UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 | |

HERBALIFE NUTRITION LTD.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| Herbalife Nutrition Ltd.

2022 Proxy Statement

|

Annual General Meeting of Shareholders

Our 2022 Annual General Meeting of Shareholders

will be held on Wednesday, April 27, 2022 at 8:30 a.m., Pacific Daylight Time, at

800 W. Olympic Blvd., Suite 406

Los Angeles, CA 90015

Admission requirements

See Part 1 – “Information concerning solicitation and voting” for details on admission requirements to attend the Annual General Meeting.

Proxy voting options

Your vote is important!

All shareholders are cordially invited to attend the Annual General Meeting. However, in order to assure your representation at the Annual General Meeting, you are urged to vote promptly. You may vote your shares via a toll-free telephone number, over the Internet or by completing, signing and mailing the proxy card or voting instruction form provided to you. Please follow the instructions on the proxy card or voting instruction form.

Proxies submitted by mail, the Internet or telephone must be received by 11:59 p.m., Eastern Time, on April 26, 2022.

Vote by internet

www.envisionreports.com/HLF

24 hours a day / 7 days a week

Instructions:

| 1. | Go to: www.envisionreports.com/HLF. |

| 2. | Follow the steps outlined on the secure website. |

Vote by telephone

1.800.652.VOTE (8683) via touch tone phone

toll-free within the USA, US territories & Canada 24 hours a day / 7 days a week

Outside the USA, US territories & Canada, call 1.781.575.2300 via a touch tone phone. Standard rates will apply.

Instructions:

| 1. | Call toll-free 1.800.652.VOTE (8683) within the USA, US territories & Canada. Outside the USA, US territories & Canada, call 1.781.575.2300. |

| 2. | Follow the instructions provided by the recorded message. |

Herbalife Nutrition Ltd.

Notice of Annual General Meeting of Shareholders

| Date: | Wednesday, April 27, 2022 | |

| Time: | 8:30 a.m., Pacific Daylight Time | |

| Place: | 800 W. Olympic Blvd., Suite 406 Los Angeles, CA 90015 | |

| Record date: | March 1, 2022 | |

| Proxy voting: | All shareholders are cordially invited to attend the Annual General Meeting. See Part 1 — “Information concerning solicitation and voting” for details on admission requirements to attend the Annual General Meeting.

However, to assure your representation at the Annual General Meeting, you are urged to vote promptly. You may vote your shares via a toll-free telephone number, over the Internet or by completing, signing and mailing the proxy card or voting instruction form provided to you. Please follow the instructions on the proxy card or voting instruction form provided to you. | |

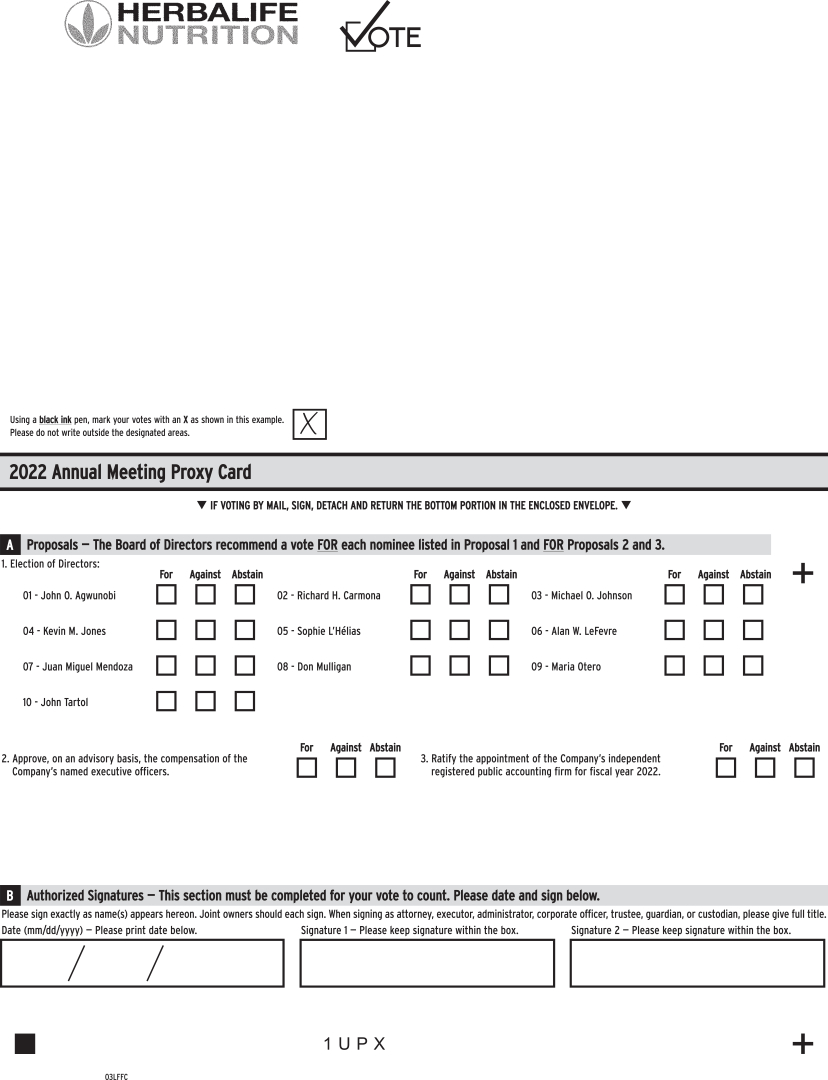

| Items of business: | 1. Elect each of the 10 directors named in the Proxy Statement to the Board of Directors to serve until the 2023 annual general meeting of shareholders of the Company or until their successors are duly elected and qualified;

2. Approve, on an advisory basis, the compensation of the Company’s named executive officers; and

3. Ratify the appointment of the Company’s independent registered public accounting firm for fiscal year 2022.

Shareholders will also transact such other business as may properly come before the Annual General Meeting and at any adjournments or postponements of the Annual General Meeting. | |

| The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only shareholders of record at the close of business on March 1, 2022 are entitled to notice of, and to vote at, the Annual General Meeting and any subsequent adjournment(s) or postponement(s) thereof. | ||

| Availability of materials: |

On or about March 16, 2022, we began mailing a Notice of Internet Availability of Proxy Materials to our shareholders. The Proxy Statement and Annual Report to Shareholders are available at http://www.edocumentview.com/HLF. | |

NOTICE IS HEREBY GIVEN that the 2022 Annual General Meeting of Shareholders of Herbalife Nutrition Ltd., a Cayman Islands exempted company incorporated with limited liability, will be held on Wednesday, April 27, 2022 at 8:30 a.m., Pacific Daylight Time, at 800 W. Olympic Blvd., Suite 406, Los Angeles, CA 90015.

Sincerely,

HENRY C. WANG

General Counsel and Corporate Secretary

Los Angeles, California

March 15, 2022

|

Proxy summary

The following is a summary of certain key disclosures in our proxy statement. This is only a summary, and it may not contain all the information that is important to you. For more complete information, please review the proxy statement as well as our 2021 Annual Report, which includes our Annual Report on Form 10-K. References to “Herbalife,” “Herbalife Nutrition”, “the Company,” “we,” “us” or “our” refer to Herbalife Nutrition Ltd.

|

Proposals to be Voted on and Board Voting Recommendations | ||||||

| Proposals | More Information |

Board’s Voting Recommendation | ||||

| Proposal 1 |

Election of Directors | Page 16 | FOR EACH NOMINEE | |||

| Proposal 2 |

Advisory Vote to Approve the Compensation of the Company’s Named Executive Officers | Page 23 | FOR | |||

| Proposal 3 |

Ratification of the Company’s Independent Registered Public Accounting Firm | Page 24 | FOR | |||

2022 Director nominees

| Committees | ||||||||||

|

Name |

Independent | Audit | Compensation | Nominating and Corporate Governance |

ESG | |||||

| John O. Agwunobi (Chairman and CEO) |

|

|

|

|

● | |||||

| Richard H. Carmona |

|

|

|

Chair |

| |||||

| Michael O. Johnson |

|

|

|

|

| |||||

| Kevin M. Jones |

|

|

● |

|

| |||||

| Sophie L’Hélias |

|

● |

|

|

Chair | |||||

| Alan W. LeFevre (Lead Director) |

|

● |

|

● |

| |||||

| Juan Miguel Mendoza |

|

|

|

|

| |||||

| Don Mulligan |

|

Chair | ● |

|

| |||||

| Maria Otero |

|

|

Chair | ● | ● | |||||

| John Tartol |

|

|

|

|

| |||||

| Proxy summary |

Corporate Governance Highlights

|

All directors stand for election annually |

|

Independent lead director with clearly defined duties and responsibilities |

|

One vote per share |

|

Majority voting standard for uncontested director elections |

|

All members of the audit, compensation and nominating and corporate governance committees are independent |

|

ESG Committee provides direct board oversight of environmental and social sustainability |

|

Robust share ownership guidelines for directors and named executive officers |

|

Annual board and committee assessments |

Executive Compensation Highlights

|

Incentive design links pay outcomes to company performance against preset goals |

|

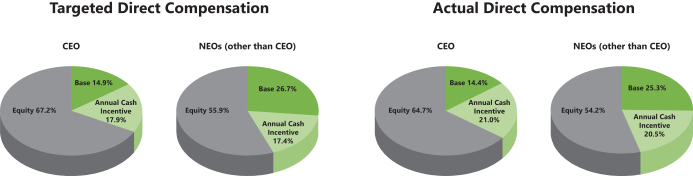

Balanced mix between fixed and variable compensation and short- and long-term incentives. For 2021, 85% of CEO targeted direct compensation was at risk, and at least 75% of 2021 equity grants to named executive officers were in the form of performance share units. |

|

Annual say-on-pay advisory vote |

|

Compensation risk assessment |

|

Robust share ownership guidelines for named executive officers |

|

“Double trigger” change in control |

|

Clawback policy applicable to Section 16 officers applicable to cash and equity incentives |

|

Anti-hedging and anti-pledging policies applicable to all employees |

This proxy statement includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical or current facts, including statements regarding our environmental and other sustainability plans and goals, made in this document are forward-looking. We use words such as anticipates, believes, expects, future, intends, and similar expressions to identify forward-looking statements. Forward-looking statements reflect management’s current expectations and are inherently uncertain. Actual results or outcomes could differ materially for a variety of reasons. Risks and uncertainties that could cause our actual results to differ significantly from management’s expectations are described in our 2021 Annual Report on Form 10-K. In addition, historical, current, and forward-looking sustainability-related statements may be based on standards for measuring progress that are still developing, internal controls and processes that continue to evolve, and assumptions that are subject to change in the future. Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this document.

| Proxy summary |

Proxy Statement table of contents

| Part 1. Our annual general meeting of shareholders | ||||

| 1 | ||||

| Part 2. Corporate governance | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 6 | ||||

| 7 | ||||

| 7 | ||||

| 7 | ||||

| 10 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 13 | ||||

| 15 | ||||

| Part 3. Proposals to be voted on at the meeting | ||||

| 16 | ||||

| 23 | ||||

| Proposal 3: Ratification of the appointment of independent registered public accounting firm |

24 | |||

| 24 | ||||

| Fees to independent registered public accounting firm for fiscal years 2021 and 2020 |

25 | |||

| 25 | ||||

| Part 4. Executive compensation | ||||

| 26 | ||||

| 27 | ||||

| 27 | ||||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 29 | ||||

| 29 | ||||

| 30 | ||||

| 32 | ||||

| 32 | ||||

| Role of executive officers in executive compensation decisions |

32 | |||

| 33 | ||||

| 33 | ||||

| 33 | ||||

| 34 | ||||

| 36 | ||||

| 36 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 44 | ||||

| Narrative disclosure to summary compensation table and grants of plan-based awards |

45 | |||

| 46 | ||||

| 47 | ||||

| 47 | ||||

| 48 | ||||

| 51 | ||||

| Table of Contents | i |

| Part 5. Security ownership of certain beneficial owners and management | ||||

| 52 | ||||

| Part 6. Certain relationships and related transactions | ||||

| 54 | ||||

| 55 | ||||

| Part 7. Additional information | ||||

| Information with respect to securities authorized for issuance under equity compensation plans |

56 | |||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 58 | ||||

| 58 | ||||

| ii | Table of Contents |

| Part 1

|

Our annual general meeting of |

Information concerning solicitation and voting

Place, time and date of meeting. This Proxy Statement is being furnished to the Company’s shareholders in connection with the solicitation of proxies on behalf of our Board of Directors, or the Board, for use at the 2022 Annual General Meeting of Shareholders, or the Meeting, to be held on Wednesday, April 27, 2022 at 8:30 a.m., Pacific Daylight Time, and at any subsequent adjournment(s) or postponement(s) thereof, for the purposes set forth herein and in the accompanying Notice of Annual General Meeting of Shareholders. The Meeting will be held at 800 W. Olympic Blvd., Suite 406, Los Angeles, CA 90015. Our telephone number is (213) 745-0500.

Record date and voting securities. Only shareholders of record at the close of business on March 1, 2022, or the Record Date, or duly authorized proxy holders of such shareholders of record, are entitled to notice of, and to vote at, the Meeting. The Company has one series of common shares, or Common Shares, outstanding. Each owner of record on the Record Date is entitled to one vote for each Common Share held by such shareholder. On March 1, 2022, there were 109,866,338 Common Shares issued and outstanding.

Voting. Each shareholder is entitled to one vote for each Common Share held on the Record Date on all matters submitted for consideration at the Meeting. A quorum, representing the holders of not less than a majority of the issued and outstanding Common Shares entitled to vote at the Meeting, must be present in person or by proxy at the Meeting for the transaction of business. Common Shares that reflect abstentions are treated as Common Shares that are present and entitled to vote for the purposes of establishing a quorum and determining the outcome of any matter submitted to the shareholders for

a vote that requires the approval of a specified percentage of shares present and entitled to vote.

“Broker non-votes” are Common Shares held in “street name” through a broker or other nominee over which the broker or nominee lacks discretionary power to vote and for which the broker or nominee has not received specific voting instructions. Thus, if you do not give your broker or nominee specific instructions, your Common Shares may not be voted on certain matters. Common Shares that reflect “broker non-votes” are treated as Common Shares that are present and entitled to vote for the purposes of establishing a quorum. However, for the purposes of determining the outcome of any matter as to which the broker or nominee has indicated on the proxy that it does not have discretionary authority to vote, which is the case with all proposals to be considered at the Meeting other than proposal 3, those Common Shares will be treated as not present and not entitled to vote with respect to that matter, even though those Common Shares are considered present and entitled to vote for the purposes of establishing a quorum and may be entitled to vote on other matters.

See “Meaning of shareholder of record” below for additional information regarding the different ways you may hold your Common Shares.

Votes required for proposals and board recommendations. The following table details information regarding the proposals to be voted on at the Meeting, the Board’s recommendation on how to vote on each proposal, the votes required to approve each proposal and the effect of abstentions and broker non-votes.

| Our annual general meeting of shareholders | 1 |

|

Proposal |

Voting Options | Board

|

Vote Required

|

Effect of

|

Effect of

| |||||

| Item 1: Elect each of the 10 directors named in the Proxy Statement to the Board of Directors to serve until the 2023 annual general meeting of shareholders of the Company or until their successors are duly elected and qualified |

For, Against or Abstain on each nominee | FOR each nominee | Majority of votes cast with respect to each nominee |

No effect |

No effect | |||||

| Item 2: Approve, on an advisory basis, the compensation of the Company’s named executive officers |

For, Against or Abstain | FOR | Majority of shares represented in person or by proxy and entitled to vote |

Treated as votes Against |

No effect | |||||

| Item 3: Ratify the appointment of the Company’s independent registered public accounting firm for fiscal year 2022 |

For, Against or Abstain | FOR | Majority of shares represented in person or by proxy and entitled to vote |

Treated as votes Against |

Brokers have discretion to vote | |||||

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Meeting, please take the time to vote. You may vote your shares via a toll-free telephone number, over the Internet or by completing, signing and mailing the proxy card or voting instruction form provided to you. Please follow the instructions on the proxy card or voting instruction form.

Revocability of proxies. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by either: (a) delivering to the Corporate Secretary of the Company a written notice of revocation or a duly executed proxy bearing a later date; (b) granting a subsequent proxy through the Internet or telephone; or (c) attending the Meeting and voting in person. However, please note that if you would like to vote at the Meeting and you are not the shareholder of record, you must request, complete and deliver a proxy from your broker or other nominee.

Proxy solicitation. The Company bears the expense of printing and mailing proxy materials. Proxies may be solicited by certain of our directors, officers and employees, without additional compensation, in person, by telephone, facsimile or electronic mail. We will, upon request, reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of Common Shares.

Meeting attendance. Only shareholders of record and beneficial owners as of the Record Date, their authorized proxy holders, and invited guests of the Board of Directors may attend the Meeting.

If you are a shareholder of record, in order to be admitted to the Meeting, you will need to produce picture identification (such as a valid driver’s license or passport) and either a copy of a form of proxy card or a Notice showing your name and address. If you are a beneficial owner and you wish to vote in person at the Meeting, you will need to obtain a proxy from the shareholder of record. If you are a beneficial owner or other authorized proxy holder, in order to attend the Meeting, you will need both an admission ticket and picture identification (such as a valid driver’s license or passport). To obtain an admission ticket to the Meeting, please send your written request to our Corporate Secretary at c/o Herbalife International of America, Inc., 800 W. Olympic Blvd., Suite 406, Los Angeles, California 90015 or electronically by emailing corpsec@herbalife.com.

Your request must be received on or before April 17, 2022 and include a copy of a form of proxy card or voting instruction form confirming your appointment as a proxy holder of a shareholder of record. In your request, please include the address where your admission ticket should be mailed to, and any special assistance needs. The Board requests that persons attending the Meeting observe a

| 2 | Our annual general meeting of shareholders |

professional business dress code. The Company also does not permit the use of cameras or other recording devices at the Meeting.

We continue to actively monitor the continued public health and travel safety concerns relating to the COVID-19 pandemic and the advisories or mandates that federal, state, and local governments, and related agencies, may issue. In response, and in continued support for the health and safety of all, the Company will hold a live listen-only audio webcast of the Meeting. Shareholders may listen to the Meeting via live audio webcast by logging on to www.meetnow.global/MNQRLZZ using your control number. Please see below:

| • | Shareholders of record: For shareholders of record, the control number can be found on your proxy card or Notice, or the email you receive from Computershare, the Company’s transfer agent. |

| • | Beneficial owners: If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to access the live audio webcast. To register, you must submit proof of your proxy power (legal proxy) reflecting your Herbalife Nutrition holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on April 20, 2022. You will receive a confirmation email of your registration from Computershare. Late submissions will be processed to the extent feasible, but registration cannot be guaranteed in time for the Meeting. Requests for registration should be directed to us at the following: |

By email: Forward the email from your broker, or attach an image of your legal proxy, to legalproxy@computershare.com

By mail: Computershare, Herbalife Nutrition Legal Proxy, P.O. Box 43001, Providence, RI 02940-3001.

Pursuant to the Company’s Amended and Restated Memorandum of Articles of Association, or the Articles, please be advised that shareholders will not be deemed to be “present” for quorum purposes and will not be able to vote their shares, or revoke or change a previously submitted vote, by logging onto the webcast of the Meeting. As a result, the Company strongly urges shareholders to submit their proxies or votes in advance of the Meeting.

In the event it is not possible or advisable to hold our Meeting in person as currently planned, we will announce the decision to do so via a press release and posting details on our website that will also be filed with the Securities and Exchange Commission, or the SEC, as proxy material. If you are planning to attend our Meeting, please check our Investor Relations website the week of the Meeting. As always, we encourage you to vote your shares prior to the Meeting.

Meaning of shareholder of record. You are a shareholder of record only if your name is recorded on the Company’s register of members. If your name is not recorded on the Company’s register of members, any shares you hold in the Company are held beneficially. In this case you may still be entitled to direct the holder of your shares as to who should be appointed as proxy in respect of those shares and/or how to vote those shares on your behalf.

Shareholders who have purchased their shares on an exchange may hold those shares through a depository, in which case they are beneficial shareholders and not shareholders of record. If you hold your shares in “street name,” you are not a shareholder of record.

If you wish to inquire as to whether or not you are a shareholder of record, please contact our Corporate Secretary at c/o Herbalife International of America, Inc., 800 W. Olympic Blvd., Suite 406, Los Angeles, California 90015 or electronically by emailing corpsec@herbalife.com.

Additional information. This Proxy Statement contains summaries of certain documents, but you are urged to read the documents yourself for complete information. The summaries are qualified in their entirety by reference to the complete text of the document. In the event that any of the terms, conditions or other provisions of any such document is inconsistent with or contrary to the description or terms in this Proxy Statement, such document will control. Each of these documents, as well as those documents referenced in this Proxy Statement as being available in print upon request, are available upon request to the Company by following the procedures described under Part 7 — “Annual report, financial and additional information”.

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders to Be Held on April 27, 2022. The Proxy Statement and Annual Report to Shareholders are available at http://www.edocumentview.com/HLF.

| Our annual general meeting of shareholders | 3 |

| Part 2

|

Corporate governance |

Under the listing standards of the New York Stock Exchange, or the NYSE, a majority of the members of the Board must satisfy the NYSE criteria for “independence”. No director qualifies as independent under the NYSE listing standards unless the Board affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company).

The Board evaluates the independence of our directors annually and will review independence of individual directors on an interim basis as needed to consider changes in employment, relationships and other factors. Our Board has affirmatively determined that all of the directors and director nominees, as well as each individual who served as a director at any time during 2021, other than Dr. Agwunobi and Messrs. Johnson, Mendoza and Tartol, are independent in accordance with Section 303A.02 of the NYSE listing standards, or the NYSE Independence Standards. Under the NYSE Independence Standards, a director will not be considered independent in the following circumstances:

| • | the director is, or has been within the last three years, an employee of the Company, or an immediate family member of the director is, or has been within the last three years, an executive officer of the Company; |

| • | the director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service); |

| • | (i) the director is a current partner or employee of a firm that is the Company’s internal or external auditor; (ii) the director has an immediate family member who is a current partner of such firm; (iii) the director has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit; or (iv) the director or an immediate family member was within the last three years a partner or employee of such a firm and personally worked on the Company’s audit within that time; |

| • | the director or an immediate family member is, or has been with the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on that company’s compensation committee; and |

| • | the director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues. |

In July 2021, the Board approved enhancements to the Company’s Principles of Corporate Governance. Under the Company’s Principles of Corporate Governance, an independent director must, in addition to satisfying the NYSE Independence Standards, be free of any existing or potential professional or personal interest, business, or relationship which could, or could reasonably be perceived to, materially interfere with the director’s ability to act in the best interests of the Company and all its shareholders.

The Board considered Dr. Carmona’s independence in view of the $25,000 in speaking fees he received from the Company in 2021, as disclosed in the subsection “Compensation to directors”. The Company leverages Dr. Carmona’s professional experience as the 17th Surgeon General of the United States to provide training and education to Herbalife Nutrition Members at various Company-sponsored sales events, such as Extravaganzas, which are training and promotional events for our independent distributors. After consideration of the foregoing and other relevant factors, the Board determined that the Company’s engagement of Dr. Carmona for these limited services did not present a conflict of interest nor compromise Dr. Carmona’s independence from the Company.

Messrs. Jonathan Christodoro, Hunter C. Gary, Nicholas Graziano, Jesse A. Lynn and James L. Nelson served on the Board until January 3, 2021. Each had been re-nominated to the Board in connection with the Company’s 2020 Annual General Meeting of Shareholders in accordance

| 4 | Corporate governance |

with the now terminated Second Amended and Restated Support Agreement, dated as of July 15, 2016, or the Support Agreement, among the Company, Carl C. Icahn and certain affiliated entities of Mr. Icahn, or the Icahn Parties. The Board determined that the Support Agreement while in effect and the relationships each director nominated pursuant to the Support Agreement had with the Icahn Parties did not compromise their independence. The Support Agreement was terminated in its entirety on January 7, 2021, and Messrs. Christodoro, Gary, Graziano, Lynn and Nelson resigned from the Board effective January 3, 2021.

Dr. Agwunobi is not determined independent because he is the Company’s Chief Executive Officer. Mr. Johnson has

previously served as the Company’s Chief Executive Officer within the last three years and is accordingly not determined independent.

Messrs. Mendoza and Tartol are not determined independent because the income received by each of them as top distributors of Herbalife Nutrition products precludes them from being determined independent. Neither are employees of the Company. For additional details surrounding their compensation as Herbalife Nutrition Members, which they receive irrespective of any service on the Board, please see “Compensation to directors”.

The Board of Directors held eight meetings during fiscal year 2021. The independent directors generally meet in executive session at each regularly scheduled meeting, without the presence of management and non-independent directors, to discuss various matters relating to the Board’s function and Company oversight, including the Company’s management. The independent lead director, or the Lead Director, presides over such executive sessions.

Each director is expected to dedicate sufficient time, energy and attention to allow for the diligent performance of his or her duties, including attending the Company’s annual general meeting of the shareholders and meetings of the Board of Directors and committees of which he or she is a member. All incumbent directors attended at least 75% of the aggregate of all Board and applicable committee meetings held during the period that he or she served as a director, as well as the Company’s 2021 annual general meeting of shareholders.

The Company’s governance framework provides the Board with the flexibility to select the appropriate leadership structure for the Company. The current leadership structure is comprised of a combined Chair of the Board and Chief Executive Officer, an independent Lead Director, Board committees led by independent directors and active engagement by all directors. The Board believes this structure best serves the interests of the Company and its shareholders. The Board believes the combined Chair and CEO role supports the Board’s effective oversight of the Company’s business and strategy, with the CEO serving as a key link between the Board and management, providing a deep understanding of the Company’s business and operations, bringing key business considerations to the Board’s attention and leading implementation of the Company’s strategic plans as approved by the Board. The Lead Director in turn allows for strong, independent Board leadership, with authority to set the meeting agendas and to lead sessions outside the Chair’s presence. We believe this to be a critical aspect of effective corporate governance.

The Lead Director is an independent director elected for a two-year term by the independent directors. The

appointment is evaluated biannually. The Lead Director chairs the Board meetings during executive sessions and when the Chair is unable to participate in Board meetings, and is a contact point for major shareholders and third parties who wish to contact the Board independent of the Chair and CEO. The responsibilities of the Lead Director include:

| • | setting the agenda for and leading the regularly-held independent director sessions, and briefing the Chair on any issues arising from those sessions; |

| • | coordinating the activities of the independent directors; |

| • | presiding at meetings of the Board at which the Chair is not present, including executive sessions of the non-management and independent directors; |

| • | acting as the principal liaison to the Chair for the views, and any concerns and issues of, the independent directors; |

| • | advising on the flow of information sent to the Board, and reviewing the agendas, materials and schedules for Board meetings; |

| • | being available for consultation and communication with major shareholders, as appropriate; |

| Corporate governance | 5 |

| • | maintaining close contact with the chair of each committee; and |

| • | performing other duties that the Board may from time to time delegate to assist the Board in the fulfillment of its responsibilities. |

Mr. LeFevre was elected to serve as Lead Director by the independent directors effective July 1, 2021, to serve until

the Company’s 2023 Annual General Meeting of Shareholders. Prior to such date, Ms. Otero served as the Lead Director, commencing January 3, 2021, when Mr. Nelson, the then-current Lead Director, resigned from the Board. The Board periodically reviews the structure of the Board and Company leadership as part of the succession planning process.

Annual Board and committee assessment process

The Board and each committee annually conduct self-evaluations, a process that is overseen by the nominating and corporate governance committee. Additionally, as part of our annual evaluation process, each director evaluates the Board and the committees on which he or she serves. The assessments provide directors and applicable committee members the opportunity to provide feedback on a number of issues, including:

|

Board and committee structure, composition, roles and leadership; |

|

Board and committee function and effectiveness, including quality of meetings and flow of information; and |

|

Access to management, advisors and internal and external resources. |

The Board’s role in risk oversight

The Board of Directors oversees the Company’s enterprise-wide approach to risk management, and as part of executing its risk oversight responsibility, delegates specific risk oversight duties to each Board committee, as set forth below.

Audit committee

| • | Integrity of the financial statements |

| • | Accounting and financial reporting matters and controls, including independent and internal auditors |

| • | Enterprise risk management program |

| • | Legal and regulatory risks and matters that may have material impact on the Company’s financial statements or operations |

| • | Major risks relating to cybersecurity, privacy and product safety matters, and steps management has taken to assess, monitor and control any such exposures |

| • | Quarterly updates from management on Company’s ethics and compliance and internal audit programs |

Compensation committee

| • | Material risks arising from the Company’s compensation policies and practices, and evaluating such practices and policies to confirm that they do not encourage excessive risk-taking |

| • | Together with the ESG committee, risks and opportunities related to human capital management |

Nominating and corporate governance committee

| • | Corporate governance practices, Board composition, leadership and structure, and Board evaluations |

ESG committee

| • | Risks related to environmental and social sustainability topics in connection with the Company’s activities |

| • | Together with the compensation committee, risks and opportunities related to human capital management |

The Board also provides oversight of management regarding key enterprise risks as well as the Company’s risk management policies and procedures to ensure they are designed and implemented in a way that reflects the Board’s and management’s consensus as to appropriate levels of risk for specific aspects of the Company’s business. The Company’s Management Risk Committee is comprised of members of senior management who meet on a regular basis to serve as a forum for risk information sharing, risk management coordination, and risk management decisioning and response. The enterprise risk management program promotes informed and data-driven decisions and integrated processes to identify, monitor and mitigate key enterprise risks.

| 6 | Corporate governance |

The compensation committee, with the assistance of Meridian, its compensation advisor, regularly conducts a review of the Company’s material compensation policies and practices applicable to its employees, including its executive officers. Based on this review, the compensation committee concluded that these policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company. Key features of the executive compensation program that support this

conclusion include: the balanced mix between fixed and variable compensation and short- and long-term incentives; the use of multiple performance measures within incentive plans; strong internal controls, including a code of conduct; compensation committee discretion over all final annual incentive awards and active involvement in setting performance targets; the use of share ownership guidelines; and the existence of an anti-hedging policy.

One of our top priorities is the health and safety of our employees, distributors and customers. With respect to our employees, in response to, and during various phases of, the COVID-19 pandemic, we have taken several actions, including supporting our employees to work from home when possible, offering mental wellness programs, and implementing the following safety measures at our U.S. facilities: required temperature screening, required face coverings, instituted social distancing protocols, enhanced robust cleaning and sanitation measures, and increased the filtration efficiency of existing ventilation systems. Earlier during the COVID-19 pandemic, we also offered incremental compensation to certain of our employees. Over the course of the pandemic, our senior management team has relied on cross-functional teams to monitor, review, and assess the evolving situation, and to recommend risk mitigation actions for the health and safety of our employees and, in the U.S., protocols to align

with all federal, state, and local public health guidelines. We believe our proactive efforts have been successful in supporting our business growth despite the obstacles and challenges presented by the COVID-19 pandemic.

With respect to our distributors, our distributor training and promotion events, such as our Success Training Seminars and our Leadership Development Weekends, have shifted to include “virtual” online approaches, with in-person events reinstituted during the fourth quarter of 2021 and continuing on a case-by-case basis as conditions allow. Promotional activities aimed at our distributors continue, though prizes that have involved travel to events have shifted in some cases to cash and other awards. Certain modified practices by us and our distributors may prove to be lasting improvements, such as events and trainings that are offered virtually as well as in-person, and expanded use of social media channels.

We are a health and nutrition company, and our success has been premised on improving communities. From helping people improve their nutrition with our science-backed products to increasing access to economic opportunities, including through our direct selling business model, we’ve helped people around the world lead healthier lives, become entrepreneurs and have a positive impact in their communities.

Our current Global Responsibility strategy has been informed by multiple inputs including a benchmarking exercise, materiality assessment, multiple rounds of internal stakeholder engagement and Board oversight. Our strategy is part of our business practices and long-term growth plans. Our three core pillars of our Global Responsibility strategy are:

| • | Healthy Communities. We focus on enabling greater access to nutrition. |

| • | Economic Opportunity. We focus on increasing access to economic opportunity, including support for organizations that empower opportunities for vulnerable communities. |

| • | Environmental stewardship. We focus on promoting a sustainable future, including our focus on environmental impact and product stewardship. |

To ensure regular review of our strategy, we are conducting a second global materiality assessment across various stakeholder groups. The results of our materiality analysis will help with continuous development of our Global Responsibility strategy.

We are dedicated to improving communities by aligning our Global Responsibility strategy with the United Nations Sustainable Development Goals (UNSDGs), specifically Goal 1 (No Poverty), Goal 2 (Zero Hunger), Goal 3 (Good

| Corporate governance | 7 |

Health and Wellbeing), Goal 12 (Responsible Consumption and Production) and Goal 13 (Climate Action).

Herbalife Nutrition joined the UN Global Compact as a signatory member in 2020 and continues to remain in good standing.

50 Million Positive Impacts

In 2020, we began working towards our goal to achieve 50 million positive impacts across our Global Responsibility focus areas by 2030, the 50th anniversary of Herbalife Nutrition, to help drive our commitment to nourish people, communities, and the planet.

Nourishing Healthy Communities

As a business that has been focused on helping people improve their nutritional habits for more than 40 years, access to food and nutrition is paramount to our stakeholders. We are committed to the goal of ending hunger and supporting opportunities to improve nutrition worldwide. Among the core aims of nourishing healthy communities include working towards hunger eradication, fostering accessible nutrition, nutrition education and supporting health and wellness for communities.

Through various partnerships and programs, Herbalife Nutrition continues with its efforts to help eradicate hunger and reduce food insecurity and malnutrition for communities around the world. To support this critical ambition, Herbalife Nutrition announced a global initiative in 2019, the Nutrition for Zero Hunger (NFZH). Supported by the Company and the Herbalife Nutrition Foundation1, NFZH is a program aimed at eradicating hunger by partnering with leading global, regional, and local nonprofit and strategic organizations. Current partners include the World Food Program USA, Feed the Children, Asociación Mexicana de Bancos de Alimentos (BAMX), who have received grants from the Herbalife Nutrition Foundation, as well as partners like SOS Children’s Villages of Europe, Africa and India, supported by charitable contributions from Herbalife Nutrition, along with other partners who are working to achieve the end of global hunger.

Nourishing Economic Opportunity

As a core part of our support for communities, we commit to working to create sustainable changes to promote economic empowerment. This includes working with nonprofit partners to provide resources to vulnerable communities including tools, education, and mentorship. Our key focus areas are supporting development of

inclusive economies, gender equity, women financial empowerment and supporting entrepreneurship.

Herbalife Nutrition proudly supports organizations that provide opportunities for underserved, vulnerable and minority communities. In 2021, the Company, along with the Herbalife Nutrition Foundation, supported more than a dozen of these organizations, reflecting the needs of diverse global, regional, and local communities.

These partners include Unidos US, League of United Latin American Citizens (LULAC), Los Angeles Urban League, and Chrysalis. In addition we support various programs including nutrition and health resources, mentoring, human rights, gender equity and advocacy as well as provide in-kind donations of nutrient-dense products.

Nourishing a Thriving Planet

Herbalife Nutrition is committed to helping protect the future of our planet in an environment where natural resources are constrained. Our integration of environmental stewardship aligns with the values of our Herbalife Nutrition Members and consumers, who care about how our products are sourced, manufactured, and produced. As with our product quality philosophy, we view our environmental footprint through a product lifecycle lens that extends from seed to feed, striving to meet the needs of our planet and our global community.

Our current sustainability initiatives focus on issues including climate and emissions, packaging, and operational waste.

Commitment to Diversity, Equity and Inclusion (DEI)

Herbalife Nutrition is focused on fostering an inclusive and representative workforce. Our DEI strategy embraces a core vision that our commitment to these principles is imperative to enabling us to better serve our Herbalife Nutrition members, stakeholders, and communities. This requires creating a work environment where people of all genders, ethnicities, abilities, cultures, races, religions, and sexual orientations can thrive.

To support our DEI efforts, we have established a Global DEI Council and supporting Regional Councils to oversee

1 Herbalife Nutrition Foundation is a public charity. Herbalife Nutrition Foundation chooses to join Herbalife Nutrition in some charitable initiatives where mission and goals are aligned.

| 8 | Corporate governance |

the implementation of our core DEI principles. In addition, we have launched eight global employee-led Employee Networks, which are identity- or experience-based groups that help employees build community and share a common purpose. They focus on strengthening belonging, providing support, and contributing to personal and professional development in the workplace.

In 2021, we set diversity goals and targets for women in leadership roles globally and for racial and ethnic minorities in leadership roles in the U.S.

ESG Governance Structure

To ensure that our Global Responsibility strategy is embedded into the Company’s overall long-term sustainable business strategy and managed throughout the global organization, we have established the following governance structures regarding ESG and Global Responsibility:

| * | The ESG Committee of the Board of Directors assists the Board in overseeing Global Responsibility strategy. It also works with other Committees, depending on relevance, scope and other factors. |

Board of Directors: Our Global Responsibility strategy is subject to Board oversight. For additional details regarding our Board’s ESG Committee, please see page 15.

Executive Committee: Provides executive direction and ensures integration of Global Responsibility goals across functional and regional strategies.

Global Responsibility Steering Committees and Working Groups: Leaders representing business functions, regions and markets meet regularly to form cross-functional and project-specific groups to drive accountability, ownership, and integration of Global Responsibility initiatives.

Global Responsibility Report and ESG Index

Herbalife Nutrition is committed to continue to report on our Global Responsibility programs, progress, metrics, and policies. In addition to our first Global Responsibility Report, which was issued in 2021, we also make metrics available through our ESG Index, updated annually.

Our ESG Index and Global Responsibility Report are prepared in accordance with the Global Reporting Initiative and the Sustainability Accounting Standards Board, and can be found on our corporate website at www.IAmHerbalifeNutrition.com. The content on this website, including the ESG Index and Global Responsibility Report, is not incorporated by reference into this Proxy Statement.

Herbalife Nutrition Foundation

Established in 1994, the Herbalife Nutrition Foundation (HNF) is a public charity. Its mission is to improve the lives of children and communities around the globe. In 2021, HNF funded 167 community-based Casa Herbalife Nutrition partners in 59 countries, reaching more than 200,000 people in need. HNF may choose to join Herbalife Nutrition in some charitable initiatives where mission and goals are aligned.

| Corporate governance | 9 |

Each non-management director receives annual cash fees for service on the Board and committees* as follows:

| Board service |

$100,000 per year | |

| Audit committee service |

Member - $10,000 per year Chair - $20,000 per year | |

| Compensation committee service |

Member - $10,000 per year Chair - $15,000 per year | |

| Nominating and corporate governance committee service |

Member - $10,000 per year Chair - $15,000 per year | |

| ESG committee service |

Member - $10,000 per year Chair - $15,000 per year | |

| * | Chairs receive chair fees in addition to member fees. For example, the chair of the audit committee receives an aggregate fee of $30,000 for his or her services on the committee. |

The Lead Director also receives an annual fee of $25,000 per year for additional services provided in that capacity.

Cash fees with respect to Board or committee membership or service as the Lead Director or a committee chair are paid ratably assuming 12 consecutive months of service from the date the particular membership or service commences. Non-management directors also receive an annual equity grant pursuant to the Herbalife Ltd. 2014 Stock Incentive Plan, as it may be amended from time to time, or the 2014 Plan, in the form of restricted stock units, or RSUs, with a grant date fair value of $135,000 (rounded down to the nearest whole unit) that vest annually. The board equity grants made in May 2021, or the 2021 Board RSU Grants, are scheduled to vest on April 15, 2022.

The Lead Director also receives an equity grant in the form of RSUs with a grant date fair value of $25,000 (rounded down to the nearest whole unit) per each year of his or her two-year term, which vests annually the following year. The current Lead Director, Mr. LeFevre, who was appointed Lead Director effective July 1, 2021, received a 75% pro-rated Lead Director equity grant, totaling a grant date fair value of $18,750 (rounded down to the nearest whole unit), in August 2021. Mr. LeFevre’s lead director equity grant is scheduled to vest on April 15, 2022.

Ms. Otero, who served as Lead Director from January 3, 2021 until July 1, 2021, received a Lead Director equity grant in May 2021 at the time of the 2021 Board RSU Grants. In July 2021, when Mr. LeFevre became Lead Director, half of Ms. Otero’s Lead Director equity grant was forfeited, while the remainder is scheduled to vest on April 15, 2022 in recognition of her approximately six-month service as Lead Director.

The compensation disclosed in the 2021 Director Compensation table below for Mr. Tartol and Mr. Mendoza includes other compensation, unrelated to their services as directors. Specifically, in addition to their director compensation, the table below includes each of Mr. Tartol’s and Mr. Mendoza’s respective earnings as top distributors of Herbalife Nutrition products under the Company’s Marketing Plan.

The Company may also reimburse our directors for their respective travel, lodging and related expenses associated with travel to and attendance at Board or Board committee meetings, as well as reasonable costs in connection with attending director continuing education programs in accordance with the Company’s applicable orientation and continuing education policy.

| 10 | Corporate governance |

The following table summarizes the compensation paid by the Company to non-management directors for the fiscal year ended December 31, 2021, which includes: (1) compensation paid to directors for their services on the Board and the Board’s committees, (2) payments made to directors for any services provided at Company events, such as Extravaganzas, and (3) payments made to independent distributors of Herbalife Nutrition products in accordance with the Company’s Marketing Plan.

2021 Director compensation table

|

Name |

Fees earned or paid in cash ($) |

Equity awards ($)(1) |

All other compensation |

Total ($) |

||||||||||||

| Richard H. Carmona |

|

128,116 |

|

|

134,994 |

|

|

25,000 |

(2) |

|

288,110 |

| ||||

| Jonathan Christodoro(3) |

|

— |

|

|

— |

|

— |

|

— |

| ||||||

| Hunter C. Gary(3) |

|

— |

|

|

— |

|

— |

|

— |

| ||||||

| Nicholas Graziano(3) |

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||

| Kevin M. Jones(4) |

|

90,976 |

|

|

157,476 |

|

|

— |

|

|

248,452 |

| ||||

| Sophie L’Hélias(4) |

|

107,851 |

|

|

157,476 |

|

|

— |

|

|

265,327 |

| ||||

| Alan W. LeFevre |

|

142,446 |

|

|

153,740 |

(5) |

|

— |

|

|

296,186 |

| ||||

| Jesse A. Lynn(3) |

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||

| Juan Miguel Mendoza(6) |

|

100,000 |

|

|

134,994 |

|

|

1,758,274 |

(6)(7) |

|

1,993,268 |

| ||||

| Michael Montelongo(8) |

|

45,262 |

|

|

— |

|

|

— |

|

|

45,262 |

| ||||

| Don Mulligan(4) |

|

107,726 |

|

|

157,476 |

|

|

— |

|

|

265,202 |

| ||||

| James L. Nelson(3) |

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||

| Maria Otero |

|

153,981 |

|

|

159,957 |

(9) |

|

— |

|

|

313,938 |

| ||||

| Margarita Paláu-Hernández(8) |

|

43,280 |

|

|

— |

|

|

— |

|

|

43,280 |

| ||||

| John Tartol(6) |

|

100,000 |

|

|

134,994 |

|

1,693,315 | (6)(10) |

|

1,928,309 |

| |||||

| (1) | Amounts represent the aggregate grant date fair value of the relevant award(s) presented in accordance with FASB ASC Topic 718, “Compensation—Stock Compensation”. See Note 9 to the to the Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2021 for a discussion of the relevant assumptions used in calculating these amounts pursuant to FASB ASC Topic 718. |

| (2) | Amount represents fees for speaking at Herbalife Nutrition events. |

| (3) | Messrs. Christodoro, Gary, Graziano, Lynn and Nelson resigned from the Board effective January 3, 2021. |

| (4) | Messrs. Jones and Mulligan and Ms. L’Hélias were appointed to the Board on February 26, 2021. Equity award amount includes the 2021 annual director equity grant and a prorated portion of annual director equity grant based on service from such appointment date through May 2021. |

| (5) | Mr. LeFevre was appointed Lead Director on July 1, 2021. Amount includes the 2021 annual director equity grant and a prorated 2021 Lead Director equity grant. |

| (6) | All independent distributors of Herbalife Nutrition products, including Messrs. Mendoza and Tartol, are eligible to receive income under the Company’s Marketing Plan as a result of their activities as distributors. Under the Company’s Marketing Plan, Herbalife Nutrition Members may earn profits by purchasing products at wholesale prices, discounted depending on the Member’s level within our Marketing Plan, and reselling those products at prices they establish for themselves to generate retail profit. Second, Herbalife Nutrition Members who sponsor other Members and establish, maintain, coach, and train their own sales organizations may earn commissions on the sales of their organization. Both Mr. Mendoza and Mr. Tartol would have received this income irrespective of their services on the Board. Neither Mr. Mendoza nor Mr. Tartol receive any preferential treatment or payments under the Company’s Marketing Plan. |

| (7) | Amount includes $30,000 in fees for speaking at Herbalife Nutrition events for Herbalife Nutrition Members. Additionally, unrelated to his service as a Board member, amount also includes $1,728,274 in income earned as a top distributor of Herbalife Nutrition products. See note 6 above. |

| (8) | Mr. Montelongo and Ms. Paláu-Hernández did not stand for re-election to the Company’s Board of Directors at the Company’s 2021 Annual General Meeting of Shareholders. |

| Corporate governance | 11 |

| (9) | Ms. Otero served as the Board’s Lead Director from January 3, 2021 through July 1, 2021. Amount reflects the 2021 annual director equity grant and Lead Director equity grant. Upon the transition from Lead Director in July 2021, half of such Lead Director equity grant was forfeited. |

| (10) | Amount includes $20,000 in fees for speaking at Herbalife Nutrition events for Herbalife Nutrition Members. Additionally, unrelated to his service as a Board member, amount also includes $1,673,315 in income earned as a top distributor of Herbalife Nutrition products. See note 6 above. |

The table below summarizes the equity-based awards held by non-management directors who served on the Company’s Board of Directors in 2021, as of December 31, 2021.

| Name |

Stock Unit Awards |

|||||||

| Number of Shares or units of stock that have not vested (#) |

Market value of Shares or units of stock that have not vested(1) ($) |

|||||||

| Richard H. Carmona |

|

2,720 |

|

|

111,330 |

| ||

| Jonathan Christodoro(2) |

|

— |

|

|

— |

| ||

| Hunter C. Gary(2) |

|

— |

|

|

— |

| ||

| Nicholas Graziano(2) |

|

— |

|

|

— |

| ||

| Kevin M. Jones |

|

3,173 |

|

|

129,871 |

| ||

| Sophie L’Hélias |

|

3,173 |

|

|

129,871 |

| ||

| Alan W. LeFevre |

|

3,114 |

(3) |

|

127,456 |

| ||

| Jesse Lynn(2) |

|

— |

|

|

— |

| ||

| Juan Miguel Mendoza |

|

2,720 |

|

|

111,330 |

| ||

| Michael Montelongo(2) |

|

— |

|

|

— |

| ||

| Don Mulligan |

|

3,173 |

|

|

129,871 |

| ||

| James L. Nelson(2) |

|

— |

|

|

— |

| ||

| Maria Otero |

|

2,971 |

(4) |

|

121,603 |

| ||

| Margarita Paláu-Hernández(2) |

|

— |

|

|

— |

| ||

|

John Tartol |

|

2,720 |

|

|

111,330 |

| ||

| (1) | Market value based on the closing price of a Common Share on the NYSE on December 31, 2021 of $40.93. |

| (2) | Former member of the Board. |

| (3) | Following Mr. LeFevre’s appointment as Lead Director in July 2021, Mr. Lefevre received a pro-rated Lead Director equity grant granted in August 2021 in the amount of 394 RSUs. |

| (4) | Ms. Otero served as Lead Director from January 3, 2021 through July 1, 2021. Ms. Otero received a Lead Director equity grant in May 2021 of 503 RSUs. Upon the Lead Director transition in July 2021, half of such Lead Director equity grant, equaling 252 RSUs, was forfeited while the remaining 251 RSUs are subject to vest April 15, 2022. |

The Company has adopted share ownership guidelines applicable to each named executive officer and non-management director to encourage each person to acquire a meaningful ownership stake in the Company over time by retaining financial interest in our common shares. Our CEO is encouraged to acquire and hold Common Shares with an aggregate value equal to five times his base salary within five years of his CEO appointment. Our other named executive officers are encouraged to acquire and hold Common Shares with an aggregate value equal to two times their respective base salaries within five years following their respective designation as a named executive officer.

Each non-management director is encouraged to hold Common Shares with an aggregate value equal to five times such director’s annual retainer within five years of such director’s appointment or election to the Board of Directors.

As of the date of this Proxy Statement, all non-management directors and current named executive officers are in compliance with the current guidelines.

| 12 | Corporate governance |

We value the viewpoint of all investors and have actively engaged with shareholders to better understand their perspectives, and strongly consider their feedback when evaluating our governance provisions and practices.

Since the 2021 Annual General Meeting of Shareholders, we engaged with a number of shareholders to initiate new, and deepen existing, relationships with our investor

base. We reached out to top Herbalife Nutrition shareholders that, in the aggregate, owned in excess of 57% of our outstanding Common Shares, and covered various governance topics including Board composition and compensation, risk oversight, shareholder rights and environmental & social initiatives across the Company. In aggregate, we had discussions with investors who hold approximately 33% of outstanding Common Shares.

Shareholders and other parties interested in communicating directly with the Board of Directors, non-management or independent directors as a group or individual directors, including the Chair or Lead Director in such capacity, may do so by writing to our Corporate Secretary at c/o Herbalife International of America, Inc., 800 W. Olympic Blvd., Suite 406, Los Angeles, California 90015, or by email to corpsec@herbalife.com, indicating to whose attention the communication should be directed. The Office of the Corporate Secretary of the Company reviews and logs all such correspondence and forwards to members of the Board of Directors a summary and/or

copies of any such correspondence that, in the opinion of the Corporate Secretary, deal with the functions of the Board of Directors or committees thereof, or that he otherwise determines requires their attention. Directors may at any time review a log of all communications received by the Company and addressed to members of the Board of Directors and request copies of any such correspondence. Concerns relating to accounting, internal controls or auditing matters are immediately brought to the attention of the Company’s internal audit department and handled in accordance with procedures established by the audit committee with respect to such matters.

Director orientation and continuing education

Herbalife Nutrition is in the business of providing health and wellness products to consumers in 95 countries and territories through our direct-selling business model. As part of our onboarding process, we introduce new directors to our company with an overview of our business through a review of background and reference materials, meetings with senior management and their direct reports, and, where feasible, tours of manufacturing facilities and nutrition clubs. Our comprehensive orientation sessions are designed to provide new directors a thorough understanding of their fiduciary duties and familiarize them with the Company’s business and strategic plans, significant financial matters, risk management approach, compliance and ethics programs, corporate governance practices, and other key policies and practices. These orientation sessions allow new

directors to begin making contributions to the Board at the start of their service.

The Company also provides, on an ongoing basis, additional opportunities for directors to further familiarize themselves with the Company’s business, finances and operations, which may include, among other things, presentations from members of management of the Company and visits to Herbalife Nutrition Members events, such as Extravaganzas and Herbalife Honors. Additionally, we encourage our directors to participate in external continuing director education programs, and provide reimbursement of expenses associated with our independent directors’ attendance at one outside director education program each fiscal year.

Our Board of Directors has an audit committee, nominating and corporate governance committee, compensation committee, and ESG committee. Our Board of Directors has adopted a written charter for each of these committees, and the charters for current

committees are available on the Company’s website at https://ir.herbalife.com/corporate-governance, and in print to any shareholder who requests it as set forth under Part 7 —“Annual report, financial and additional information”.

| Corporate governance | 13 |

Current committee memberships

|

Directors(1) |

Audit(2) | Compensation(3) |

Nominating and Corporate |

ESG(4) | ||||

| Richard H. Carmona † |

|

|

Chair |

| ||||

| Kevin M. Jones † |

|

● |

|

| ||||

| Sophie L’Hélias † | ● |

|

|

Chair | ||||

| Alan W. LeFevre * † | ● |

|

● |

| ||||

| Don Mulligan * † | Chair | ● |

|

| ||||

| Maria Otero † |

|

Chair | ● | ● | ||||

| Dr. John Agwunobi |

|

|

|

● |

* Audit Committee “financial expert” † Independent • Member

| (1) | In connection with the termination of the Support Agreement, Messrs. Christodoro, Gary, Graziano, Lynn and Nelson resigned from the Board and all of its committees effective January 3, 2021. For additional details regarding the Support Agreement, please see page 4. |

| (2) | Mr. Montelongo and Ms. Paláu-Hernández served on the committee until April 28, 2021. Ms. L’Hélias and Mr. Mulligan were appointed to the audit committee on April 28, 2021. Mr. Mulligan assumed responsibilities as chair of the audit committee on July 1, 2021. Each member who currently serves on the audit committee, or served on the committee during 2021, is or was financially literate and met the independence requirements of the NYSE and Rule 10A-3 under the Securities Exchange Act of 1934, as amended, or the Exchange Act. The Board determined each of Messrs. Mulligan and LeFevre as an “Audit Committee financial expert” as such term is defined in SEC rules and regulations. |

| (3) | Ms. Paláu-Hernández and Dr. Carmona served on the committee until April 28, 2021. Messrs. Jones and Mulligan were appointed to the compensation committee on April 28, 2021. Each member who currently serves on the compensation committee, or served on the compensation committee during 2021, is or was (a) independent under the listing standards of the NYSE, including the heightened standards applicable to members of a listed company’s compensation committee, and (b) a “nonemployee director” under Rule 16b-3 of the Exchange Act. |

| (4) | Mr. Montelongo and Ms. Paláu-Hernández both served on the ESG committee until April 28, 2021. Mmes. L’Hélias and Otero were appointed to the ESG committee on April 28, 2021 with Ms. L’Hélias serving as its chair starting from such date. |

| Audit committee | ||

| The audit committee represents and assists the Board in fulfilling its responsibilities for overseeing our financial reporting processes and the audit of our financial statements. | Meetings Held in 2021:

6 | |

The principal duties of the audit committee include the following:

| • | monitoring the integrity of the Company’s financial reporting process and systems of internal controls regarding finance, accounting and reporting; |

| • | monitoring the independence and performance of the Company’s independent registered public accounting firm and internal audit function; |

| • | monitoring compliance with legal and regulatory requirements and performance of the Company’s ethics and compliance program; and |

| • | reviewing the Company’s framework and guidelines with respect to risk assessment and risk management, including the Company’s enterprise risk management program and risks and practices related to cyber security, privacy and product safety matters. |

| Compensation committee | ||

| The compensation committee discharges the Board’s responsibilities related to the compensation of our executives and directors, and provides general oversight of our compensation structure, including our equity compensation plans and benefits programs. | Meetings Held in 2021:

5 | |

| 14 | Corporate governance |

The principal duties of the compensation committee include the following:

| • | overseeing and approving compensation policies and programs, and administering existing incentive compensation plans and equity-based plans; |

| • | reviewing and approving corporate goals and objectives relevant to the compensation of the Company’s CEO and other executive officers; |

| • | evaluating the performance of the CEO and recommending the compensation level of the CEO for approval by the independent members of the Board of Directors; |

| • | evaluating the performance of executive officers and, considering the CEO’s recommendations, setting the compensation level for such executive officers; |

| • | reviewing the compensation of directors, and making recommendations to the Board; |

| • | overseeing management succession planning processes; and |

| • | overseeing the Company’s response to regulatory developments affecting executive compensation. |

| Nominating and corporate governance committee | ||

| The nominating and corporate governance committee oversees, and represents and assists the Board in fulfilling its responsibilities relating to, our corporate governance, and director nominations and elections. | Meetings Held in 2021:

9 | |

The principal duties of the nominating and corporate governance committee include the following:

| • | recommending to the Board of Directors proposed nominees for election to the Board of Directors both at annual general meetings of shareholders and to fill vacancies that occur between annual general meetings; and |

| • | reviewing and making recommendations to the Board of Directors regarding the Company’s corporate governance matters and practices. |

| ESG committee | ||

| The ESG committee assists the Board in discharging its oversight responsibility relating to the Company’s significant environmental, social and related governance activities and practices, including policies, programs and practices, strategy, stakeholder engagement and risks. | Meetings Held in 2021:

4 | |

The principal duties of the ESG committee include the following:

| • | recommending to the Board on the Company’s environmental and social sustainability strategy, programs, policies and investments that support the Company’s overall business strategy; |

| • | overseeing the review and evaluation of risks and opportunities related to environmental and social sustainability topics that may arise in connection with the Company’s activities and advising the Board on such risks and opportunities in coordination with the Board’s other committees; and |

| • | reviewing and discussing with management the Company’s public disclosures and communication strategies with investors and other stakeholders regarding such topics. |

Compensation committee interlocks and insider participation

During the fiscal year ended December 31, 2021, Dr. Carmona and Messrs. Gary, Graziano, Jones and Mulligan and Mmes. Otero and Paláu-Hernández served on the compensation committee of the Board. During the fiscal year ended December 31, 2021, there were no relationships or transactions between the Company and any member of the compensation committee requiring disclosure hereunder.

None of our executive officers currently serves, or during the fiscal year ended December 31, 2021 served, as a member of the board of directors or compensation committee of any entity that has one or more executive officers serving on our Board of Directors or compensation committee.

| Corporate governance | 15 |

| Part 3

|

Proposals to be voted on at the |

Proposal 1: The election of directors

Generally

The Articles presently provide for not less than one nor more than 15 directors. The Board of Directors has, by resolution, presently fixed the number of directors at 9, and there is currently a full complement of 9 members of the Board. There are 10 Board nominees recommended for election at the Annual Meeting. The number of directors will be increased to 10 if the 10 director nominees are elected at the Annual Meeting. Directors are elected at each annual general meeting of shareholders to hold office for one-year terms until the next annual general meeting of shareholders.

The Board has nominated each of John O. Agwunobi, Richard H. Carmona, Michael O. Johnson, Kevin M. Jones, Sophie L’Hélias, Alan W. LeFevre, Juan Miguel Mendoza, Don Mulligan, Maria Otero, and John Tartol for election as directors to serve one-year terms expiring at the 2023 annual general meeting. Considering his prior service with the Company as chair and chief executive officer, Mr. Johnson was identified and recruited by members of the nominating and corporate governance committee. Directors are elected under a majority voting standard in uncontested director elections (i.e., an election where the number of persons nominated for election does not exceed the number of directors to be elected). The election of directors at the Meeting constitutes an uncontested director election. Under a majority voting standard in uncontested director elections, each vote is required to be counted “for” or “against” a director nominee’s election. In order to be elected, the votes cast “for” such nominee’s election must exceed the number of votes cast “against” such nominee’s election. Abstentions and “broker non-votes” will not affect the outcome of the election of directors.

The persons named as proxies on the accompanying proxy card intend to vote the Common Shares as to which they are granted authority to vote for the election of the nominees listed herein. The form of proxy card does not permit shareholders to vote for a greater number of nominees than 10. Although the Board does not know of any reason why any nominee will be unavailable for election, in the event any nominee should be unavailable

at the time of the Meeting, the proxies may be voted for a substitute nominee as selected by the Board of Directors or just for the remaining nominees, leaving a vacancy. Alternatively, the Board may reduce the size of the Board.

Director qualifications

The Board believes that the Board, as a whole, should possess a combination of skills, professional experience and diversity of backgrounds necessary to oversee the Company’s business. In addition, the Board believes that there are certain attributes that every director should possess, as reflected in the Board’s membership criteria discussed hereunder. Accordingly, the Board and the nominating and corporate governance committee consider the qualifications of directors and director candidates individually and in the broader context of the Board’s overall composition, as well as the Company’s current and future needs.