PricewaterhouseCoopers LLP as the Company’s independent registered public accounting firm for fiscal year 2024 |

For, Against or Abstain | FOR | Majority of shares represented in person or by proxy and entitled to vote and which do vote |

No effect |

Brokers have discretion to vote | |||||

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Meeting, please take the time to vote. You may vote your shares via a toll-free telephone number, over the Internet or by completing, signing and mailing the proxy card or voting instruction form provided to you. Please follow the instructions on the proxy card or voting instruction form.

Revocability of proxies. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by either: (a) delivering to the Corporate Secretary of the Company a written notice of revocation or a duly executed proxy bearing a later date; (b) granting a subsequent proxy through the Internet or telephone; or (c) attending the Meeting and voting in person. However, please note that if you would like to vote at the Meeting and you are not the shareholder of record, you must request, complete and deliver a proxy from your broker or other nominee.

Proxy solicitation. The Company bears the expense of printing and mailing proxy materials. Proxies may be solicited by certain of our directors, officers and employees, without additional compensation, in person, by telephone, facsimile or electronic mail. We will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of Common Shares.

| 2 | Our annual general meeting of shareholders |

Meeting attendance. Only shareholders of record and beneficial owners as of the Record Date, their authorized proxy holders, and invited guests of the Board of Directors may attend the Meeting. Each shareholder may appoint only one proxy holder or representative to attend the meeting on his or her behalf.

If you are a shareholder of record, in order to be admitted to the Meeting, you will need to produce a valid government issued picture identification (such as a valid driver’s license or passport) and either a copy of a form of proxy card or a Notice of Internet Availability of Proxy Materials showing your name and address. If you are a beneficial owner and you wish to vote in person at the Meeting, you will need to obtain a proxy from the shareholder of record. Additionally, if you are a beneficial owner or other authorized proxy holder, in order to attend the Meeting, you will need both an admission ticket and a valid government issued picture identification (such as a valid driver’s license or passport). To obtain an admission ticket to the Meeting, please send your written request to our Corporate Secretary at c/o Herbalife International of America, Inc., 800 W. Olympic Blvd., Suite 406, Los Angeles, California 90015 or electronically by emailing corpsec@herbalife.com.

Your request for an admission ticket must be received on or before April 15, 2024 and include a copy of a proxy card or voting instruction form confirming your appointment as a proxy holder of a shareholder of record. In your request, please include the address where your admission ticket should be mailed to, and any special assistance needs. The Board requests that persons attending the Meeting observe a professional business dress code. The Company also does not permit the use of cameras or other recording devices at the Meeting.

In continued support for the health and safety of all, and to continue to enhance shareholder accessibility, the Company will again hold a live listen-only audio webcast of the Meeting. Shareholders may listen to the Meeting via live audio webcast by logging on to www.meetnow.global/MHJ9FPD using your control number. Please see below:

| • | Shareholders of record: For shareholders of record, the control number can be found on your proxy card or Notice, or the email you receive from Computershare, the Company’s transfer agent. |

| • | Beneficial owners: If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to access the live audio webcast. To register, you must submit proof of your proxy power (legal proxy) reflecting your Herbalife holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal |

| Proxy” and be received no later than 5:00 p.m., Eastern Time on April 22, 2024. You will receive a confirmation email of your registration from Computershare. Late submissions will be processed to the extent feasible, but registration cannot be guaranteed in time for the Meeting. Requests for registration should be directed to us at the following: |

By email: Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail: Computershare, Herbalife Legal Proxy, P.O. Box 43001, Providence, RI 02940-3001.

Pursuant to the Company’s Amended and Restated Memorandum of Articles of Association, or the Articles, please be advised that shareholders will not be deemed to be “present” for quorum purposes and will not be able to vote their shares, or revoke or change a previously submitted vote, by logging onto the listen-only audio webcast of the Meeting. As a result, the Company strongly urges shareholders to submit their proxies or votes in advance of the Meeting.

In the event it is not possible or advisable to hold our Meeting in person as currently planned, we will announce the decision to do so via a press release and posting details on our website that will also be filed with the Securities and Exchange Commission, or the SEC, as proxy material. If you are planning to attend our Meeting, please check our Investor Relations website the week of the Meeting. As always, we encourage you to vote your shares prior to the Meeting.

Meaning of shareholder of record. You are a shareholder of record only if your name is recorded on the Company’s register of members. If your name is not recorded on the Company’s register of members, any shares you hold in the Company are held beneficially. In this case you may still be entitled to direct the holder of your shares as to who should be appointed as proxy in respect of those shares and/or how to vote those shares on your behalf.

Shareholders who have purchased their shares on an exchange may hold those shares through a depository, in which case they are beneficial shareholders and not shareholders of record. If you hold your shares in “street name,” you are not a shareholder of record.

If you wish to inquire as to whether or not you are a shareholder of record, please contact our Corporate Secretary at c/o Herbalife International of America, Inc., 800 W. Olympic Blvd., Suite 406, Los Angeles, California 90015 or electronically by emailing corpsec@herbalife.com.

| Our annual general meeting of shareholders | 3 |

Additional information. This Proxy Statement contains summaries of certain documents, but you are urged to read the documents yourself for complete information. The summaries are qualified in their entirety by reference to the complete text of the document. In the event that any of the terms, conditions or other provisions of any such document is inconsistent with or contrary to the description or terms

in this Proxy Statement, such document will control. Each of these documents, as well as those documents referenced in this Proxy Statement as being available in print upon request, are available upon written request to the Company by following the procedures described under Part 7 —“Annual report, financial and additional information.”

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to Be Held on April 25, 2024. The Proxy Statement and Annual Report to Shareholders are available at

| http://www.edocumentview.com/HLF. |

| 4 | Our annual general meeting of shareholders |

| Part 2

|

Corporate governance |

Director independence

Under the listing standards of the New York Stock Exchange, or the NYSE, a majority of the members of the Board must satisfy the NYSE criteria for “independence.” No director qualifies as independent under the NYSE listing standards unless the Board affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company).

The Board evaluates the independence of our directors annually and will review independence of individual directors on an interim basis as needed to consider changes in employment, relationships and other factors. Our Board has affirmatively determined that all of the directors, as well as each individual who served as a director at any time during 2023, other than Ms. Macadrai and Messrs. Johnson, Gratziani, Mendoza and Tartol, are or were independent in accordance with Section 303A.02 of the NYSE listing standards, or the NYSE Independence Standards. Under the NYSE Independence Standards, a director will not be considered independent in the following circumstances:

| • | the director has a material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company); |

| • | the director is, or has been within the last three years, an employee of the Company, or an immediate family member of the director is, or has been within the last three years, an executive officer of the Company; |

| • | the director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| • | (i) the director is a current partner or employee of a firm that is the Company’s internal or external auditor; (ii) the director has an immediate family member who is a current partner of such firm; (iii) the director has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit; or (iv) the director or an immediate family |

| member was within the last three years a partner or employee of such a firm and personally worked on the Company’s audit within that time; |

| • | the director or an immediate family member is, or has been with the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on that company’s compensation committee; and |

| • | the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues. |

Under the Company’s Principles of Corporate Governance, an independent director must, in addition to satisfying the NYSE Independence Standards, be free of any existing or potential professional or personal interest, business, or relationship which could, or could reasonably be perceived to, materially interfere with the director’s ability to act in the best interests of the Company and all its shareholders.

The Board considered Dr. Carmona’s independence in view of the $75,000 in speaking fees he received from the Company in 2023, as disclosed in the subsection “Compensation to directors.” The Company leverages Dr. Carmona’s professional experience as the 17th Surgeon General of the United States to provide training and education to Herbalife Members at various Company-sponsored sales, promotional, and training events. After consideration of the foregoing and other relevant factors, the Board determined that the Company’s engagement of Dr. Carmona for these limited services did not present a conflict of interest nor compromise Dr. Carmona’s independence from the Company.

Mr. Johnson was not determined independent because of his role as the Company’s Chief Executive Officer. Ms. Macadrai and Mr. Mendoza are not, and Messrs. Gratziani and Tartol were not, determined independent because each receives or received, as applicable, income for serving as top distributors of Herbalife products while

| Corporate governance | 5 |

serving as a director, thereby precluding them from being determined independent. None are or were employees of the Company during their respective service on the Board. For additional details regarding Ms. Macadrai’s and

Messrs. Gratziani’s, Mendoza’s and Tartol’s compensation as Herbalife Members, which they receive irrespective of any service on the Board, please see “Compensation to directors.”

Board meetings and attendance

The Board of Directors held ten meetings during fiscal year 2023. The independent directors generally meet in executive session at each regularly scheduled meeting, without the presence of management and non-independent directors, to discuss various matters relating to the Board’s function and Company oversight, including the Company’s management. The independent lead director, or the Lead Director, presides over such executive sessions.

Each director is expected to dedicate sufficient time, energy and attention to allow for the diligent performance of his or her duties, including attending the Company’s annual general meeting of the shareholders and meetings of the Board of Directors and committees of which he or she is a member. All directors attended at least 75% of the aggregate of all Board and applicable committee meetings held during the period that he or she served as a director. All members of the Board attended the Company’s 2023 annual general meeting of shareholders.

Board leadership

The Company’s governance framework provides the Board with the flexibility to select the appropriate leadership structure for the Company. The current leadership structure is comprised of a combined Chair of the Board and Chief Executive Officer, an independent Lead Director, Board committees led by independent directors and active engagement by all directors. The Board believes this structure best serves the interests of the Company and its shareholders. The combined Chair and CEO role supports the Board’s effective oversight of the Company’s business and strategy, with the CEO serving as a key link between the Board and management, providing a deep understanding of the Company’s business and operations, bringing key business considerations to the Board’s attention and leading implementation of the Company’s strategic plans as reviewed and approved by the Board. The Lead Director in turn allows for strong, independent Board leadership, with authority to set the meeting agendas and to lead sessions outside the Chair’s presence. We believe this to be a critical aspect of effective corporate governance.

The Lead Director is an independent director elected for a two-year term by the independent directors. The appointment is evaluated biannually. The Lead Director chairs the Board meetings during executive sessions and when the Chair is unable to participate in Board meetings. The Lead Director also serves as a contact point for major shareholders and third parties who wish to contact the Board independent of the Chair and CEO. The responsibilities of the Lead Director include:

| • | setting the agenda for and leading the regularly-held independent director sessions, and briefing the Chair on any issues arising from those sessions; |

| • | coordinating the activities of the independent directors; |

| • | presiding at meetings of the Board at which the Chair is not present, including executive sessions of the non-management and independent directors; |

| • | acting as the principal liaison to the Chair for the views, and any concerns and issues of, the independent directors; |

| • | advising on the flow of information sent to the Board, and reviewing the agendas, materials and schedules for Board meetings; |

| • | being available for consultation and communication with major shareholders, as appropriate; |

| • | maintaining close contact with the chair of each committee; and |

| • | performing other duties that the Board may from time to time delegate to assist the Board in the fulfillment of its responsibilities. |

Mr. LeFevre was elected to serve as Lead Director by the independent directors effective July 1, 2021, to serve until the Company’s 2023 Annual General Meeting of Shareholders, and was re-elected by the independent directors on April 27, 2023 to serve another two-year term through the Company’s 2025 Annual General Meeting of Shareholders. The Board periodically reviews the structure of the Board and Company leadership as part of the succession planning process.

| 6 | Corporate governance |

Annual Board and committee assessment process

The Board and each committee annually conduct self-evaluations, a process that is overseen by the Nominating and Corporate Governance Committee. Additionally, as part of our annual evaluation process, each director evaluates the Board and the committees on which he or she serves. The assessments provide directors and applicable committee members the opportunity to

provide feedback on a number of issues, including:

|

Board and committee structure, composition, roles and leadership; |

|

Board and committee function and effectiveness, including quality of materials, meetings and flow of information; and |

|

Access to management, advisors and internal and external resources. |

The Board’s role in risk oversight

The Board of Directors oversees the Company’s enterprise-wide approach to risk management. As part of executing its risk oversight responsibility, the Board delegates specific enterprise risk oversight duties to each Board committee, as set forth below, while maintaining direct oversight over other enterprise risks.

Audit Committee

| • | Integrity of the financial statements |

| • | Accounting and financial reporting matters and controls, including independent and internal auditors |

| • | Enterprise risk management program |

| • | Legal and regulatory risks and matters that may have material impact on the Company’s financial statements or operations |

| • | Major risks relating to cybersecurity, privacy and product safety matters, and steps management has taken to assess, monitor and control any such exposures |

| • | Quarterly updates from management on Company’s ethics and compliance and internal audit programs |

Compensation Committee

| • | Material risks arising from the Company’s compensation policies and practices, and evaluating such practices and policies to confirm that they do not encourage excessive risk-taking |

| • | Together with the ESG Committee, risks and opportunities related to human capital management |

Nominating and Corporate Governance Committee

| • | Corporate governance practices, Board composition, leadership and structure, and Board evaluations |

ESG Committee

| • | Risks related to environmental and social sustainability topics in connection with the Company’s activities |

| • | Together with the Compensation Committee, risks and opportunities related to human capital management |

The Board also provides oversight of management regarding key enterprise risks as well as the Company’s risk management policies and procedures so they are designed and implemented in a way that reflects the Board’s and management’s consensus as to appropriate levels of risk for specific aspects of the Company’s business. The Company’s Management Risk Committee is comprised of members of senior management who meet on a regular basis to serve as a forum for risk information sharing, and risk management coordination, decisioning and response. We believe the enterprise risk management program promotes timely, informed and data-driven decisions and integrated processes to identify, monitor and mitigate key enterprise risks.

Compensation risk assessment

The Compensation Committee, with the assistance of Meridian Compensation Partners, LLC, its compensation advisor, regularly conducts a review of the Company’s material compensation policies and practices applicable to its employees, including its executive officers. Based on this review, the Compensation Committee concluded that these policies and practices do not create risks that are

reasonably likely to have a material adverse effect on the Company. Key features of the executive compensation program that support this conclusion include: the balanced mix between fixed and variable compensation and short-and long-term incentives; the use of multiple performance measures within incentive plans; strong internal controls, including a code of conduct; Compensation Committee

| Corporate governance | 7 |

discretion over all final annual incentive awards and active involvement in setting performance targets; the use of

share ownership guidelines; and the existence of an anti-hedging policy, as well as clawback policy.

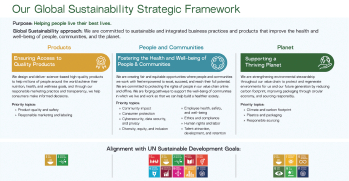

Sustainability highlights

Sustainability Approach

Our goals and objectives to help people and communities live their best lives and to improve the planet are part of both our day-to-day activities and our long-term growth strategy. We believe that focusing on sustainability initiatives relating to the reduction of operational emission and waste, as well as the health and safety of our people and communities in which we operate can bring value to our stakeholders, including our employees, Members, shareholders, and global communities in which we work and live.

Sustainability Governance Structure

|

ESG Committee of the Board of Directors: Assists the Board in overseeing our significant environmental, social, and related governance strategies, policies, programs, and practices and risks on environmental and social matters. The ESG Committee also provides insights to relevant trending issues under the purview of other committees, including the Audit, Nominating and Corporate Governance and Compensation Committees.

Executive Committee: Provides executive direction to promote integration of sustainability initiatives into business strategy across functions and regions. |

Steering Committee and Working Groups: Leads implementation of sustainability programs designed to meet goals and targets.

Sustainability Priorities

Our sustainability strategic framework is informed by periodic engagement with multiple stakeholders. We seek to prioritize sustainability areas that are important to the Company and, we believe, to stakeholders for business growth and risk management and integrate relevant programs into our business to make a measurable impact.

Planet

We are committed to supporting a thriving planet by making responsibly informed choices in an environment where natural resources are constrained. To that end, we seek to continue building on our environmental sustainability initiatives.

Climate and Carbon Footprint: We are committed to doing our part to reduce GHG emissions across our value chain to limit global warming to 1.5°C. We aim to set short- and long-term science-based targets to reduce GHG emissions using baseline data we are collecting.

Sustainable Packaging: Introduction of recycled plastic material in packaging contributes to circular packaging and helps reduce environmental impact. We have implemented projects to reduce virgin plastic by incorporating post-consumer recycled (PCR) materials into the packaging of our flagship product, Formula 1 Health Meal Nutritional Shake, distributed in multiple markets, where permitted by regulation. We are seeking additional opportunities across operations to reduce the amount of plastic used in packaging materials to help reduce cost and waste.

Responsible Sourcing: We are committed to sourcing materials responsibly with respect for people and the environment in which our materials and services originate. We have assessed our top direct suppliers, which represents 70% of our direct spend, across four pillars for

| 8 | Corporate governance |

responsible sourcing: environment, labor and human rights, ethics, and sustainable procurement. By the end of 2025, we aim to include 80% of suppliers representing our direct spend in our Responsible Sourcing program. Additionally, we aim to include 100% of soy and cocoa suppliers in the program, as we recognize that there are various sustainability-related risks associated with these materials. We plan to expand assessment of suppliers and work with those companies that require support and guidance.

People and Communities

We believe that our business thrives when our communities are healthy and empowered. From our employees and Independent Distributors to our suppliers and consumers, we are committed to protecting people’s rights and creating diverse, fair, and equitable opportunities.

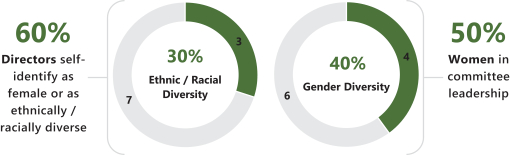

Diversity, Equity, and Inclusion: We are committed to diversity, equity, and inclusion at all levels, including our employees, management and executive leadership and Board of Directors. We believe our Diversity, Equity, and Inclusion (DEI) strategy fosters an environment of belonging in our workplace where employee voices are heard and welcomed; creating an employee workforce that is reflective of the distributors, the customers they serve and their communities, and ensuring equitable recruitment processes; and extending the Herbalife brand to the community in a demonstrative way to drive tangibility and relevancy with diverse segments. We have

further developed and involved our Global and Regional DEI councils to support our commitments to an inclusive workplace. Our DEI goals are overseen by the Board’s ESG and Compensation Committees. In 2023, our Board of Directors included approximately 60% women and ethnically underrepresented groups.

Community Impact: Our corporate social responsibility program focuses on supporting the health and well-being of people and global communities. Together with Herbalife Nutrition Foundation, we support nonprofit partners which include World Food Program USA, The Global FoodBanking Network, American Red Cross, and Feed the Children, among other leading regional and local nonprofit partners.

Herbalife Nutrition Foundation: Established in 1994, the Herbalife Nutrition Foundation (HNF) is a public charity. Its mission is to improve the lives of children and communities around the globe. In 2023, HNF gave approximately $5.5 million in grants to 178 community-based Casa Herbalife partners around the world.

Learn more about Sustainability at Herbalife

We are committed to transparency pertaining to sustainability policies, strategies, programs, and impact. Our annual sustainability scorecard and Global Sustainability Report are published in accordance with existing standard frameworks and can be found at https://ir.herbalife.com/esg.

| Corporate governance | 9 |

Compensation to directors

Each non-management director receives annual cash fees for service on the Board and committees* as follows:

| Board service |

$100,000 per year | |

| Audit Committee service |

Member - $10,000 per year Chair - $20,000 per year | |

| Compensation Committee service |

Member - $10,000 per year Chair - $15,000 per year | |

| Nominating and Corporate Governance Committee service |

Member - $10,000 per year Chair - $15,000 per year | |

| ESG Committee service |

Member - $10,000 per year Chair - $15,000 per year | |

| * | Chairs receive chair fees in addition to member fees. For example, the chair of the Audit Committee receives an aggregate fee of $30,000 for his or her services on the Committee. |

Cash fees with respect to Board or committee membership or service as the Lead Director or a committee chair are paid ratably assuming 12 consecutive months of service from the date the particular membership or service commences. Non-management directors also receive an annual equity grant pursuant to the Herbalife Ltd. 2023 Stock Incentive Plan, or the 2023 Plan, as it may be amended from time to time (or a successor equity incentive plan), in the form of restricted stock units, or RSUs, with a grant date fair value of $150,000 (rounded down to the nearest whole unit) that vest annually. The Board equity grants made in May 2023, or the 2023 Board RSU Grants, are scheduled to vest on April 15, 2024.

The Lead Director receives an equity grant in the form of RSUs with a grant date fair value of $25,000 (rounded

down to the nearest whole unit) per year of his or her two-year term, which vests in full the following year. Mr. LeFevre’s lead director equity grant that was made in May 2023 is scheduled to vest on April 15, 2024.

The compensation disclosed in the 2023 Director Compensation table and notes below for Ms. Macadrai and Messrs. Gratziani, Mendoza, and Tartol includes other compensation, unrelated to their services as directors.

The Company may also reimburse our directors for their respective travel, lodging and related expenses associated with attendance at Board or Board committee meetings, as well as reasonable costs in connection with attending director continuing education programs in accordance with the Company’s applicable orientation and continuing education policy.

| 10 | Corporate governance |

The following table summarizes the compensation paid by the Company to each of our directors, except for Mr. Johnson, the Company’s Chairman and Chief Executive Officer, who is a named executive officer and whose compensation is covered in Part 4 of this Proxy Statement, for the fiscal year ended December 31, 2023. The table includes: (1) compensation paid to directors for their services on the Board and the Board’s committees, (2) payments made to directors for any services provided at Company events, such as speaking engagements, and (3) payments made to independent distributors of Herbalife products in accordance with the Company’s Marketing Plan.

2023 Director compensation table

| Name | Fees earned or paid in cash ($) |

Stock awards ($)(1) |

All other compensation ($) |

Total ($) |

||||||||||||

| Richard H. Carmona | 125,000 | 149,994 | 75,000 | (2) | 349,994 | |||||||||||

| Celine Del Genes |

|

110,000 |

|

|

149,994 |

|

— |

|

259,994 |

| ||||||

| Stephan Gratziani(3)(4) |

|

26,389 |

|

|

— |

|

15,620,075 | (5) |

|

15,646,464 |

| |||||

| Sophie L’Hélias |

|

135,000 |

|

|

149,994 |

|

|

— |

|

|

284,994 |

| ||||

| Kevin M. Jones |

|

110,000 |

|

|

149,994 |

|

|

— |

|

|

259,994 |

| ||||

| Alan W. LeFevre |

|

145,000 |

|

|

174,991 |

(6) |

|

— |

|

|

319,991 |

| ||||

| Rodica Macadrai(3)(7) |

|

30,833 |

|

|

99,994 |

|

|

984,652 |

(8) |

|

1,115,479 |

| ||||

| Juan Miguel Mendoza(3) |

|

108,988 |

|

|

149,994 |

|

|

1,232,288 |

(9) |

|

1,491,270 |

| ||||

| Don Mulligan |

|

140,000 |

|

|

149,994 |

|

— |

|

289,994 |

| ||||||

| Maria Otero |

|

145,000 |

|

|

149,994 |

|

|

— |

|

|

294,994 |

| ||||

| John Tartol(3)(10) |

|

31,944 |

|

|

— |

|

|

1,537,003 |

(11) |

|

1,568,947 |

| ||||

| (1) | Amounts represent the aggregate grant date fair value of the relevant award(s) presented in accordance with FASB ASC Topic 718, “Compensation—Stock Compensation.” See Note 9 to the to the Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, for a discussion of the relevant assumptions used in calculating these amounts pursuant to FASB ASC Topic 718. |

| (2) | Amount represents fees for speaking at Herbalife events. |

| (3) | All independent distributors of Herbalife products, including Ms. Macadrai and Messrs. Mendoza and Tartol, are eligible to receive income under the Company’s Marketing Plan as a result of their activities as distributors Ms. Macadrai and Messrs. Gratziani, Mendoza and Tartol would have received this income, which is quantified in notes 5,8,9, and 11 below, irrespective of their services on the Board. Mr. Gratziani did not receive any such income after suspension of his distributorship. Neither Ms. Macadrai nor Messrs. Gratziani, Mendoza and Tartol receive any preferential treatment or payments under the Company’s Marketing Plan. |

| (4) | Mr. Gratziani resigned from the Board, effective August 1, 2023. |

| (5) | Amount includes: (i) the $227,077 in pro-rated base salary, (b) $115,360 in bonus, (c) $1,399,996 in awards, which is the aggregate grant date fair value in accordance with FASB ASC Topic 718, (d) $285 in Company-paid premiums for executive life insurance, and (e) $6,387 in Company paid 401(k) matching contributions, in each case, in respect of Mr. Gratziani’s service as the Company’s Chief Strategy Officer in 2023 and consistent with amounts disclosed in the corresponding “Salary,” “Stock awards,“ “Option Awards,” “Non-Equity Incentive Plan Compensation” and “All Other Compensation” columns of the 2023 Summary Compensation Table; (ii) $47,422 in fees for speaking at Herbalife events for Herbalife Members; and (iii) $4,069,562 in income earned as a top distributor of Herbalife products. Additionally, unrelated to his service as a Board member, amount also includes $9,753,986 in consideration for suspending the operation of Mr. Gratziani’s distributorship which includes: (x) $4,753,994 in cash compensation of which $3,000,000 in cash compensation was paid in 2023 and the remaining amount to be paid in 2024 and 2025 and (y) a grant of stock appreciation rights having a grant date fair value equal to $4,999,992. |

| (6) | Includes Mr. LeFevre’s lead director equity grant in 2023. |

| (7) | Ms. Macadrai was appointed to the Board on September 10, 2023. |

| (8) | Amount includes $40,425 in fees for speaking at Herbalife events for Herbalife Members. Additionally, unrelated to her service as a Board member, amount also includes $944,226 in income earned as a top distributor of Herbalife products. See note 3 above. |

| (9) | Amount includes $107,412 in fees for speaking at Herbalife events for Herbalife Members. Additionally, unrelated to his service as a Board member, amount also includes $1,124,870 in income earned as a top distributor of Herbalife products. See note 3 above. |

| (10) | Mr. Tartol served on the Board until April 26, 2023. |

| (11) | Amount includes $30,000 in fees for speaking at Herbalife events for Herbalife Members. Additionally, unrelated to his service as a Board member, amount also includes $1,537,003 in income earned as a top distributor of Herbalife products. See note 3 above. |

| Corporate governance | 11 |

The table below summarizes the equity-based awards held by non-management directors who served on the Company’s Board of Directors in 2023, as of December 31, 2023.

| Name |

Stock Unit Awards |

|||||||

| Number of Shares or units of stock that have not vested (#) |

Market value of Shares or units of stock that have not vested(1) ($) |

|||||||

|

Richard H. Carmona |

|

11,029 |

|

|

$168,303 |

| ||

| Celine Del Genes |

|

11,029 |

|

|

$168,303 |

| ||

| Stephan Gratziani(2) |

|

— |

|

|

— |

| ||

| Kevin M. Jones |

|

11,029 |

|

|

$168,303 |

| ||

| Sophie L’Hélias |

|

11,029 |

|

|

$168,303 |

| ||

| Alan W. LeFevre |

|

12,867 |

(3) |

|

$196,350 |

| ||

| Rodica Macadrai(4) |

|

7,541 |

|

|

$115,076 |

| ||

| Juan Miguel Mendoza |

|

11,029 |

|

|

$168,303 |

| ||

| Don Mulligan |

|

11,029 |

|

|

$168,303 |

| ||

| Maria Otero |

|

11,029 |

|

|

$168,303 |

| ||

| John Tartol(5) |

|

— |

|

|

— |

| ||

| (1) | Market value based on the closing price of a Common Share on the NYSE on December 29, 2023, of $15.26 |

| (2) | The 11,029 RSUs Mr. Gratziani received as compensation for his services on the Board was forfeited upon Mr. Gratziani’s resignation from the Board in August 2023. |

| (3) | Amount includes Mr. LeFevre’s lead director equity grant in 2023. |

| (4) | Ms. Macadrai was appointed to the Board on September 10, 2023. |

| (5) | Mr. Tartol served on the Board until April 26, 2023. |

Share ownership guidelines

The Company has adopted share ownership guidelines applicable to each named executive officer and non-management director to encourage each person to acquire a meaningful ownership stake in the Company over time by retaining financial interest in our common shares. Our CEO is encouraged to hold Common Shares and unvested restricted stock units with an aggregate value equal to five times his base salary. Our other named executive officers are encouraged to hold Common Shares and unvested restricted stock units with an aggregate value equal to two times their respective base salaries. Each non-management director is encouraged to hold

Common Shares and unvested restricted stock units with an aggregate value equal to five times such director’s annual retainer. Such named executive officers and directors are expected to refrain from selling Common Shares until such guideline is satisfied, and, so long as they are complying with such holding requirement, such director or named executive officer will not be considered out of compliance.

As of the date of this Proxy Statement, all non-management directors and current named executive officers are in compliance with the current guidelines.

| 12 | Corporate governance |

Shareholder outreach

We value the viewpoint of all investors and have actively engaged with shareholders to better understand their perspectives, and strongly consider their feedback when evaluating our governance provisions and practices.

Since the 2023 Annual General Meeting of Shareholders, we conducted engagement efforts with a number of shareholders to initiate new, and deepen existing, relationships with our investor base. We reached out to

top Herbalife shareholders that, in the aggregate, own in excess of approximately 56% of our outstanding Common Shares, to cover and hear their views on various governance topics including Board composition, shareholder rights, risk oversight and environmental & social initiatives across the Company. In aggregate, we received feedback from investors who hold approximately 23% of outstanding Common Shares.

Communications with the Board

Shareholders and other parties interested in communicating directly with the Board of Directors, non-management or independent directors as a group or individual directors, including the Chair or Lead Director in such capacity, may do so by writing to our Corporate Secretary at c/o Herbalife International of America, Inc., 800 W. Olympic Blvd., Suite 406, Los Angeles, California 90015, or by email to corpsec@herbalife.com, indicating to whose attention the communication should be directed. The Office of the Corporate Secretary of the Company reviews and logs all such correspondence and forwards to members of the Board of Directors a summary and/or

copies of any such correspondence that, in the opinion of the Corporate Secretary, deal with the functions of the Board of Directors or committees thereof, or that he otherwise determines requires their attention. Directors may at any time review a log of all communications received by the Company and addressed to members of the Board of Directors and request copies of any such correspondence. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Company’s internal audit department and handled in accordance with procedures established by the Audit Committee with respect to such matters.

Director orientation and continuing education

Herbalife is in the business of providing health and wellness products to consumers in 95 markets through our direct-selling business model. As part of our onboarding process that spans over a two-month period consisting of eleven “onboarding sessions,” we introduce new directors to our company with an overview of our business through a review of background and reference materials, and meetings with senior management and their direct reports. Additionally, where feasible, new directors tour manufacturing facilities, nutrition clubs, and distributor events. Our comprehensive orientation sessions are designed to provide new directors a thorough understanding of their fiduciary duties and familiarize them with the Company’s business and strategic plans, significant financial matters, risk management approach, compliance and ethics programs, corporate governance practices, and other key policies

and practices. These orientation sessions allow new directors to begin making contributions to the Board at the start of their service.

The Company also provides, on an ongoing basis, additional opportunities for directors to further familiarize themselves with the Company’s business, finances and operations, which may include, among other things, presentations from members of management of the Company and visits to Herbalife Members events, such as Extravaganzas and Herbalife Honors. Additionally, our directors receive internal training and materials. We also encourage our directors to participate in external continuing director education programs, and provide reimbursement of expenses associated with our independent directors’ attendance at one outside director education program each fiscal year.

| Corporate governance | 13 |

Committees of the Board

Our Board of Directors has an Audit Committee, Nominating and Corporate Governance Committee, Compensation Committee, and ESG Committee. Our Board of Directors has adopted a written charter for each of these committees, and the charters for current

committees are available on the Company’s website at https://ir.herbalife.com/corporate-governance, and in print to any shareholder who requests it as set forth under Part 7 —“Annual report, financial and additional information.”

Current committee memberships

| Directors |

Audit(1) | Compensation(2) | Nominating and Corporate |

ESG | ||||

| Richard H. Carmona † |

|

|

Chair |

| ||||

| Sophie L’Hélias † | ● |

|

|

Chair | ||||

| Alan W. LeFevre * † | ● |

|

● |

| ||||

| Don Mulligan * † | Chair | ● |

|

| ||||

| Maria Otero † |

|

Chair | ● | ● | ||||

| Juan Miguel Mendoza |

|

|

|

● | ||||

| Celine Del Genes † |

|

● |

|

|

* Audit Committee “financial expert” † Independent • Member

| (1) | Each member who currently serves on the Audit Committee is or was financially literate and met the independence requirements of the NYSE and Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. The Board determined each of Messrs. Mulligan and LeFevre as an “Audit Committee financial expert” as such term is defined in SEC rules and regulations. |

| (2) | Each member who currently serves on the Compensation Committee, or served on the Compensation Committee during 2023, is or was (a) independent under the listing standards of the NYSE, including the heightened standards applicable to members of a listed company’s compensation committee, and (b) a “nonemployee director” under Rule 16b-3 of the Exchange Act. |

| Audit Committee | ||

| The Audit Committee represents and assists the Board in fulfilling its responsibilities for overseeing our financial reporting processes and the audit of our financial statements. | Meetings Held in 2023:

6

| |

The principal duties of the Audit Committee include the following:

| • | monitoring the integrity of the Company’s financial reporting process and systems of internal controls regarding finance, accounting and reporting; |

| • | monitoring the independence and performance of the Company’s independent registered public accounting firm and internal audit function; |

| • | monitoring compliance with legal and regulatory requirements and performance of the Company’s ethics and compliance program; and |

| • | reviewing the Company’s framework and guidelines with respect to risk assessment and risk management, including the Company’s enterprise risk management program and risks and practices related to cyber security, privacy and product safety matters. |

| Compensation Committee | ||

| The Compensation Committee discharges the Board’s responsibilities related to the compensation of our executives and directors, and provides general oversight of our compensation structure, including our equity compensation plans and benefits programs. | Meetings Held in 2023:

10 | |

The principal duties of the Compensation Committee include the following:

| • | overseeing and approving compensation policies and programs, and administering existing incentive compensation plans and equity-based plans; |

| 14 | Corporate governance |

| • | reviewing and approving corporate goals and objectives relevant to the compensation of the Company’s CEO and other executive officers; |

| • | evaluating the performance of the CEO and recommending the compensation level of the CEO for approval by the independent members of the Board of Directors; |

| • | evaluating the performance of executive officers and, considering the CEO’s recommendations, setting the compensation level for such executive officers; |

| • | reviewing the compensation of directors, and making recommendations to the Board; |

| • | overseeing management succession planning processes; and |

| • | overseeing the Company’s response to regulatory developments affecting executive compensation. |

| Nominating and Corporate Governance Committee | ||

| The Nominating and Corporate Governance Committee oversees, and represents and assists the Board in fulfilling its responsibilities relating to, our corporate governance, and director nominations and elections.

|

Meetings Held in 2023:

6 | |

The principal duties of the Nominating and Corporate Governance Committee include the following:

| • | recommending to the Board of Directors proposed nominees for election to the Board of Directors both at annual general meetings of shareholders and to fill vacancies that occur between annual general meetings; and |

| • | reviewing and making recommendations to the Board of Directors regarding the Company’s corporate governance matters and practices. |

| ESG Committee | ||

| The ESG Committee assists the Board in discharging its oversight responsibility relating to the Company’s significant environmental, social and related governance activities and practices, including policies, programs and practices, strategy, stakeholder engagement and risks.

|

Meetings Held in 2023:

6

| |

The principal duties of the ESG Committee include the following:

| • | recommending to the Board on the Company’s environmental and social sustainability strategy, programs, policies and investments that support the Company’s overall business strategy; |

| • | overseeing the review and evaluation of risks and opportunities related to environmental and social sustainability topics that may arise in connection with the Company’s activities and advising the Board on such risks and opportunities in coordination with the Board’s other committees; and |

| • | reviewing and discussing with management the Company’s public disclosures and communication strategies with investors and other stakeholders regarding such topics. |

Compensation Committee interlocks and insider participation

During the fiscal year ended December 31, 2023, Messrs. Jones and Mulligan and Mmes. Otero and Del Genes served on the Compensation Committee of the Board. During the fiscal year ended December 31, 2023, there were no relationships or transactions between the Company and any member of the Compensation Committee requiring disclosure hereunder.

None of our executive officers currently serves, or during the fiscal year ended December 31, 2023, served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors or Compensation Committee.

| Corporate governance | 15 |

| Part 3

|

Proposals to be voted on at the |

Proposal 1: The election of directors

Generally

The Articles presently provide for not less than one nor more than 15 directors. The Board of Directors has, by resolution, presently fixed the number of directors at 10, and there is currently a full complement of 10 members of the Board. There are 10 Board nominees recommended for election at the Meeting. Directors are elected at each annual general meeting of shareholders to hold office for one-year terms until the next annual general meeting of shareholders.

The Board has nominated each of Michael O. Johnson, Richard H. Carmona, Celine Del Genes, Sophie L’Hélias, Alan W. LeFevre, Michael J. Levitt, Rodica Macadrai, Juan Miguel Mendoza, Don Mulligan and Maria Otero for election as directors to serve one-year terms expiring at the 2025 annual general meeting. On March 1, 2024, the Board accepted the resignation tendered by Kevin M. Jones pursuant to the Company’s director resignation policy set forth in its Principles of Corporate Governance. Mr. Levitt was identified and recommended by management and certain members of the Board for consideration by the Nominating and Corporate Governance Committee, which then recommended to the full Board to appoint Mr. Levitt as a director and to include him on the slate of nominees of directors for election at the Meeting. Directors are elected under a majority voting standard in uncontested director elections (i.e., an election where the number of persons nominated for election does not exceed the number of directors to be elected). The election of directors at the Meeting constitutes an uncontested director election. Under a majority voting standard in uncontested director elections, each vote is required to be counted “for” or “against” a director nominee’s election. In order to be elected, the votes cast “for” such nominee’s election must exceed the number of votes cast “against” such nominee’s election. Abstentions and “broker non-votes” will not affect the outcome of the election of directors.

The persons named as proxies on the accompanying proxy card intend to vote the Common Shares as to which they are granted authority to vote for the election of the nominees listed herein. The form of proxy card does not permit shareholders to vote for a greater number of nominees than 10. Although the Board does not know of any reason why any nominee will be unavailable for election, in the event any nominee should be unavailable at the time of the Meeting, the proxies may be voted for a substitute nominee as selected by the Board of Directors or just for the remaining nominees, leaving a vacancy. Alternatively, the Board may reduce the size of the Board.

Director qualifications

The Board believes that the Board, as a whole, should possess a combination of skills, professional experience and diversity of backgrounds necessary to oversee the Company’s business and strategy. In addition, the Board believes that there are certain attributes that every director should possess, as reflected in the Board’s membership criteria discussed hereunder. Accordingly, the Board and the Nominating and Corporate Governance Committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition, as well as the Company’s current and future needs.

The Nominating and Corporate Governance Committee is responsible for developing and recommending Board membership criteria to the Board for approval. These criteria are discussed in the Company’s Principles of Corporate Governance, which are available on the Company’s website at https://ir.herbalife.com/corporate-governance, and include business experience and skills, independence, judgment, integrity, the ability to commit sufficient time and attention to Board activities and the absence of potential conflicts with the Company’s interests. In addition, the Nominating and Corporate Governance Committee periodically evaluates the composition of the Board to assess the skills and experience that are currently represented on the Board, as well as the skills and experiences that the Board will find valuable in the future, given the Company’s current needs and strategic plans. The Nominating and Corporate Governance Committee seeks a variety of occupational, educational and personal backgrounds on the Board in order to obtain a range of viewpoints and perspectives and to enhance the diversity of the Board as a group in areas including professional experience, geography, race, gender, ethnicity and age. This periodic assessment of the Board’s composition enables the

| 16 | Proposals to be voted on at the meeting |

Board to update the skills and experience it seeks in the Board as a whole, and in individual directors, as the Company’s needs evolve and change over time and to assess the effectiveness of efforts at pursuing diversity.

In identifying and recruiting director candidates through a combination of internal referrals, from both management and members of the Board, and third-party executive search firms, the Nominating and Corporate Governance Committee may establish specific skills and experiences that it believes the Company should seek in order to constitute a balanced and effective Board.

In evaluating director candidates, and considering incumbent directors for re-nomination to the Board, the Nominating and Corporate Governance Committee considers a variety of factors. These include each nominee’s independence, financial literacy, personal and professional accomplishments and experience, each in light of the composition of the Board as a whole and the needs of the Company in general, and for incumbent directors, past performance on the Board. The Board believes that our director nominees represent an effective mix of skills, experiences, diversity and perspectives, including gender and ethnic/racial diversity.

Additionally, the Nominating and Corporate Governance Committee believes it is important that the viewpoints of independent distributors of Herbalife products are represented on the Board. As of the date of this Proxy Statement, two independent distributors of Herbalife products sit on the Board: Ms. Macadrai and Mr. Mendoza.

The Nominating and Corporate Governance Committee will consider director candidates recommended by shareholders under the same criteria and processes outlined above. A shareholder who wishes to recommend a prospective nominee for the Board of Directors pursuant to the provisions of the Articles should notify the Corporate Secretary in writing with the appropriate supporting materials, as more fully described under Part 7 — “Shareholder nominations.”

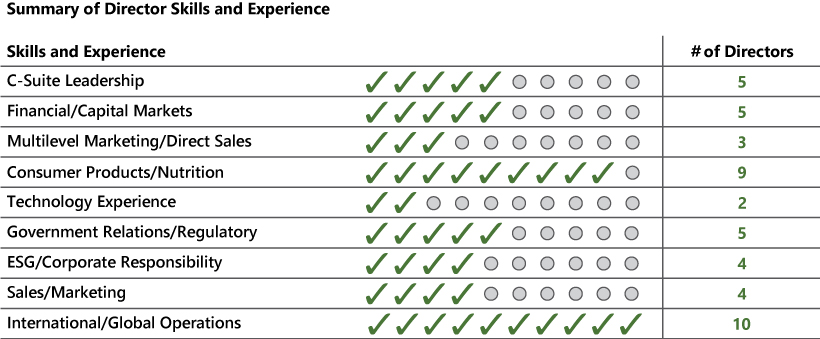

Director skills and experience

The Nominating and Corporate Governance Committee expects each of the Company’s directors to be accomplished individuals in their respective fields of expertise. In addition to the significant diversity of perspectives and individual expertise, the Nominating and Corporate Governance Committee assess the specific skills and experience that the Board, as a whole, possesses. The matrix reflects the key skills and expertise identified as necessary by Nominating and Corporate Governance Committee for robust oversight of management’s execution of our strategy as well as the number of director nominees who possess the relevant skill or experience:

| Proposals to be voted on at the meeting | 17 |

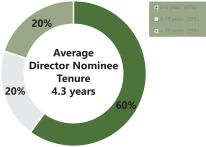

The below reflects: (1) the tenure of our director nominees and (2) the racial/ethnic and gender diversity of our director nominees:

Set forth below is biographical information about the 10 nominees standing for election at the Meeting, including each such person’s specific experience, qualifications, attributes and skills that led our Board of Directors to conclude that such individual should serve on our Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES NAMED IN THIS PROXY STATEMENT TO THE BOARD OF DIRECTORS.

| 18 | Proposals to be voted on at the meeting |

Nominees for election as directors

| Michael O. Johnson

Age: 69

Director Since April 2022 Chairman Since October 2022 |

Qualifications and Expertise Provided to the Board

Mr. Johnson has unparalleled institutional knowledge of the Company’s operations and distributor network, and experience leading the Company through multiple economic cycles and international expansion over his previous 16 years as its CEO. Mr. Johnson brings extensive global sales and marketing leadership as well as significant experience in government engagement around the world. His expertise helps the Board provide effective oversight of the Company’s business strategy.

| |||

| Experience

Mr. Johnson currently serves as the Company’s Chairman and Chief Executive Officer and has held such positions since December 2022. He served as the Company’s Chairman and interim Chief Executive Officer from October 2022 to December 2022. He previously served as Chairman of the Board and held this position from May 2007 to April 2020. He also previously served as Chief Executive Officer of the Company and held such position from January 2019 to March 2020. He previously served as the Company’s Executive Chairman from June 2017 to January 2019 and as the Company’s Chief Executive Officer from April 2003 to May 2017. Prior to joining the Company, Mr. Johnson spent 17 years with The Walt Disney Company, where he served as President of Walt Disney International, and also served as President of Asia Pacific for The Walt Disney Company and President of Buena Vista Home Entertainment. Mr. Johnson has also served as a publisher of Audio Times magazine, and has directed the regional sales efforts of Warner Amex Satellite Entertainment Company for three of its television channels that include MTV, Nickelodeon and The Movie Channel. Mr. Johnson formerly served as a director of Univision Communications, Inc., a television company serving Spanish-speaking Americans, until March 2007, and on the Board of Regents for Loyola High School of Los Angeles. Mr. Johnson received his Bachelor of Arts in Political Science from Western Colorado University.

Other Public Boards

• None

Previous Public Boards (Past Five Years)

• Herbalife Ltd. (April 2003 – April 2020) | ||||

| Proposals to be voted on at the meeting | 19 |

| Dr. Richard H. Carmona

Age: 74

Independent Director Since 2013

Board Committees: Nominating and Corporate Governance Committee (Chair) |

Qualifications and Expertise Provided to the Board

Dr. Carmona’s experience as the Surgeon General of the United States, as Chief of Health Innovations at a pioneering integrative wellness company, and as distinguished professor of surgery, public health, family, and community medicine are directly relevant to the Company’s business. His diverse experience strengthens the Board’s oversight of the Company’s nutritional product innovation and wellness-focused business strategy.

| |||

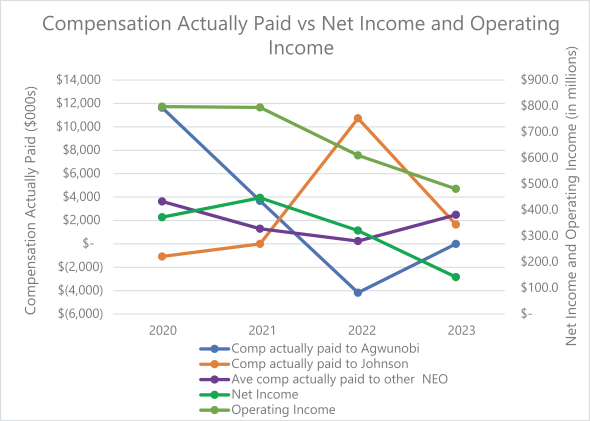

| Experience