SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 | |

HERBALIFE NUTRITION LTD.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | Fee not required. | |||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid:

| |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

HERBALIFE

NUTRITION

Making the World Healthier and Happier

PROXY

STATEMENT

2019

| Herbalife Nutrition Ltd.

2019 Proxy Statement

|

Annual General Meeting of Shareholders

Our 2019 Annual General Meeting of Shareholders

will be held on Wednesday, April 24, 2019 at 8:30 a.m., Pacific Daylight Time, at:

800 W. Olympic Blvd., Suite 406

Los Angeles, CA 90015

Admission requirements

See Part 1 – “Information concerning solicitation and voting” for details on admission requirements to attend the Annual General Meeting.

Herbalife Nutrition Ltd.

Notice of Annual General Meeting of Shareholders

| Date: | Wednesday, April 24, 2019 | |

| Time: | 8:30 a.m., Pacific Daylight Time | |

| Place: | 800 W. Olympic Blvd., Suite 406 Los Angeles, CA 90015 | |

| Record date: | February 26, 2019 | |

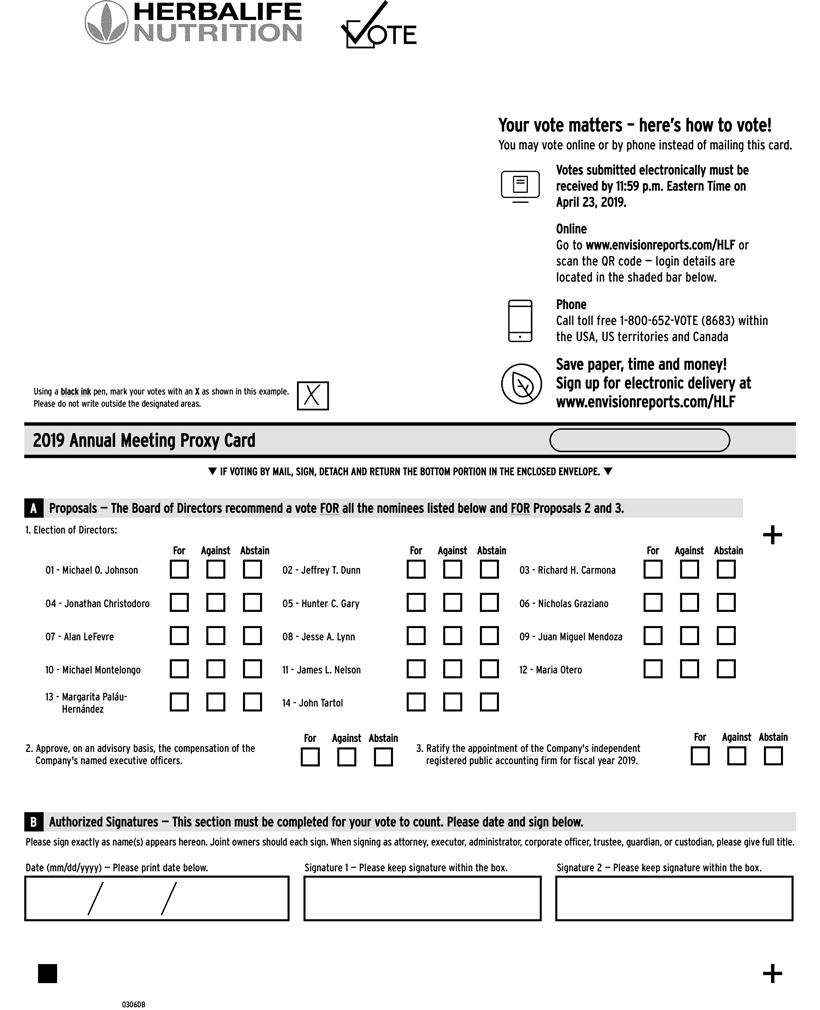

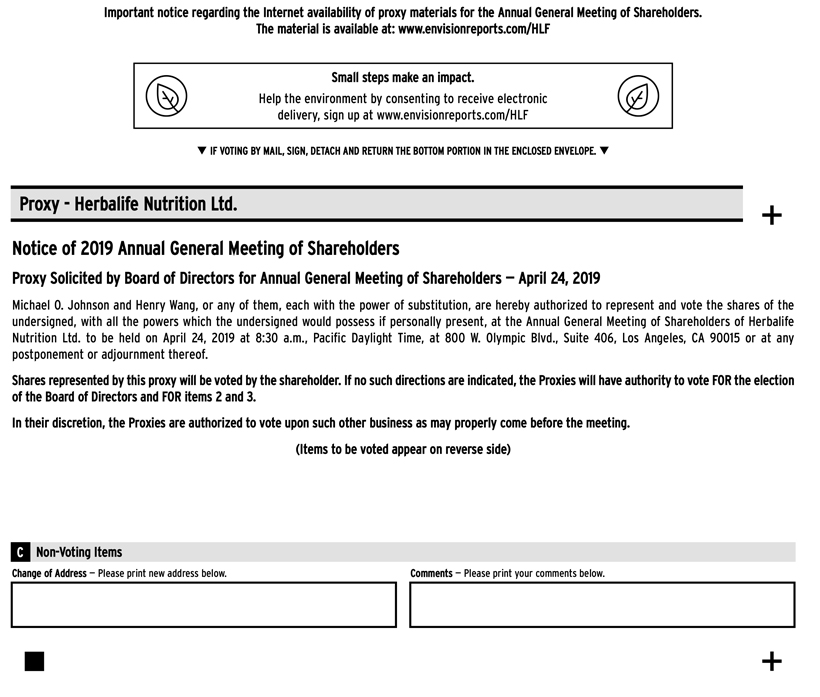

| Proxy voting: | All shareholders are cordially invited to attend the Annual General Meeting in person. See Part 1 — “Information concerning solicitation and voting” for details on admission requirements to attend the Annual General Meeting.

However, to assure your representation at the Annual General Meeting, you are urged to vote promptly. You may vote your shares via a toll-free telephone number, over the Internet or by completing, signing and mailing the proxy card or voting instruction form provided to you. Please follow the instructions on the proxy card or voting instruction form provided to you. | |

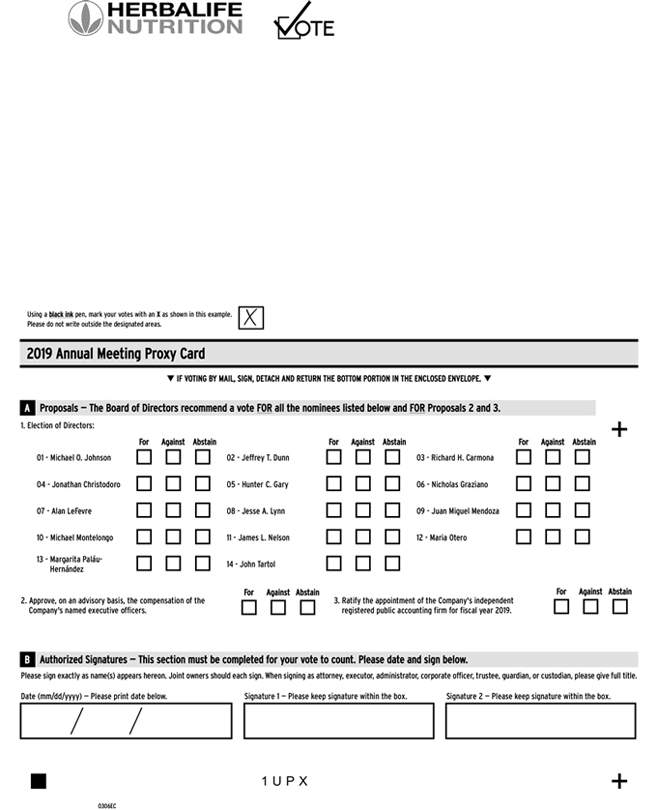

| Items of business: | 1. Elect the 14 directors named in the Proxy Statement to the Board of Directors to serve until the 2020 annual general meeting of shareholders of the Company or until their successors are duly elected and qualified;

2. Approve, on an advisory basis, the compensation of the Company’s named executive officers; and

3. Ratify the appointment of the Company’s independent registered public accounting firm for fiscal year 2019.

Shareholders will also act upon such other matters as may properly come before the Annual General Meeting. | |

| The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only shareholders of record at the close of business on February 26, 2019 are entitled to notice of, and to vote at, the Annual General Meeting and any subsequent adjournment(s) or postponement(s) thereof. | ||

| Availability of Materials: | The Proxy Statement and Annual Report to Shareholders are available at http://www.envisionreports.com/HLF. | |

NOTICE IS HEREBY GIVEN that the 2019 Annual General Meeting of Shareholders of Herbalife Nutrition Ltd., a Cayman Islands exempted company incorporated with limited liability, or the Company, will be held on Wednesday, April 24, 2019 at 8:30 a.m., Pacific Daylight Time, at 800 W. Olympic Blvd., Suite 406, Los Angeles, CA 90015.

Sincerely,

HENRY C. WANG

General Counsel and Corporate Secretary

Los Angeles, California

March 12, 2019

Proxy summary

This summary highlights information contained elsewhere in this Proxy Statement. You should carefully read this Proxy Statement in its entirety prior to voting on the proposals listed below and outlined herein. This Proxy Statement is dated March 12, 2019 and is first being made available to shareholders of Herbalife Nutrition Ltd., a Cayman Islands exempted company incorporated with limited liability, or the Company, on or about March 14, 2019. A Notice Regarding Internet Availability of Proxy Materials for the 2019 Annual General Meeting of Shareholders, or the Meeting, was mailed to shareholders of the Company on or about March 14, 2019.

Annual General Meeting of Shareholders

| Date: | Wednesday, April 24, 2019 | |

| Time: | 8:30 a.m., Pacific Daylight Time | |

| Place: | 800 W. Olympic Blvd., Suite 406 Los Angeles, CA 90015 | |

| Record date: | February 26, 2019 | |

| Voting: | Shareholders as of the record date are entitled to vote. | |

Admission to meeting: Proof of share ownership will be required to enter the Meeting. See Part 1 – “Information concerning solicitation and voting” for details on admission requirements to enter the Meeting.

Meeting agenda

| 1. | Elect the 14 directors named in the Proxy Statement to the Board of Directors to serve until the 2020 annual general meeting of shareholders of the Company or until their successors are duly elected and qualified; |

| 2. | Approve, on an advisory basis, the compensation of the Company’s named executive officers; and |

| 3. | Ratify the appointment of the Company’s independent registered public accounting firm for fiscal year 2019. |

Shareholders will also act upon such other matters as may properly come before the Meeting.

Voting matters and vote recommendation

Our Board of Directors unanimously recommends that you vote on the proposals to be considered at the Meeting as follows:

|

Matter |

Board vote recommendation |

Page Reference (for more detail) | ||||

|

1. |

Election of 14 directors named in this Proxy Statement to the Board of Directors to serve until the 2020 annual general meeting of shareholders of the Company or until their successors are duly elected and qualified |

For each director nominee |

12 | |||

|

2. |

Advisory vote to approve the compensation of the Company’s named executive officers |

For |

24 | |||

|

3. |

Ratification of the Company’s independent registered public accounting firm for fiscal year 2019 |

For |

25 | |||

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to attend the Meeting, please take the time to vote. You may vote your shares via a toll-free telephone number, over the Internet or by completing, signing and mailing the proxy card or voting instruction form provided to you. Please follow the instructions on the proxy card or voting instruction form.

| Proxy summary |

| ii | Table of Contents |

Important Notice Regarding the Availability of Proxy Materials for the Annual General Meeting of Shareholders To Be Held on April 24, 2019. The Proxy Statement and Annual Report to Shareholders are available at http://www.envisionreports.com/HLF.

| 2 | Our annual general meeting of shareholders |

| 6 | The board of directors |

The table below summarizes the compensation paid by the Company to non-management directors for the fiscal year ended December 31, 2018.

| Name | Fees earned or paid in cash ($)

|

Equity awards ($)(1) |

All other compensation

|

Total ($) |

||||||||||||

| Richard P. Bermingham(2)

|

|

44,400

|

|

|

—

|

|

|

—

|

|

|

44,000

|

| ||||

| Pedro Cardoso(2)

|

|

31,200

|

|

|

—

|

|

1,273,885 | (3) |

|

1,305,085

|

| |||||

| Dr. Richard Carmona

|

|

112,400

|

|

|

134,987

|

|

50,000 | (4) |

|

297,387

|

| |||||

| Jonathan Christodoro

|

|

119,700

|

|

|

134,987

|

|

|

—

|

|

|

254,687

|

| ||||

| Keith Cozza(2)

|

|

30,700

|

|

|

—

|

|

|

—

|

|

|

30,700

|

| ||||

| Jeffrey T. Dunn

|

|

143,500

|

|

|

159,951

|

|

|

—

|

|

|

303,451

|

| ||||

| Hunter C. Gary

|

|

110,200

|

|

|

134,987

|

|

|

—

|

|

|

245,187

|

| ||||

| Nicholas Graziano(2)

|

|

75,500

|

|

|

134,987

|

|

|

—

|

|

|

210,487

|

| ||||

| Alan LeFevre(2)

|

|

89,200

|

|

|

134,987

|

|

|

—

|

|

|

224,187

|

| ||||

| Jesse A. Lynn

|

|

120,600

|

|

|

134,987

|

|

|

—

|

|

|

255,587

|

| ||||

| Juan Miguel Mendoza(2)

|

|

68,600

|

|

|

134,987

|

|

1,284,971 | (5) |

|

1,488,558

|

| |||||

| Michael Montelongo

|

|

121,500

|

|

|

134,987

|

|

|

—

|

|

|

256,487

|

| ||||

| James L. Nelson

|

|

140,500

|

|

|

134,987

|

|

|

—

|

|

|

275,487

|

| ||||

| Maria Otero

|

|

131,500

|

|

|

134,987

|

|

|

—

|

|

|

266,487

|

| ||||

| Margarita Paláu-Hernández(2)

|

|

68,600

|

|

|

134,987

|

|

|

—

|

|

|

203,587

|

| ||||

| John Tartol

|

|

98,800

|

|

|

134,987

|

|

1,643,457 | (6) |

|

1,877,244

|

| |||||

| (1) | Amounts represent the aggregate grant date fair value of the relevant award(s) presented in accordance with ASC Topic 718, “Compensation—Stock Compensation.” See note 9 of the notes to consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 regarding assumptions underlying the valuation of equity awards. |

| (2) | Messrs. Bermingham, Cardoso and Cozza did not stand for re-election at our 2018 annual general meeting of shareholders, and their terms accordingly ended on April 24, 2018. Messrs. Graziano, LeFevre, Mendoza, and Ms. Paláu-Hernández were newly elected to the Board of Directors at our 2018 annual general meeting of shareholders. |

| (3) | Amount includes $36,000 in fees for speaking at Herbalife Nutrition events and $1,237,885 in compensation under the Company’s Marketing Plan resulting from Mr. Cardoso’s activities as an Herbalife Nutrition Member. |

| (4) | Amount represents fees for speaking at Herbalife Nutrition events. |

| (5) | Amount includes $28,000 in fees for speaking at Herbalife Nutrition events and $1,256,971 in compensation under the Company’s Marketing Plan resulting from Mr. Mendoza’s activities as an Herbalife Nutrition Member. |

| (6) | Amount includes $4,000 in fees for speaking at Herbalife Nutrition events and $1,639,457 in compensation under the Company’s Marketing Plan resulting from Mr. Tartol’s activities as an Herbalife Nutrition Member. |

| The board of directors | 7 |

The table below summarizes the equity-based awards held by non-management directors who served on the Company’s Board of Directors in 2018, as of December 31, 2018.

| Name | Options/Stock Appreciation Rights |

Stock Unit Awards |

||||||||||||||||||||||

|

Number of securities underlying unexercised options/SARs (#) exercisable |

Number of securities underlying unexercised options/SARs (#) un-exercisable |

Exercise price ($) |

Expiration date |

Number of Shares or units of stock that have not vested (#) |

Market value of Shares or units of stock that have not vested(1) ($)

|

|||||||||||||||||||

| Richard P. Bermingham(2) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||||

| Pedro Cardoso(2) |

|

15,006 |

|

|

— |

|

|

22.395 |

|

|

05/31/2019 |

|

|

— |

|

|

— |

| ||||||

| Pedro Cardoso(2) |

|

9,052 |

|

|

— |

|

|

39.79 |

|

|

12/19/2020 |

|

|

— |

|

|

— |

| ||||||

| Dr. Richard Carmona |

|

9,052 |

|

|

— |

|

|

39.79 |

|

|

12/19/2020 |

|

|

— |

|

|

— |

| ||||||

| Dr. Richard Carmona |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| Jonathan Christodoro |

|

9,052 |

|

|

— |

|

|

39.79 |

|

|

12/19/2020 |

|

|

— |

|

|

— |

| ||||||

| Jonathan Christodoro |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| Keith Cozza(2) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

| ||||||

| Jeffrey T. Dunn |

|

15,006 |

|

|

— |

|

|

22.395 |

|

|

05/31/2019 |

|

|

— |

|

|

— |

| ||||||

| Jeffrey T. Dunn |

|

9,052 |

|

|

— |

|

|

39.79 |

|

|

12/19/2020 |

|

|

— |

|

|

— |

| ||||||

| Jeffrey T. Dunn |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| Jeffrey T. Dunn |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

442 |

|

|

26,056 |

| ||||||

| Hunter C. Gary |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| Nicholas Graziano |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| Alan LeFevre |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| Jesse Lynn |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| Juan Miguel Mendoza |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| Michael Montelongo |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| James L. Nelson |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| Maria Otero |

|

9,052 |

|

|

— |

|

|

39.79 |

|

|

12/19/2020 |

|

|

— |

|

|

— |

| ||||||

| Maria Otero |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| Margarita Paláu-Hernández |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

2,390 |

|

|

140,891 |

| ||||||

| John Tartol |

|

15,006 |

|

|

— |

|

|

22.395 |

|

|

05/31/2019 |

|

|

— |

|

|

— |

| ||||||

| John Tartol |

|

9,052 |

|

|

— |

|

|

39.79 |

|

|

12/19/2020 |

|

|

— |

|

|

— |

| ||||||

| John Tartol

|

|

—

|

|

|

—

|

|

|

—

|

|

|

— |

|

|

2,390

|

|

|

140,891

|

| ||||||

| (1) | Market value based on the closing price of a Common Share on the NYSE on December 31, 2018 of $58.95. |

| (2) | Former member of the Board. |

| 8 | The board of directors |

| 10 | The board of directors |

| Proposals to be voted on at the meeting | 13 |

Set forth below is biographical information about the 14 nominees standing for election at the Meeting, including each such person’s specific experience, qualifications, attributes and skills that led our Board of Directors to conclude that such individual should serve on our Board of Directors.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES NAMED IN THIS PROXY STATEMENT TO THE BOARD OF DIRECTORS.

Nominees for Election as Directors

| 14 | Proposals to be voted on at the meeting |

| Proposals to be voted on at the meeting | 15 |

| 16 | Proposals to be voted on at the meeting |

| Proposals to be voted on at the meeting | 17 |

| 18 | Proposals to be voted on at the meeting |

| Proposals to be voted on at the meeting | 19 |

| 20 | Proposals to be voted on at the meeting |

| Proposals to be voted on at the meeting | 21 |

| 22 | Proposals to be voted on at the meeting |

| Proposals to be voted on at the meeting | 23 |

Fees to independent registered public accounting firm for fiscal years 2018 and 2017

The following fees were for services provided by PwC:

| 2018 |

2017 |

|||||||

| Audit fees(1) |

|

$8,030,000 |

|

|

$6,818,000 |

| ||

| Audit-related fees(2) |

|

$344,000 |

|

|

$211,000 |

| ||

| Tax fees(3) |

|

$938,000 |

|

|

$1,409,000 |

| ||

| Total |

|

$9,312,000 |

|

|

$8,438,000 |

| ||

| (1) | Audit fees for 2018 and 2017 consist of fees for professional services rendered for the audit of the Company’s consolidated financial statements included in the Company’s Annual Report on Form 10-K for the years ended December 31, 2018 and December 31, 2017, including the audit of internal controls required by Section 404 of the Sarbanes-Oxley Act of 2002, and the review of financial statements included in the Company’s Quarterly Reports on Form 10-Q, and for services that are normally provided by the auditor in connection with statutory and regulatory filings or engagements and comfort letters. |

| (2) | Audit-related fees consist of assurance and related services that were reasonably related to the performance of the audit or review of the Company’s consolidated financial statements and which are not reported under “Audit fees”. |

| (3) | Tax fees were for tax compliance and tax guidance. |

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF PwC AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL YEAR 2019.

| 26 | Proposals to be voted on at the meeting |

| Part 4

|

Executive compensation |

Compensation discussion and analysis

This section explains the Company’s 2018 executive compensation program as it relates to our named executive officers, or NEOs:

| Richard P. Goudis | Former Chief Executive Officer(1) | |

| John G. DeSimone | Co-President, Chief Strategic Officer and Former Chief Financial Officer(2) | |

| Dr. John Agwunobi | Co-President, Chief Health and Nutrition Officer | |

| Shin-Shing Bosco Chiu | Chief Financial Officer | |

| David Pezzullo | Chief Operating Officer | |

| (1) | Mr. Goudis served as the Company’s Chief Executive Officer from June 1, 2017 to January 8, 2019. |

| (2) | Mr. DeSimone served as the Company’s Chief Financial Officer from January 1, 2010 to May 1, 2018, when he was promoted to Co-President, Chief Strategic Officer. |

Executive summary of our compensation program

Financial performance for purposes of our annual incentive program

The Company’s financial performance is a material factor in determining the total compensation for our NEOs. As such, top-line growth stated in terms of Volume Points and profitability stated in terms of Operating Income are the performance metrics used for our annual incentive program with a weighting of 30% and 70%, respectively. These performance measures are more fully described in “Annual incentive awards — Targets and award determination” below.

In 2018, we exceeded our performance targets for Operating Income and Volume Points.

| Results for Bonus Purposes

|

||||||||||||||||||||

| 2015 | 2016 | 2017 | 2018 | 2018 Target

|

||||||||||||||||

| Volume Points (millions)

|

|

5,336

|

|

|

5,582

|

|

|

5,379

|

|

|

5,861

|

|

|

5,569

|

| |||||

| Operating Income ($, millions)

|

648.0 | (1) | 637.9 | (1) | 575.3 | (2) | 703.2 | (3) | 615.5 | |||||||||||

| (1) | Operating Income for 2015 is adjusted to exclude the impact of re-measurement and impairment losses related to Venezuela, the legal reserve for the Bostick case, foreign exchange gain from Euro/USD exposure on intercompany balances, and the recovery of asset impairment charges. Operating Income for 2015 to 2016 are adjusted to exclude expenses relating to challenges to the Company’s business model, expenses related to regulatory inquiries, and expenses incurred for the recovery of fees relating to the re-audit of our 2010 to 2012 financial statements, or the Re-Audit. Operating Income for 2016 is also adjusted to exclude the arbitration award in connection with the Re-Audit, regulatory settlements, FTC Consent Order implementation and China grant income. |

| (2) | Operating Income for 2017 is adjusted to exclude impact of the Tax Cuts and Jobs Act, or the Tax Act, expenses relating to FTC Consent Order implementation, expenses relating to regulatory inquiries, expenses relating to challenges to our business model, China grant income, and impact from changes in currency exchange rates. |

| (3) | Operating Income for 2018 is adjusted to exclude the impact of expenses relating to regulatory inquiries, China grant income, devaluation of the Venezuelan currency, impact from changes in currency exchange rates, and our China growth program. |

| Executive compensation | 27 |

The following table summarizes the 2018 annual incentive awards for the NEOs. All 2018 annual incentive awards to NEOs were based solely on the calculated results to target performance levels. For a more detailed discussion of our 2018 annual incentive awards for the NEOs, please refer to the discussion under “— Annual incentive awards.”

| NEO | 2018 Annual Incentive Award Amount | ||||

| Richard P. Goudis(1)

|

$0

| ||||

| John G. DeSimone

|

$858,863

| ||||

| Dr. John Agwunobi

|

$576,841

| ||||

| Shin-Shing Bosco Chiu

|

$409,599

| ||||

| David Pezzullo

|

$765,691

| ||||

| (1) | In connection with his resignation in January 2019, Mr. Goudis entered into a separation agreement and general release with Herbalife International of America, Inc., or the Separation Agreement. Pursuant to the terms of the Separation Agreement, Mr. Goudis forfeited all of his 2018 incentive awards. Additional details of the Separation Agreement can be found under the subsection “— Employment and Severance Agreements.” |

| 28 | Executive compensation |

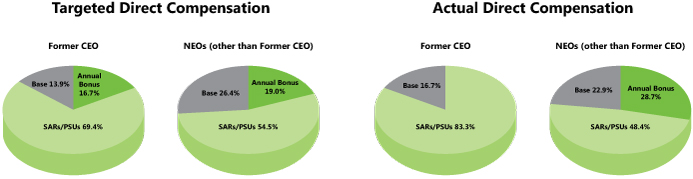

Targeted Direct Compensation Actual Direct Compensation Former CEO NEOs (other than 2018 CEO) Former CEO NEOs (other than 2018 CEO)

Percentages may not total 100% due to rounding.

| Executive compensation | 29 |

Executive compensation program objectives

As a leader in the nutritional products industry, manufacturing approximately 60% to 65% of our own products that are sold through a direct selling distribution channel and generating approximately 80% of our net sales outside the United States for the year ended December 31, 2018, we operate in an environment of challenging regulatory, economic and geopolitical uncertainty. Our success depends on the leadership of a highly-talented, adaptive and dedicated executive team. Our executive compensation program provides competitive rewards to our NEOs who contribute to our annual success in achieving growth in revenues and profitability, as well as making strategic decisions that should lead to increasing shareholder returns over time.

| 30 | Executive compensation |

The Committee believes that shareholder interests are advanced if the Company assembles, motivates and rewards a high-performing management team. To promote this objective, the Committee developed its executive compensation program guided by a “pay for performance” organizing framework and the resulting underlying principles listed below:

|

Principle |

Implication on HLF Program |

Rationale | ||

| The program must attract and encourage a long-term commitment from talented executives necessary to lead our global nutrition business and advance shareholders’ interests in a manner consistent with our company value of “operating with integrity and transparency.”

|

• Strong emphasis on long-term incentives and shareholder value creation.

• Performance considerations reflect the Company’s values and strategy and an appropriate balance of risk and reward. |

• Focus on long-term performance and shareholder value helps mitigate risk and encourages growth.

• Operating with integrity and transparency is a key corporate value that must be central to how we conduct our business. | ||

| Compensation opportunities must be competitive with the pay practices of companies that operate in global markets and able to attract and retain high-performing, highly-employable executive talent with similar executive skills and capabilities. |

• Peer group reflects the market in which we reasonably compete for executive talent.

• We reference both proxy-sourced market data from our peer group as well as general industry survey data from Mercer (a nationally recognized compensation survey).

• The Committee’s independent advisor provides the Committee with the 25th, 50th and 75th percentiles of market data to understand the scope of the market, with target compensation for top executives spanning from the 25th percentile to the 75th percentile based on a variety of factors, including individual performance, internal equity, succession planning and business strategy.

• Overall, our executives are within a competitive range of market, with appropriate variance based on incumbent-specific characteristics.

|

• The Company recruits high-performing executives with known track records in competitive, complex and global businesses.

• To attract the talent the Company needs to lead its business, compensation opportunities must be reasonably attractive to similar opportunities at our peers. | ||

| A majority of total compensation is at-risk and tied to achievement of annual financial and non-financial performance goals and improvement in long-term shareholder value. |

• 83% of actual 2018 compensation for Mr. Goudis, our former CEO who resigned in January 2019, and between 72% and 79% of actual 2018 compensation for our other NEOs were incentive-based directly linked to performance.

• 75% of long-term incentives awarded in 2018 were performance-based and 25% were time-vesting equity.

• Value of PSUs align with sustained long-term shareholder value and vesting requires achievement of performance goals that support our business. |

• Annual and long-term incentive plans use growth objectives, profit objectives, non-financial objectives. These plans are forward-looking and backward-looking, to ensure a comprehensive set of metrics are used to consider overall performance of the Company and our executive team. | ||

| Executive compensation | 31 |

|

Principle |

Implication on HLF Program |

Rationale | ||

| Incentive compensation must provide superior pay for superior performance that meets or exceeds the expectations of our shareholders. |

• Superior performance expectations are built into performance targets and ranges of our incentive plans such that when incentive targets are met, the Company is exceeding peer financial performance and meeting shareholder expectations.

• Our incentive plans are calibrated to deliver above-median compensation for meeting superior performance targets, and, in the case of PSUs, deriving value through increased shareholder value.

|

• The only way for our executives to earn above-market compensation is by meeting or exceeding financial and non-financial goals. | ||

| Incentive compensation should reflect a balanced time horizon between annual and long-term performance in order to promote sustainable growth in the value of the enterprise. |

• Annual incentive is paid in cash based on achievement of annual financial performance targets.

• PSUs awarded in 2018 are earned based on achievement of the following three metrics over a performance period from January 1, 2018 to December 31, 2020: Local Currency Net Sales, Adjusted EBIT and Adjusted EPS.

|

• A mix of cash and equity compensation is a competitive practice.

• Paying a mix of cash and equity based on a “portfolio” of equity vehicles and performance metrics also helps balance risk within the pay program. | ||

| Long-term incentives should be provided in Company equity, where allowed by local law, to encourage executives to plan and act with the perspective of shareholders and with the Company’s vision, mission and values in mind, and be rewarded for the successful implementation of our growth strategies.

|

• In 2018, long-term incentive awards granted to NEOs consisted of 75% PSUs and 25% RSUs.

• The Company has competitive stock ownership guidelines. |

• PSUs and RSUs align executive rewards with the Company’s sustained long-term performance and shareholder value creation.

• Encouraging equity ownership further aligns executives with sustained performance and shareholder value. | ||

| 32 | Executive compensation |

Purpose of compensation elements

The compensation and benefits program for our NEOs consists of and is designed to achieve the following:

| Direct pay component |

Purpose | |

| Base salary |

Provide a competitive foundation for total compensation to each executive in consideration of job scope and responsibilities, demonstrated sustained performance, capabilities and experience.

| |

| Annual cash incentives |

Reward NEOs for the achievement of challenging annual financial targets that drive growth in shareholder value.

| |

| Long-term equity-based incentives (PSUs and RSUs) |

Provide incentives for NEOs to develop strategic plans, and make tactical decisions that will enhance shareholder value, reward NEOs with participation in the creation of sustained long-term shareholder value and encourage successful NEOs to remain with the Company.

| |

| Indirect pay (benefits) |

||

| Retirement benefits |

Encourage NEOs to build retirement resources by providing a match on deferred compensation in the Company’s 401(k) plan and Senior Executive Deferred Compensation Plan.

| |

| Life insurance benefits |

Provide a competitive benefit in the event of death of an executive.

| |

| Severance benefits |

Enable each NEO to focus his full time and attention on meeting the financial and operating objectives set by the Committee without fear of the financial consequences of an unexpected termination of employment.

| |

| Change in control benefits |

Enable NEOs to focus on shareholder interests when considering strategic alternatives.

| |

The Chair of the Committee, with input from the independent compensation advisor, recommends the CEO’s compensation to the Committee in an executive session not attended by the CEO. Once a recommendation has been established by the Committee, the CEO’s compensation is reviewed with, and approved by, the independent members of the Board in an executive session.

Role of executive officers in executive compensation decisions

The CEO reviews compensation data gathered from a group of peer companies approved by the Committee and described under the subsection “— Peer Group”, or the Herbalife Nutrition Peer Group, and, along with general industry compensation surveys, considers each executive officer’s performance and scope of responsibility, and makes a recommendation to the Committee on changes to base salary, annual incentive awards and equity awards for each executive officer other than himself. The CEO participates in Committee meetings at the Committee’s request to provide relevant background information regarding the Company’s strategic objectives and to evaluate the performance of and compensation recommendations for the other executive officers. The Committee utilizes the information provided by the CEO along with input from its independent compensation advisor and the knowledge and experience of Committee members in making compensation decisions.

| Executive compensation | 33 |

| NEO | 2016 Salary | 2017 Salary | 2018 Salary |

Current Salary (as of December 31, 2018) |

Rationale for Change | |||||||||||||||||

|

Richard P. Goudis

|

|

$675,000

|

|

|

$675,680

|

|

|

$1,000,000

|

|

|

$1,000,000

|

|

||||||||||

| John G. DeSimone |

$600,000 | $619,000 | $619,000 | (1) | $619,000 | |||||||||||||||||

| Dr. John Agwunobi |

$450,000 | $469,000 | $469,000 | $525,000 | (2) |

Ø Appointed Co-President, Chief Health and Nutrition Officer

| ||||||||||||||||

| Shin-Shing Bosco Chiu |

$357,727 | $366,727 | $366,727 | $430,000 | (3) | Ø Appointed Chief Financial Officer

| ||||||||||||||||

| David Pezzullo |

$438,626 | $457,626 | $525,000 | $565,000 | Ø Assumed additional responsibilities and direct reports

| |||||||||||||||||

| (1) | This annual salary amount was effective for the period of time Mr. DeSimone served as Chief Financial Officer of the Company, which was January 1, 2018 through April 30, 2018. |

| (2) | Effective March 4, 2019, Dr. Agwunobi’s base salary increased to $619,000. |

| (3) | Effective March 4, 2019, Mr. Chiu’s base salary increased to $450,000. |

| 34 | Executive compensation |

The chart below summarizes the 2018 annual incentive plan performance measures and weightings for our NEOs.

|

Weight in determining annual incentive | ||

|

Operating Income |

Volume Points | |

| 70%

|

30%

| |

| Executive compensation | 35 |

The following table shows the performance targets set by the Committee with respect to 2018 and the Company’s performance relative to those targets.

2018 Annual incentive plan performance targets

| Target |

2018 Target

|

2018 Results

|

2018 Results

| |||||||

| Volume Points (millions)

|

|

5,569

|

|

|

5,861

|

|

105.2%

| |||

| Operating income (millions)

|

$615.5 | $703.2 | (1) | 114.3% | ||||||

| (1) | Operating Income presented as adjusted, as discussed below. |

| 36 | Executive compensation |

For 2018, other than Dr. Agwunobi who was not an executive officer until May 2018, target-level bonuses were awarded for results between 95% and 108% of the applicable target, and bonus awards above 96.25% of target increase on a prorated basis in steps. Should 95% of the applicable financial target not be achieved, there is no bonus funding or payouts to the NEOs. The Committee determined to increase the maximum percentage to 108% in order to encourage the Company’s high performance culture. This bonus scale is designed to encourage realistic target-setting and prudent risk-taking while simultaneously creating consequences for not meeting target and capping the potential payout in order to avoid excessive incentive awards as compared to performance. Our 2018 annual incentive opportunities as a percentage of base salary were established as follows:

2018 Annual incentive opportunities by executive and target

| Percentage of Base Salary Awarded for Performance Target Achievement Range — % of Target(1) |

||||||||||||||||||||||||||||||||||||||||

| NEO | Target |

Below 95% |

95% | 96.25% | 97.50% | 98.75% | 100.0% | 102.0% | 104.0% | 106.0% | 108.0% | |||||||||||||||||||||||||||||

| Max | ||||||||||||||||||||||||||||||||||||||||

| Goudis(2) |

Volume Point Operating Income

|

0% 0%

|

|

18 42

|

% %

|

|

22.5 52.5

|

% %

|

|

27 63

|

% %

|

|

31.5 73.5

|

% %

|

|

36 84

|

% %

|

|

45 105

|

% %

|

|

54 126

|

% %

|

|

63 147

|

% %

|

|

72 168

|

% %

| |||||||||||

| DeSimone/Pezzullo |

Volume Point Operating Income

|

0% 0%

|

|

11.25 26.25

|

% %

|

|

14.06 32.8

|

% %

|

|

16.88 39.38

|

% %

|

|

19.69 45.94

|

% %

|

|

22.5 52.5

|

% %

|

|

28.13 65.63

|

% %

|

|

33.75 78.75

|

% %

|

|

39.38 91.88

|

% %

|

|

45 105

|

% %

| |||||||||||

| Agwunobi (January 1, |

Volume Point Operating Income

|

* *

|

|

9 21

|

% %

|

|

9 21

|

% %

|

|

10.5 24.5

|

% %

|

|

10.5 24.5

|

% %

|

|

12 28

|

% %

|

|

13.5 31.5

|

% %

|

|

15 35

|

% %

|

|

16.5 38.5

|

% %

|

|

18 42

|

% %

| |||||||||||

| Agwunobi (May 1, 2018

|

Volume point Operating income

|

0% 0%

|

|

11.25 26.25

|

% %

|

|

14.06 32.8

|

% %

|

|

16.88 39.38

|

% %

|

|

19.69 45.94

|

% %

|

|

22.5 52.5

|

% %

|

|

28.13 65.63

|

% %

|

|

33.75 78.75

|

% %

|

|

39.38 91.88

|

% %

|

|

45 105

|

% %

| |||||||||||

| Chiu (January 1, 2018

|

Volume Point Operating Income

|

0% 0%

|

|

6 14

|

% %

|

|

7.5 17.5

|

% %

|

|

9 21

|

% %

|

|

10.5 24.5

|

% %

|

|

12 28

|

% %

|

|

15 35

|

% %

|

|

18 42

|

% %

|

|

21 49

|

% %

|

|

24 56

|

% %

| |||||||||||

| Chiu (May 1, 2018 to

|

Volume Point Operating income

|

0% 0%

|

|

9 21

|

% %

|

|

11.25 26.25

|

% %

|

|

13.50 31.50

|

% %

|

|

15.75 36.75

|

% %

|

|

18 42

|

% %

|

|

22.5 52.5

|

% %

|

|

27 63

|

% %

|

|

31.5 73.5

|

% %

|

|

36 84

|

% %

| |||||||||||

| (1) | Rounded to the nearest hundredth |

| (2) | Pursuant to the terms of the Separation Agreement, Mr. Goudis forfeited his unvested incentive awards. Additional details of the Separation Agreement are provided under “— Employment and Severance Agreements.” |

| * | Dr. Agwunobi’s performance target achievement range during the period he was Chief Health and Nutrition Officer (January 1, 2018 to April 30, 2018) provided for potential payouts for results that exceeded at least 90% of the applicable financial target. No bonus payout to Dr. Agwunobi would have been made during this period if less than 90% of the applicable financial target was achieved. Beginning May 1, 2018, when Dr. Agwunobi was promoted to Co-President in addition to his Chief Health and Nutrition Officer role, his performance target achievement range was adjusted so that no bonus payout would be made to him if at least 95% of the applicable financial target was not achieved. |

| Executive compensation | 37 |

The following table shows the incentive eligible earnings (i.e., 2018 base salary), target and maximum incentive percentages and amounts expressed as a percentage of base salary, and 2018 incentive awards for each NEO participating in the annual incentive plan. All 2018 awards to NEOs were based solely on the calculated results to target performance levels. For 2018, the Company exceeded its maximum funding levels for Operating Income and Volume Point targets.

2018 Actual incentive award calculation

|

NEO |

Salary | Target incentive % of Salary |

Max incentive % of Salary |

Actual results (% of target) | Award % of |

Award Amount |

||||||||||||||||||||||

| Volume Points |

Operating income(1) |

|||||||||||||||||||||||||||

| Richard P. Goudis | $1,000,000 | |||||||||||||||||||||||||||

| Volume Point incentive |

36 | 72 | 105.2 | — | 54 | $0 | (2) | |||||||||||||||||||||

| Operating Income incentive |

84 | 168 | — | 114.3 | 168 | $0 | (2) | |||||||||||||||||||||

| Total

|

|

$1,000,000

|

|

$0 | (2) | |||||||||||||||||||||||

| John DeSimone | $619,000 | |||||||||||||||||||||||||||

| Volume Point incentive |

22.5 | 45 | 105.2 | — | 33.75 | $208,913 | ||||||||||||||||||||||

| Operating Income incentive |

52.5 | 105 | — | 114.3 | 105 | $649,950 | ||||||||||||||||||||||

| Total

|

|

$619,000

|

|

|

$858,863

|

| ||||||||||||||||||||||

| Dr. John Agwunobi | $154,192 | |||||||||||||||||||||||||||

| 1/1/18 – 4/30/18 | ||||||||||||||||||||||||||||

| Volume Point incentive |

12 | 18 | 105.2 | — | 15 | $23,129 | ||||||||||||||||||||||

| Operating Income incentive |

28 | 42 | — | 114.3 | 42 | $64,761 | ||||||||||||||||||||||

| 5/1/18 – 12/31/18 | $352,397 | |||||||||||||||||||||||||||

| Volume Point incentive |

22.5 | 45 | 105.2 | — | 33.75 | $118,934 | ||||||||||||||||||||||

| Operating Income incentive |

52.5 | 105 | — | 114.3 | 105 | $370,017 | ||||||||||||||||||||||

| Total

|

|

$506,589

|

|

|

$576,841

|

| ||||||||||||||||||||||

| Shin-Shing Bosco Chiu | $120,568 | |||||||||||||||||||||||||||

| 1/1/18 – 4/30/18 | ||||||||||||||||||||||||||||

| Volume Point incentive |

12 | 24 | 105.2 | — | 18 | $21,702 | ||||||||||||||||||||||

| Operating Income incentive |

28 | 56 | — | 114.3 | 56 | $67,518 | ||||||||||||||||||||||

| 5/1/18 – 12/31/18 | $288,630 | |||||||||||||||||||||||||||

| Volume Point incentive |

18 | 36 | 105.2 | — | 27 | $77, 930 | ||||||||||||||||||||||

| Operating Income incentive |

42 | 84 | — | 114.3 | 84 | $242,449 | ||||||||||||||||||||||

| Total

|

|

$409,198

|

|

|

$409,599

|

| ||||||||||||||||||||||

| David Pezzullo | $172,603 | |||||||||||||||||||||||||||

| 1/1/18 – 4/30/18 | ||||||||||||||||||||||||||||

| Volume Point incentive |

22.5 | 45 | 105.2 | — | 33.75 | $58,253 | ||||||||||||||||||||||

| Operating Income incentive |

52.5 | 105 | — | 114.3 | 105 | $181,233 | ||||||||||||||||||||||

| 5/1/18 – 12/31/18 | $379,247 | |||||||||||||||||||||||||||

| Volume Point incentive |

22.5 | 45 | 105.2 | — | 33.75 | $127,996 | ||||||||||||||||||||||

| Operating Income incentive |

52.5 | 105 | — | 114.3 | 105 | $398,209 | ||||||||||||||||||||||

| Total

|

|

$551,850

|

|

|

$765,691

|

| ||||||||||||||||||||||

| (1) | Operating Income presented as adjusted, as discussed under “2018 Annual incentive plan performance targets.” |

| (2) | Pursuant to the terms of the Separation Agreement, Mr. Goudis forfeited his unvested incentive awards. Additional details of the Separation Agreement can be found under “— Employment and Severance Agreements.” |

| 38 | Executive compensation |

2018 Long-term incentive awards — annual grant program

| NEO |

PSU grant value(1)

|

Total PSUs awarded

|

RSU grant value(1)

|

Total

|

||||||||||||

| Richard P. Goudis(2)

|

|

$3,750,000

|

|

|

86,906

|

|

|

$1,250,000

|

|

|

28,968

|

| ||||

| John G. DeSimone

|

|

$960,000

|

|

|

22,246

|

|

|

$320,000

|

|

|

7,414

|

| ||||

| Dr. John Agwunobi

|

|

$960,000

|

|

|

22,246

|

|

|

$320,000

|

|

|

7,414

|

| ||||

| Shin-Shing Bosco Chiu

|

|

$487,500

|

|

|

11,296

|

|

|

$162,500

|

|

|

3,764

|

| ||||

| David Pezzullo

|

|

$900,000

|

|

|

20,856

|

|

|

$300,000

|

|

|

6,952

|

| ||||

| (1) | Grant values are targets set by the Committee and vary slightly from amounts set forth in the Summary Compensation Table due to share price movements between the date of Committee approval and grant date. |

| (2) | Pursuant to the terms of the Separation Agreement, Mr. Goudis forfeited his unvested incentive awards. Additional details of the Separation Agreement can be found below under “— Employment and Severance Agreements.” |

| Executive compensation | 39 |

| 40 | Executive compensation |

| Executive compensation | 41 |

| 42 | Executive compensation |

Our level of compensation for our NEOs was compared to compensation paid by the Herbalife Nutrition Peer Group. The criteria used to identify the Herbalife Nutrition Peer Group were: (1) principal operations in the U.S. with an international presence — we operate in 94 countries around the world in a highly regulated business where approximately 80% of our net sales for the year ended December 31, 2018, were generated outside of the United States; (2) financial scope — our management talent should be similar to that of companies of a similar size in terms of revenues and market capitalization; (3) industry — we compete for talent with other companies in consumer product related industries; and (4) common “peer of peers” — we examined companies that are most frequently considered peers by Herbalife Nutrition’s peers. Annually, the Committee reviews the peer group and updates the group as appropriate.

With respect to pay decisions regarding 2018 NEO compensation, the industry peer group was comprised of the fourteen (14) companies listed below. All of the peer companies were within the range of approximately 50% and 180% of Herbalife’s trailing twelve-month revenues at the time the peer group was established in July 2017. The peer group median revenue of $4.0 billion and median market capitalization of $6.2 billion, in each case at the time the Herbalife Nutrition Peer Group was established, were comparable to those of Herbalife Nutrition. During this period, the Herbalife Nutrition Peer Group consisted of the following:

| Company | Industry |

Revenue

|

Market capitalization* ($ millions) |

|||||||

| Avon Products Inc.

|

Personal Products

|

|

$5,738

|

|

|

$672

|

| |||

| Campbell Soup Co

|

Packaged Foods and Meats

|

|

$9,218

|

|

|

$9,931

|

| |||

| Church & Dwight Inc.

|

Household Products

|

|

$4,105

|

|

|

$16,192

|

| |||

| Dr Pepper Snapple Group, Inc.

|

Soft Drinks

|

|

$6,863

|

|

$— | (1) | ||||

| Edgewell Personal Care Co

|

Personal Products

|

|

$2,234

|

|

|

$2,021

|

| |||

| GNC Holdings, Inc.

|

Specialty Stores

|

|

$2,341

|

|

|

$199

|

| |||

| Hain Celestial Group Inc.

|

Packaged Foods and Meats

|

|

$2,429

|

|

|

$1,650

|

| |||

| International Flavors & Fragrances

|

Specialty Chemicals

|

|

$3,613

|

|

|

$14,316

|

| |||

| The J.M. Smucker Company

|

Packaged Foods and Meats

|

|

$7,609

|

|

|

$10,635

|

| |||

| McCormick & Co, Inc.

|

Packaged Foods and Meats

|

|

$5,401

|

|

|

$18,329

|

| |||

| Nu Skin Enterprises Inc.

|

Personal Products

|

|

$2,662

|

|

|

$3,407

|

| |||

| Post Holdings Inc.

|

Packaged Foods and Meats

|

|

$6,257

|

|

|

$5,943

|

| |||

| Spectrum Brands Holdings, Inc.(2)

|

Household Products

|

|

$3,146

|

|

|

$2,257

|

| |||

| Tupperware Brands Corp

|

Housewares and Specialties

|

|

$2,152

|

|

|

$1,534

|

| |||

| Herbalife Nutrition Ltd.

|

Personal Products

|

|

$4,799

|

|

|

$8,613

|

| |||

| Percentile Rank

|

|

58

|

%

|

|

64

|

%

| ||||

| * | As of December 31, 2018. |

| (1) | As of July 2018, Dr Pepper Snapple Group, Inc. became a business unit of Keurig Dr Pepper. |

| (2) | Spectrum Brands Holdings, Inc. was not included as part of any benchmarking study due to its pending acquisition by Energizer Holdings, Inc. and a lack of compensation disclosure at the time of the 2017 benchmarking study. |

| Executive compensation | 43 |

After reviewing the peer group in July 2018, GNC Holdings, Inc. was removed from the Herbalife Nutrition Peer Group because its market capitalization was not comparable to the Company’s. Also, in July 2018, The Clorox Company, Conagra Brands, Inc., Coty Inc. and TreeHouse Foods, Inc. were all added to the Herbalife Nutrition Peer Group because their revenue size and market capitalization were comparable to the Company’s. For 2019 pay decisions, the Herbalife Nutrition Peer Group will consist of the following:

| Company | Industry |

Revenue

|

Market capitalization as of 12/31/18 ($ millions) |

|||||||

| Avon Products Inc.

|

Personal Products

|

|

$5,738

|

|

|

$672

|

| |||

| Campbell Soup Co

|

Packaged Foods and Meats

|

|

$9,218

|

|

|

$9,931

|

| |||

| Church & Dwight Inc.

|

Household Products

|

|

$4,105

|

|

|

$16,192

|

| |||

| The Clorox Company

|

Household Products

|

|

$6,187

|

|

|

$19,676

|

| |||

| Conagra Brands, Inc.

|

Packaged Foods and Meats

|

|

$8,179

|

|

|

$10,373

|

| |||

| Coty Inc.

|

Personal Products

|

|

$9,191

|

|

|

$4,927

|

| |||

| Dr Pepper Snapple Group, Inc.(1)

|

Soft Drinks

|

|

$6,863

|

|

$— | (1) | ||||

| Edgewell Personal Care Co

|

Personal Products

|

|

$2,234

|

|

|

$2,021

|

| |||

| Hain Celestial Group Inc.

|

Packaged Foods and Meats

|

|

$2,429

|

|

|

$1,650

|

| |||

| International Flavors & Fragrances

|

Specialty Chemicals

|

|

$3,613

|

|

|

$14,316

|

| |||

| The J.M. Smucker Company

|

Packaged Foods and Meats

|

|

$7,609

|

|

|

$10,635

|

| |||

| McCormick & Co, Inc.

|

Packaged Foods and Meats

|

|

$5,401

|

|

|

$18,329

|

| |||

| Nu Skin Enterprises Inc.

|

Personal Products

|

|

$2,662

|

|

|

$3,407

|

| |||

| Post Holdings Inc.

|

Packaged Foods and Meats

|

|

$6,257

|

|

|

$5,943

|

| |||

| Spectrum Brands Holdings, Inc.(2)

|

Household Products

|

|

$3,146

|

|

|

$2,257

|

| |||

| TreeHouse Foods, Inc.

|

Packaged Foods and Meats

|

|

$6,031

|

|

|

$2,840

|

| |||

| Tupperware Brands Corp

|

Housewares and Specialties

|

|

$2,152

|

|

|

$1,534

|

| |||

| Herbalife Nutrition Ltd.

|

Personal Products

|

|

$4,799

|

|

|

$8,613

|

| |||

| Percentile Rank

|

|

41

|

%

|

|

58

|

%

| ||||

As of December 31, 2018

| (1) | As of July 2018, Dr Pepper Snapple Group, Inc. became a business unit of Keurig Dr Pepper. |

| (2) | Spectrum Brands Holdings, Inc. was included as part of the 2018 benchmarking study due to delay in its pending acquisition by Energizer Holdings, Inc. and its compensation disclosure at the time of the 2018 benchmarking study. |

| 44 | Executive compensation |

| Executive compensation | 45 |

Executive officers of the registrant

Set forth below is certain information as of the date hereof regarding each NEO.

|

NEO

|

Age

|

Position with the company

|

Officer since

| |||||

| Michael O. Johnson

|

|

64

|

|

Chairman and Chief Executive Officer*

|

2003

| |||

| John G. DeSimone

|

|

52

|

|

Co-President, Chief Strategic Officer and Former Chief Financial Officer

|

2009

| |||

| Dr. John Agwunobi

|

|

54

|

|

Co-President, Chief Health and Nutrition Officer

|

2016

| |||

| Shin-Shing Bosco Chiu

|

|

52

|

|

Chief Financial Officer

|

2010

| |||

| David Pezzullo

|

|

53

|

|

Chief Operating Officer

|

2004

| |||

| * | Richard Goudis, age 57, resigned as the Company’s Chief Executive Officer, effective January 8, 2019, at which time the Board appointed Michael O. Johnson to serve as the Chief Executive Officer. Our executive officers are appointed by the Board and serve at the discretion of the Board. |

| 46 | Executive compensation |

2018 Summary compensation table

The following table sets forth the total compensation for the fiscal years ended December 31, 2018, 2017 and 2016, of the Company’s Chief Executive Officer, Chief Financial Officer, and each of the three other most highly compensated executive officers.

| Name and principal position |

Year |

Salary ($) |

Stock ($)(1) |

Option awards ($)(1) |

Non-equity incentive plan compensation ($)(2) |

All other compensation ($) |

Total ($) |

|||||||||||||||||||||

| Richard Goudis |

2018 | 1,000,000 | 4,999,963 | — | — | 102,362 | (3) | 6,102,325 | ||||||||||||||||||||

| Former Chief Executive Officer

|

2017 | 873,689 | 3,193,983 | 1,806,020 | 735,110 | 31,243 | 6,640,045 | |||||||||||||||||||||

| 2016 | 675,680 | — | 1,805,997 | 918,925 | 40,249 | 3,440,851 | ||||||||||||||||||||||

| John G. DeSimone |

2018 | 619,000 | 1,279,829 | — | 858,863 | 72,487 | (4) | 2,830,179 | ||||||||||||||||||||

| Co-President and Chief

|

2017 | 619,000 | — | 1,735,021 | 365,597 | 22,552 | 2,742,170 | |||||||||||||||||||||

| 2016 | 600,000 | — | 1,735,009 | 900,000 | 22,860 | 3,257,869 | ||||||||||||||||||||||

| Dr. John Agwunobi(5) Co-President and Chief Health and Nutrition Officer

|

2018 | 506,589 | 1,279,829 | — | 576,841 | 18,537 | (6) | 2,381,796 | ||||||||||||||||||||

| — | — | — | — | — | — | — | ||||||||||||||||||||||

| — | — | — | — | — | — | — | ||||||||||||||||||||||

| Shin-Shing Bosco Chiu(5) Chief Financial Officer |

2018 | 409,198 | 649,839 | — | 409,599 | 15,123 | (7) | 1,483,759 | ||||||||||||||||||||

| — | — | — | — | — | — | — | ||||||||||||||||||||||

| — | — | — | — | — | — | — | ||||||||||||||||||||||

| David Pezzullo(8) |

2018 | 551,850 | 1,199,915 | — | 765,691 | 45,161 | (9) | 2,562,617 | ||||||||||||||||||||

| Chief Operating Officer |

2017 | 485,699 | 549,976 | 683,251 | 310,078 | 21,402 | 2,050,407 | |||||||||||||||||||||

| — | — | — | — | — | — | — | ||||||||||||||||||||||

| (1) | Amounts represent the aggregate grant date fair value of the relevant award(s) presented in accordance with ASC Topic 718, “Compensation — Stock Compensation.” See note 9 of the notes to consolidated financial statements included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2018 regarding assumptions underlying valuation of equity awards. For the 2018 PSU grants, the grant date fair values of such awards, assuming performance at the maximum level would be $7,499,988 for Mr. Goudis, $1,919,830 for Mr. DeSimone, $1,919,830 for Dr. Agwunobi, $974,845 for Mr. Chiu and $1,799,873 for Mr. Pezzullo. Pursuant to the terms of Mr. Goudis’ Separation Agreement, Mr. Goudis forfeited all of his unvested equity awards. Additional details of the Separation Agreement can be found above under “— Employment and Severance Agreements.” |

| (2) | Incentive plan amounts determined as more specifically discussed under “— Compensation Discussion and Analysis — Annual Incentive Awards & Long-Term Incentive Program — Targets and Award Determination.” Pursuant to the terms of Mr. Goudis’ Separation Agreement, Mr. Goudis forfeited eligibility for a cash incentive award for 2018. |

| (3) | Mr. Goudis’ other compensation includes: (i) $25,375 in deferred compensation which represents the Company’s matching contribution earned in 2018 but credited to Mr. Goudis’ account in 2019; (ii) $840 in Company-paid premiums for executive life insurance; (iii) $9,625 in Company paid 401(k) matching contributions; (iv) $4,937 attributable to non-business use of private aircraft; and (v) $31,634 for authorized spousal travel expenses related to distributor events pursuant to the Company’s Senior Executive Event Travel Policy and $29,951 in tax gross-ups related thereto. |

| (4) | Mr. DeSimone’s other compensation includes: (i) $12,040 in deferred compensation which represents the Company’s matching contribution earned in 2018 but credited to Mr. DeSimone’s account in 2019; (ii) $840 in Company-paid premiums for executive life insurance; (iii) $9,625 in Company paid 401(k) matching contributions; and (iv) $31,208 for authorized spousal travel expenses related to distributor events pursuant to the Company’s Senior Executive Event Travel Policy and $18,774 in tax gross-ups related thereto. |

| Executive compensation | 47 |

| (5) | Dr. Agwunobi and Mr. Chiu were NEOs for the first time in fiscal year 2018. Accordingly, only information relating to their fiscal year 2018 compensation is included in the compensation tables and related discussions of NEO compensation. |

| (6) | Dr. Agwunobi’s other compensation includes: (i) $8,072 in deferred compensation which represents the Company’s matching contribution earned in 2018 but credited to Dr. Agwunobi’s account in 2019; (ii) $840 in Company-paid premiums for executive life insurance; and (iii) $9,625 in Company paid 401(k) matching contributions. |

| (7) | Mr. Chiu’s other compensation includes: (i) $4,658 in deferred compensation which represents the Company’s matching contribution earned in 2018 but credited to Mr. Chiu’s account in 2019; (ii) $840 in Company-paid premiums for executive life insurance; and (iii) $9,625 in Company paid 401(k) matching contributions. |

| (8) | Mr. Pezzullo was a NEO for the first time in fiscal year 2017. Accordingly, only information relating to his 2017 and 2018 compensation is included in the compensation tables and related discussion of NEO compensation. |

| (9) | Mr. Pezzullo’s other compensation includes: (i) $9,660 in deferred compensation which represents the Company’s matching contribution earned in 2018 but credited to Mr. Pezzullo’s account in 2019; (ii) $840 in Company-paid premiums for executive life insurance; (iii) $9,625 in Company paid 401(k) matching contributions; (iv) $2,634 attributable to non-business use of private aircraft; and (v) $12,108 for authorized spousal travel expenses related to distributor events pursuant to the Company’s Senior Executive Event Travel Policy and $10,294 in tax gross-ups related thereto. |

2018 Grants of plan-based awards

The following table sets forth all grants of plan-based awards made to the NEOs during the fiscal year ended December 31, 2018. For further discussion regarding the grants see “— Compensation Discussion and Analysis — Annual Incentive Awards — Long-Term Incentive Awards.”

| NEO | Grant Date(1) |

Estimated future payouts under non-equity incentive plan awards |

Estimated future payouts under equity incentive plan awards(1) |

All other stock awards: number of shares or |

Exercise of base price of SAR Awards ($/share) |

Grant date fair value of Stock ($) |

||||||||||||||||||||||||||||||

| Target ($) |

Maximum ($) |

Threshold (#) |

Target (#) |

Maximum (#) |

||||||||||||||||||||||||||||||||

| Richard Goudis(3) |

|

1,200,000 |

|

|

2,400,000 |

|

||||||||||||||||||||||||||||||

|

|

02/26/2018 |

|

|

72,421 |

|

|

115,874 |

|

|

202,780 |

|

|

— |

|

|

— |

|

|

8,749,957 |

| ||||||||||||||||

| John G. DeSimone |

|

464,250 |

|

|

928,500 |

|

||||||||||||||||||||||||||||||

|

|

02/26/2018 |

|

|

18,537 |

|

|

29,660 |

|

|

51,906 |

|

|

— |

|

|

— |

|

|

2,239,744 |

| ||||||||||||||||

| Dr. John Agwunobi |

|

393,750 |

(4) |

|

621,111 |

(4) |

||||||||||||||||||||||||||||||

|

|

02/26/2018 |

|

|

18,537 |

|

|

29,660 |

|

|

51,906 |

|

|

— |

|

|

— |

|

|

2,239,744 |

| ||||||||||||||||

| Shin-Shing Bosco Chiu |

|

258,000 |

(5) |

|

442,810 |

(5) |

||||||||||||||||||||||||||||||

|

|

02/26/2018 |

|

|

9,412 |

|

|

15,060 |

|

|

26,356 |

|

|

— |

|

|

— |

|

|

1,137,261 |

| ||||||||||||||||

| David Pezzullo |

|

423,750 |

(6) |

|

827,774 |

(6) |

||||||||||||||||||||||||||||||

|

|

2/26/2018 |

|

|

17,380 |

|

|

27,808 |

|

|

48,664 |

|

|

— |

|

|

— |

|

|

2,099,852 |

| ||||||||||||||||

| (1) | All equity grants were approved by the Committee in February 2018. All equity grants reflected in this table were made under the 2014 Stock Incentive Plan. |

| (2) | For the 2018 PSU grants, the grant date fair value above was calculated assuming performance at the maximum level. |

| (3) | Pursuant to the terms of his Separation Agreement, Mr. Goudis forfeited all equity grants issued in 2018 in addition to all other unvested equity grants. Additional details of the Separation Agreement can be found above under “— Employment and Severance Agreements.” |

| (4) | Estimated future payouts are based upon a prorated bonus eligible salary of $506,589. |

| (5) | Estimated future payouts are based upon a prorated bonus eligible salary of $409,198. |

| (6) | Estimated future payouts are based upon a prorated bonus eligible salary of $551,850. |

| 48 | Executive compensation |

| Executive compensation | 49 |

Outstanding equity awards at 2018 fiscal year-end

The following table sets forth equity awards of the NEOs outstanding as of December 31, 2018.

| NEO | Grant Date |

Option/Stock Appreciation Right Awards

|

Stock Unit Awards

|

|||||||||||||||||||||||||

| Number of securities underlying unexercised options/SARs (#) exercisable |

Equity incentive plan awards: number of securities unexercised options/SARs (#)

|

Exercise Price ($) |

Expiration date |

Equity incentive plan awards: number of unearned stock units or other rights that have not vested (#) |

Equity incentive plan awards: market or payout value of unearned shares, units or other rights that have not vested ($) |

|||||||||||||||||||||||

| Richard P. Goudis(1) |

05/09/2016 | 72,798 | 31.255 | 05/09/2026 | (2) | |||||||||||||||||||||||

| 02/27/2017 | 102,034 | 28.595 | 02/27/2027 | (3) | ||||||||||||||||||||||||

| 06/06/2017 | 91,610 | (4) | $5,400,410 | |||||||||||||||||||||||||

| 02/26/2018 | 86,906 | (5) | $5,123,109 | |||||||||||||||||||||||||

| 02/26/2018 | 28,968 | (6) | $1,707,664 | |||||||||||||||||||||||||

| John G. DeSimone |

05/09/2016 | 46,624 | 69,936 | 31.255 | 05/09/2026 | (2) | ||||||||||||||||||||||

| 02/27/2017 | 24,506 | 98,022 | 28.595 | 02/27/2027 | (3) | |||||||||||||||||||||||

| 02/26/2018 | 22,246 | (5) | $1,311,402 | |||||||||||||||||||||||||

| 02/26/2018 | 7,414 | (6) | $437,055 | |||||||||||||||||||||||||

| Dr. John Agwunobi |

02/29/2016 | 22,128 | 33,196 | 27.375 | 02/28/2026 | (7) | ||||||||||||||||||||||

| 02/27/2017 | 4,236 | 16,950 | 28.595 | 02/27/2027 | (3) | |||||||||||||||||||||||

| 02/26/2018 | 22,246 | (5) | $1,311,402 | |||||||||||||||||||||||||

| 02/26/2018 | 7,414 | (6) | $437,055 | |||||||||||||||||||||||||

| Shin-Shing Bosco Chiu |

12/19/2013 | 24,212 | 39.79 | 12/19/2023 | (8) | |||||||||||||||||||||||

| 05/07/2015 | 42,500 | 23.90 | 05/07/2025 | (8) | ||||||||||||||||||||||||

| 05/09/2016 | 6,180 | 9,270 | 31.255 | 05/09/2026 | (2) | |||||||||||||||||||||||

| 02/27/2017 | 3,248 | 12,994 | 28.595 | 02/27/2027 | (3) | |||||||||||||||||||||||

| 02/26/2018 | 11,296 | (5) | $665,899 | |||||||||||||||||||||||||

| 02/26/2018 | 3,764 | (6) | $221,888 | |||||||||||||||||||||||||

| David Pezzullo |

05/18/2011 | 20,764 | 26.645 | 05/18/2021 | (8) | |||||||||||||||||||||||

| 03/01/2012 | 6,816 | 33.85 | 03/01/2022 | (8) | ||||||||||||||||||||||||

| 12/19/2013 | 29,508 | 39.79 | 12/19/2023 | (8) | ||||||||||||||||||||||||

| 05/09/2016 | 17,468 | 26,200 | 31.255 | 05/09/2026 | (2) | |||||||||||||||||||||||

| 02/27/2017 | 9,180 | 36,722 | 28.595 | 02/27/2027 | (3) | |||||||||||||||||||||||

| 08/03/2017 | 16,806 | (4) | $990,714 | |||||||||||||||||||||||||

| 02/26/2018 | 20,856 | (5) | $1,229,461 | |||||||||||||||||||||||||

| 02/26/2018 | 6,952 | (6) | $409,820 | |||||||||||||||||||||||||

| (1) | Pursuant to the terms of the Separation Agreement, Mr. Goudis forfeited all equity grants issued in 2018 in addition to all other unvested equity grants. Additional details of the Separation Agreement can be found above under “— Employment and Severance Agreements.” |

| (2) | Subject to continued Company service, these SARs vest annually, 20% on the first anniversary, 20% on the second anniversary and 60% on the third anniversary of the grant date, provided that the applicable sales leader retention performance criteria are met. |

| (3) | Subject to continued Company service, these SARs vest in February 2020, three years from the grant date, and are subject to potential, partial early vesting, provided that the applicable sales leader retention performance criteria are met. |

| (4) | These PSUs vest 100% on the December 31, 2019 subject to continued employment and provided that the applicable performance criteria are met. The number of PSUs reflected assumes a target level of performance. |

| (5) | These PSUs vest 100% on the December 31, 2020 subject to continued employment and provided that the applicable performance criteria are met. The number of PSUs reflected assumes a target level of performance. |

| (6) | Subject to continued Company service, these RSUs vest annually, 20% on the first anniversary, 20% on the second anniversary and 60% on the third anniversary of the grant date. |

| (7) | Subject to continued Company service, these SARs vest annually, 20% on the first anniversary, 20% on the second anniversary and 60% on the third anniversary of the grant date. |

| (8) | These SARS were fully vested as of December 31, 2018. |

| 50 | Executive compensation |

2018 Option exercises and stock vested

The following table sets forth information with respect to Common Shares acquired upon the exercise of stock options and the vesting of stock awards of the NEOs during the fiscal year ended December 31, 2018.

| NEO | Option awards | Stock awards | ||||||||||||||||

| Number of shares acquired on exercise (#)

|

Value realized on exercise ($)

|

Number of shares acquired on vesting (#)

|

Value realized on vesting ($)

|

|||||||||||||||

| Richard Goudis |

1,045,798 | $56,697,232 | — | — | ||||||||||||||

| John G. DeSimone |

679,083 | $37,954,493 | — | — | ||||||||||||||

| Dr. John Agwunobi |

— | — | — | — | ||||||||||||||

| Shin-Shing Bosco Chiu |

63,129 | $2,819,488 | — | — | ||||||||||||||

| David Pezzullo |

255,279 | $13,156,940 | — | — | ||||||||||||||

2018 Non-qualified deferred compensation table

The following table sets forth all non-qualified deferred compensation of the NEOs for the fiscal year ended December 31, 2018 pursuant to the Herbalife International of America, Inc. Senior Executive Deferred Compensation Plan, effective January 1, 1996, as amended and restated on January 1, 2001, or the Senior Executive Plan.

| NEO |

Executive contributions in last FY ($)

|

Company contributions in last FY ($)(1)

|

Aggregate earnings in last FY ($)

|

Aggregate withdrawals/ distribution ($)

|

Aggregate balance at last FYE ($)(2)

| ||||||||||||||||||||

| Richard Goudis |

50,000 | 25,375 | (41,550) | — | 816,178 | ||||||||||||||||||||

| John G. DeSimone |

30,950 | 12,040 | (27,179) | — | 362,324 | ||||||||||||||||||||

| Dr. John Agwunobi |

50,562 | 8,072 | (5,191) | — | 45,371 | ||||||||||||||||||||

| Shin Shing Bosco Chiu |

16,324 | 4,658 | 15,674 | — | 547,659 | ||||||||||||||||||||

| David Pezzullo |

53,048 | 9,660 | (45,850) | 355,015 | 1,039,638 | ||||||||||||||||||||

| (1) | All amounts are also reported as compensation in “All Other Compensation” in the “2018 Summary Compensation Table.” Amount represents contributions earned in 2018 but credited to the NEO’s account in 2019 and thus not part of the “Aggregate balance at last FYE”. |

| (2) | The following amounts, which are included in the “Aggregate balance at last FYE”, have been included in the Summary Compensation Table of the Company’s previously filed proxy statements: $559,836 for Mr. Goudis for the reported years 2006 to 2017; $262,508 for Mr. DeSimone for the reported years 2010 to 2017; and $0 for Mr. Pezzullo for the reported year 2017. |

| Executive compensation | 51 |

| 52 | Executive compensation |

| Executive compensation | 53 |

| 54 | Executive compensation |

| Executive compensation | 55 |

The table below sets forth the estimated value of the potential payments to each of our NEOs, assuming the executive’s employment had terminated on December 31, 2018 and/or that a change in control of the Company had also occurred on that date. Amounts are reported without any reduction for possible delay in the commencement or timing of payments.

| NEO |