Filed Pursuant to Rule 424(b)(3)

Registration No. 333-115363

PROSPECTUS

$275,000,000

WH HOLDINGS (CAYMAN ISLANDS) LTD.

WH CAPITAL CORPORATION

Indirect Parent of

![]()

Exchange Offer for All Outstanding

91/2% Notes Due April 1, 2011

(CUSIP Nos. 92926X AA 3 and G96013 AA 8)

For New

91/2% Notes Due April 1, 2011

Which Have Been Registered

Under the Securities Act of 1933

This exchange offer will expire at 5:00 p.m., New York City time,

on Wednesday, July 9, 2004, unless extended.

We are offering to exchange our 91/2% Notes Due April 1, 2011 (New Notes) which have been registered under the Securities Act of 1933, as amended, for any and all of our outstanding 91/2% Notes Due April 1, 2011 (Outstanding Notes) in the aggregate principal amount of $275,000,000.

See the "Description of Notes" section for more information about the New Notes to be issued in this exchange offer.

The New Notes involve substantial risks similar to those associated with the Outstanding Notes. See the section entitled "Risk Factors" beginning on page 18 for a discussion of these risks.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES AND EXCHANGE COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR THE ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Prospectus dated June 9, 2004.

| |

Page |

|

|---|---|---|

| Disclosure Regarding Forward-Looking Statements | i | |

| Market Data | ii | |

| Prospectus Summary | 1 | |

| Risk Factors | 18 | |

| The Recapitalization of Holdings and Related Transactions | 28 | |

| The Exchange Offer | 29 | |

| Use of Proceeds | 39 | |

| Capitalization | 40 | |

| Selected Consolidated Historical Financial Data | 41 | |

| Unaudited Pro Forma Condensed Consolidated Financial Statements | 44 | |

| Management's Discussion and Analysis of Financial Condition and Results of Operations | 48 | |

| Business | 66 | |

| Management | 84 | |

| Executive Compensation | 87 | |

| Principal Shareholders | 101 | |

| Certain Relationships and Related Transactions | 105 | |

| Description of Other Indebtedness | 109 | |

| Description of Notes | 111 | |

| Form and Transfer of the Notes | 149 | |

| United States Federal Income Tax Consequences | 154 | |

| Certain ERISA Considerations | 158 | |

| Cayman Islands Tax Consequences | 160 | |

| Plan Of Distribution | 161 | |

| Legal Matters | 162 | |

| Experts | 162 | |

| Available Information | 162 | |

| Index to Consolidated Financial Statements | F-1 |

You should rely only on the information contained in this document or to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these securities. The information in this document may only be accurate on the date of this document.

DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains "forward-looking statements" within the meaning of Section 27A of the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). All statements other than statements of historical fact are "forward-looking statements" for purposes of federal and state securities laws, including any projections of earnings, revenue or other financial items; any statements of the plans, strategies and objectives of management for future operation; any statements concerning proposed new services or developments; any statements regarding future economic conditions or performance; any statements of belief; and any statements of assumptions underlying any of the foregoing. Forward-looking statements may include the words "may," "will," "estimate," "intend," "continue," "believe," "expect" or "anticipate" and other similar words.

Although we believe that the expectations reflected in any of our forward-looking statements are reasonable, actual results could differ materially from those projected or assumed in any of our forward-looking statements. Our future financial condition and results of operations, as well as any forward-looking statements, are subject to change and to inherent risks and uncertainties, such as those disclosed in this prospectus. Important factors that could cause our actual results, performance and achievements, or industry results to differ materially from estimates or projections contained in forward-looking statements include, among others, the following:

Additional factors that could cause actual results to differ materially from the forward-looking statements are set forth in this prospectus, including under the headings "Prospectus Summary," "Risk Factors," "Management's Discussion and Analysis of Financial Condition and Results of Operations," "Business" and in our "Prospectus Summary—Summary Historical Consolidated Financial Data" and the related notes. We do not intend, and undertake no obligation, to update any forward-looking statement.

This exchange offer involves risks. Before you tender your Outstanding Notes in exchange for New Notes, you should carefully consider the matters set forth under the heading "Risk Factors" and all other information contained in this prospectus. All subsequent written and oral forward-looking statements attributable to us, or persons acting on our behalf, are expressly qualified in their entirety by the cautionary statements.

i

Market data and other statistical information used throughout this prospectus are based on independent industry publications, government publications, and reports by market research firms or other published independent sources. Some data are also based on our good faith estimates, which are derived from our review of internal surveys, as well as the independent sources listed above. Although we believe that these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy or completeness.

ii

The following summary should be read in conjunction with, and is qualified in its entirety by, the more detailed information and financial statements (including the accompanying notes) appearing elsewhere in this prospectus. Unless otherwise noted, the terms "we," "our," "us," "Company" and "Successor" refer to WH Holdings (Cayman Islands) Ltd. ("Holdings") and its subsidiaries, including WH Capital Corporation ("WH Capital Corp.") and Herbalife International, Inc. and its subsidiaries ("Herbalife") for periods subsequent to Herbalife's acquisition on July 31, 2002, and the terms "we," "us," "our," "Company" and "Predecessor" refer to Herbalife before the acquisition for periods through July 31, 2002. Holdings is a holding company, with substantially all of its assets consisting of the capital stock of its indirect, wholly-owned subsidiary, Herbalife. See "—Corporate Structure." The term "Outstanding Notes" refers to the 91/2% Notes due 2011 issued on March 8, 2004. The terms "New Notes" and "Notes" refer to the 91/2% Notes due 2011 offered by this prospectus. Unless the context indicates otherwise, "on a pro forma basis" or "pro forma" means after giving effect to the offering of the Notes and the transactions described under "Unaudited Pro Forma Condensed Consolidated Financial Data." "Adjusted EBITDA" is defined in Note 2 to the Summary Historical Consolidated Financial Data included herein. You should carefully consider the information set forth under "Risk Factors." In addition, certain statements are forward-looking statements which involve risks and uncertainties. See "Disclosure Regarding Forward-Looking Statements."

The Exchange Offer

In contemplation of the consummation of the Transactions described below under "—The Recapitalization of Holdings and Related Transactions," on March 8, 2004, Holdings and Capital completed a private offering of $275,000,000 of the Outstanding Notes. In connection with that offering, Holdings and Capital entered into a registration rights agreement with the initial purchaser of the Outstanding Notes in which they agreed, among other things, to deliver this prospectus and to complete this exchange offer within 195 days of the issue date of the Outstanding Notes. You are entitled to exchange in this exchange offer Outstanding Notes that you hold for New Notes with substantially identical terms. You should read the discussion under the headings "Summary of the Terms of the New Notes" beginning on page 13 and "Description of Notes" beginning on page 110 for further information regarding the New Notes.

We believe that the New Notes that will be issued in this exchange offer may be resold by you without compliance with the registration and prospectus delivery provisions of the Securities Act, if you can make the representations in the fifth paragraph under "The Exchange Offer—Exchange Terms" on page 28 below. We cannot guarantee that the Securities Exchange Commission, or SEC, would make a

1

similar decision about this exchange offer. If our belief is wrong, or if you cannot truthfully make the representations mentioned above, and you transfer any New Note issued to you in the exchange offer without meeting the registration and prospectus delivery requirements of the Securities Act, or without an exemption from such requirements, you could incur liability under the Securities Act. We are not indemnifying you for any such liability. You should read the discussion under the headings "Summary of the Terms of the Exchange Offer" beginning on page 10 and "The Exchange Offer" beginning on page 28 for further information regarding this exchange offer and resale of the New Notes.

The Company

Herbalife, founded in 1980, is a worldwide marketer of weight management, inner nutrition and Outer Nutrition® products that support our customers' wellness and healthy lifestyles. We market and sell these products through a global network marketing organization comprised of over one million independent distributors in 58 countries. Throughout our 24-year operating history, the high quality of our products and the effectiveness of our network marketing organization have been the primary drivers of our growth and geographic expansion and have made Herbalife a brand name recognized worldwide. For the year ended December 31, 2003, our net sales and adjusted EBITDA were approximately $1.2 billion and $167.7 million, respectively.

We are focused on delivering a science-based wellness program and way of life to our distributors and their customers through our product portfolio. Our products seek to appeal to the growing number of consumers who desire to live a healthy lifestyle. We group our products into three categories: weight management, which consists of a full range of meal replacement programs and healthy snacks; inner nutrition, which consists of nutritional supplements; and Outer Nutrition®, which represents personal care products. We currently market a broad range of products as well as literature and promotional materials designed to support our distributors' marketing efforts. Our products are often sold in programs, which are comprised of a series of related products designed to achieve a common wellness or health result, simplify weight management and nutrition for our consumers and maximize our distributors' cross-selling opportunities.

Weight management

Inner nutrition

2

43.6% of our net sales were derived from inner nutrition products. For the three months ended March 31, 2004, $139.3 million or 42.9% of our net sales were derived from inner nutrition products.

Outer Nutrition®

Our products are distributed through a global network marketing organization comprised of over one million independent distributors in 58 countries, except in China where our sales are regulated to be conducted on a wholesale basis to local retailers. We believe that the direct-selling distribution channel is ideally suited to selling our products, because sales of weight management and inner nutrition products are strengthened by ongoing personal contact between retail consumers and distributors. This personal contact enhances the education of consumers in the weight management and nutrition markets and the motivation of consumers to begin and maintain weight management programs for healthy living. In addition, our distributors use Herbalife's products themselves, providing first-hand testimonial proof of product effectiveness, which serves as a powerful sales tool.

We provide our distributors attractive and flexible career opportunities through selling our high-quality products. Our distributors have the opportunity to earn income and receive non-financial rewards designed to motivate and recognize individual achievement. As a result, we believe the income opportunity provided by our network marketing system appeals to a broad cross-section of people throughout the world, particularly those seeking to supplement family income, start a home business or pursue non-conventional, full and part-time employment opportunities. Our distributors, who are independent contractors, earn income on their own sales and can also earn royalties and bonuses on sales made by the distributors in their sales organizations. We believe our network marketing system provides an attractive income opportunity relative to other network marketing companies.

Holdings acquired Herbalife on July 31, 2002, which we refer to herein as the "Acquisition," and was formed by and on behalf of an investment group led by Whitney & Co., LLC ("Whitney") and Golden Gate Private Equity, Inc. ("Golden Gate"), which we refer to herein as the "Equity Sponsors," to consummate the Acquisition.

The Industry

Wellness and personal care markets

We compete primarily in the wellness industry with our weight management and inner nutrition products and in the personal care industry with our Outer Nutrition® products. According to Euromonitor, these markets are substantial in size, representing an estimated $34.8 billion and $173.0 billion of worldwide sales in 2001, respectively. We believe these markets represent significant business opportunities for us given our focus on high-quality products and our distributors' personal interaction with consumers of our products. According to Euromonitor:

3

We are capitalizing on demographic trends in our market driving demand for health-related products and increasing the emphasis on healthier lifestyles. The global markets for our products are expected to continue to experience strong growth due to a number of factors, including:

Direct selling

Direct selling as a distribution channel has proven to be extremely effective for sales of weight management, inner nutrition and Outer Nutrition® products and has exhibited strong historical growth. The World Federation of Direct Selling Associations estimates the following statistics about the direct selling channel:

Competitive Strengths

Recognized Brand Name. Our success is largely due to the strength of the Herbalife brand name, which has been built through consistently offering high-quality products and an attractive income opportunity for our distributors. Our specially-designed formulations and high-quality products, combined with our reputation built over 24 years in the industry, set us apart from the competition and contribute significantly to the recognition of the Herbalife brand name. We believe that our recognized brand name has contributed significantly to our ability to expand our business into new markets and add distributors to our network marketing organization and will enhance our ability to further penetrate our existing markets.

High-Quality, Established Product Portfolio. Our underlying initiative is to expand our reputation as a well-respected industry leader committed to providing the highest quality science-based products for our weight management and nutritional programs to support a healthier way of life. We are well positioned to take advantage of current trends concerning worldwide obesity and consumers increasingly turning to nutrition to address weight-related health concerns. In support of this effort, we have formed a Scientific Advisory Board comprised of leading worldwide experts to conduct product research and advise on product concepts. Members of this board include Chairman, David Heber,

4

M.D., Ph.D., Director of the UCLA Center for Human Nutrition and Director of the UCLA Center for Dietary Supplement Research in Botanicals, and Nobel Laureate in Medicine, Louis Ignarro, Ph.D., Distinguished Professor of Pharmacology at the UCLA School of Medicine. We recently established the Mark Hughes Cellular and Molecular Nutrition Laboratory at UCLA (the "UCLA Lab") through the donation of equipment and technology. Through the UCLA Lab, we fund diverse research projects that support both product development and marketing. We also have formed a Medical Advisory Board to provide training on product usage and give health-news updates through Herbalife literature, the internet, and live training events around the world. By drawing upon the technical resources of the UCLA Lab and combining its research with the scientific expertise of the Scientific Advisory Board, the educational skills of the Medical Advisory Board and our own research and development group, we will endeavor to enhance Herbalife's reputation as a provider of world class weight management and nutritional products that meet the highest industry standards for quality, safety and efficacy.

Effective Distribution Channel. We believe the direct sales model, the method we have used since we began operations in February 1980, is the most attractive and effective way to sell our products. Sales of our products are strengthened by ongoing personal contact between retail consumers and distributors, thereby enhancing the education of consumers in the weight management and nutrition markets. In turn, the motivation of consumers to begin and maintain weight management programs for healthy living is similarly enhanced. We also believe that sales of our weight management and inner nutrition products are strengthened by the first-hand, testimonial proof of product effectiveness provided by many of our distributors, who are consumers of our products themselves. Additionally, our global direct-selling model provides a more effective channel for our products than traditional retailing methods would: it eliminates a high, fixed-cost infrastructure, provides incentives for existing distributors to develop a sales organization of other individuals selling our products, and offers a highly attractive income opportunity to our distributors.

Product and Market Diversification. We offer a broad range of products across our three primary product segments. For the fiscal year ended December 31, 2003, 43.1% of our net sales were in weight management products, 43.6% in inner nutrition products, 9.1% in Outer Nutrition® products and the remaining 4.2% in literature and promotional materials. For the three months ended March 31, 2004, 43.8% of our net sales were in weight management products, 42.9% in inner nutrition products, 9.1% in Outer Nutrition® products and the remaining 4.2% in literature and promotional materials. Additionally, the geographic diversity of our markets mitigates our financial exposure to any particular market. For the fiscal year ended December 31, 2003, 36.6% of our net sales were in The Americas, 38.7% in Europe, 14.4% in Asia/Pacific Rim and 10.3% in Japan. For the three months ended March 31, 2004, 34.3% of our net sales were in The Americas, 42.2% in Europe, 14.2% in Asia/Pacific Rim and 9.3% in Japan.

Scalable and Profitable Business Model. We believe our business model is attractive due to our significant and sustained profitability and our ability to scale to new market segments and more distributors. We require no company-employed sales force to market and sell our products and our distributor compensation varies directly with sales. Lastly, our distributors bear the majority of our consumer marketing expenses, and supervisors sponsor and coordinate a large share of distributor recruiting and training initiatives.

Strong Cash Flow Generation in a Leveraged Operating Environment. Since the Acquisition, we have generated a significant amount of cash flow and reduced our net debt (total debt less cash and cash equivalents). At July 31, 2002, the date of the Acquisition, we had net debt of approximately $289.3 million. At December 31, 2003, we had reduced our net debt to approximately $168.9 million, an aggregate reduction of approximately $120.4 million over seventeen months. We currently expect our business will continue to generate strong cash flow, which we intend to use to service our debt and reduce indebtedness.

5

Experienced Management Team. Since the Acquisition, we have worked to strengthen our management team with experienced executives focused on making Herbalife the leading weight management and nutrition company worldwide. Since 2002, we have made several important additions to our management team that we believe will strengthen our capabilities in product development, operations and marketing. Our key hires are as follows:

Our management team also draws significant support from our many veteran members, including William D. Lowe (joined in 1998), our Senior Vice President, Principal Financial and Accounting Officer; Carol Hannah (joined in 1984), our President of Distributor Communications and Support and former Co-President; and Brian L. Kane (joined in 1993), our President of Herbalife's European region and former Co-President.

In addition, we recently extended an offer to Richard Goudis to serve as our new Chief Financial Officer for a three-year term commencing on June 14, 2004, which Mr. Goudis accepted on June 1, 2004.

Business Strategy

Our business strategy is comprised of the following principal elements:

Increase Brand Recognition with Science-based Weight Management and Nutrition Products. Since the Acquisition, we have significantly increased our emphasis on scientific research in the weight management and nutrition arena and increased our focus on developing products with scientifically demonstrated efficacy. Our underlying initiative is to continue to enhance our reputation as an industry leading and well-respected company committed to scientific research. For example, in 2003, we

6

introduced Niteworks™, a cardiovascular enhancement product developed by Dr. Louis Ignarro, a Nobel Laureate in Medicine. In addition, we recently funded and opened the Mark Hughes Lab for Cellular and Molecular Nutrition at UCLA. We have also established our own Scientific Advisory Board, which is committed to advancing the field of nutritional science. We are well positioned to take advantage of current worldwide consumer trends indicating that individuals are turning more and more towards weight management and nutritional products to address weight, fitness and age-related health concerns. We believe our focus on nutritional science will result in meaningful product enhancements and give consumers increased confidence in our products.

Provide Superior Personal Interaction, Care and Support for Our Customers. We believe the direct sales model, the method we have used since we began operations in February 1980, is the most attractive and effective way to sell our products in a manner that provides superior personal interaction, care and support for our customers. Sales of our products are strengthened by ongoing personal contact between retail consumers and distributors, thereby enhancing the education of consumers in the weight management and nutrition markets. In turn, the motivation of consumers to begin and maintain weight management programs for healthy living is similarly enhanced. We also believe that sales of our weight management and inner nutrition products are strengthened by the first-hand, testimonial proof of product effectiveness provided by many of our distributors, who are consumers of our products themselves.

Enhance the Visibility of Herbalife and Consumer Access to Herbalife Products. Our distributors are the only access point for consumers to purchase Herbalife products. While this distribution strategy is highly effective, we believe that we can assist our distributors in reaching a broader consumer base by increasing the visibility of Herbalife and its products. To accomplish this, we intend to supplement our distributors' selling efforts with Herbalife-sponsored marketing and public relations campaigns designed to generate consumer demand for our products. To allow consumers to access our products more easily, we are exploring implementing new ways for consumers to locate distributors, including internet-based referral systems and other new access points to Herbalife products.

Increase Market Penetration. Herbalife has historically grown principally by entering into new markets. Because Herbalife has already succeeded in entering into the most attractive markets for our products and distribution system, an increasingly important part of our strategy for continued growth is to increase the number and range of our products available in existing markets. We believe this will drive sales growth through increased penetration in each of our country markets around the world.

Increase Distributor Productivity and Retention. We recognize that in addition to high-quality products and a rewarding distributor compensation plan, the success of our business depends on the support and training of our distributors. We are strengthening our distributor support services by enhancing customer service capabilities at our call centers, offering greater business-building opportunities through the internet, creating new business support initiatives and offering enriched reward recognition programs. To further enhance distributor productivity and improve retention, we are developing new educational training programs aimed at assisting distributors with their sales, marketing and recruiting techniques. Extensive training opportunities enable distributors to not only develop invaluable business-building and leadership skills, but also to become experts in our products and offer customers sound advice on weight management, nutrition and personal care. By placing a top priority on training, we build credibility among our distributors and further establish Herbalife as an industry leader.

Improve Margins through Expense Management. During the last two years, we have implemented certain product manufacturing and other sustainable expense reduction initiatives that have already resulted in significant improvements in financial performance. We are focused on realizing savings through cost control of corporate expenses and continued focus on the implementation of the above initiatives. Through these initiatives and our improvement in net sales, we have improved our EBITDA from $86.8 million (8.5% of net sales) in 2001 to $167.7 million (14.5% of net sales) in 2003. We

7

believe the combination of reduced product costs and our continued control of corporate spending will enhance profitability and cash flow.

The Recapitalization of Holdings and Related Transactions

The proceeds of the offering of the Outstanding Notes, together with available cash, was used as a part of a recapitalization of Holdings, which consisted of (i) the redemption of all of Holdings' outstanding 12% Series A Cumulative Convertible Preferred Shares, which we refer to herein as the "Preferred Shares," including shares issued upon the exercise of warrants to purchase the Preferred Shares, which we refer to herein as the "Warrants;" (ii) the purchase of all of Holdings' outstanding 15.5% Senior Notes due 2011, which we refer to herein as the "Senior Notes;" (iii) the reduction of outstanding amounts under Herbalife's senior credit facilities; and (iv) the payment of related fees and expenses (collectively, the "Transactions").

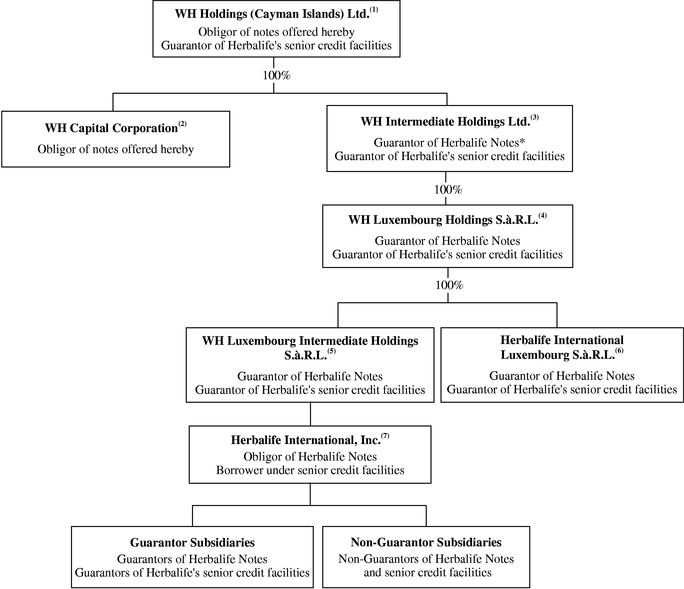

Corporate Structure

International activities are an important part of our business. In 2003, international sales accounted for approximately 76% of our net sales. Our ultimate parent company is organized in the Cayman Islands, and its immediate subsidiaries are organized either in the Cayman Islands or in Luxembourg in accordance with our foreign holding and operating company structure. We believe that this foreign holding and operating company structure provides us with an effective platform to organize our international business activities and to take advantage of favorable environments to implement our international business, operating and financial strategies.

8

The chart below illustrates our organizational structure after giving effect to the Transactions:

(footnotes on following page)

9

(footnotes from preceding page)

10

Summary of the Terms of the Exchange Offer

The following is a summary of the principal terms of the exchange offer. A more detailed description is contained in the section "The Exchange Offer." The term "Outstanding Notes" refers to our outstanding 91/2% Notes due 2011, and the terms "New Notes" and "Notes" refer to our 91/2% due 2011. The term "indenture" refers to the indenture that governs both the Outstanding Notes and the New Notes.

| The Exchange Offer | We are offering to issue registered New Notes in exchange for a like principal amount and like denomination of our Outstanding Notes. We are offering to issue these registered New Notes to satisfy our obligations under a registration rights agreement that we entered into with the initial purchaser of the Outstanding Notes when we sold the Outstanding Notes in a transaction that was exempt from the registration requirements of the Securities Act. The terms of the New Notes offered in the exchange offer are substantially identical to those of the Outstanding Notes. You may tender your Outstanding Notes for exchange by following the procedures described under the caption "The Exchange Offer." | |||

Registration Rights Agreement |

We sold the Outstanding Notes on March 8, 2004 to the initial purchaser in a transaction that was exempt from the registration requirements of the Securities Act. In connection with the sale, we entered into a registration rights agreement with the initial purchaser which grants the holders of the Outstanding Notes specified exchange and registration rights. This exchange offer satisfies those rights, which terminate upon consummation of the exchange offer. You will not be entitled to any exchange or registration rights with respect to the New Notes. |

|||

Expiration Date |

The exchange offer will expire at 5:00 p.m., New York City time, on July 9, 2004, which is 30 days after the commencement of the exchange offer, unless we extend it. |

|||

Withdrawal |

You may withdraw the tender of any Outstanding Notes pursuant to the exchange offer at any time prior to the Expiration Date. We will return, as promptly as practicable after the expiration or termination of the exchange offer, any Outstanding Notes not accepted for exchange for any reason without expense to you. |

|||

Interest on the Notes |

Interest on the New Notes will accrue from the date of the original issuance of the Outstanding Notes or from the date of the last payment of interest on the Outstanding Notes, whichever is later. No additional interest will be paid on Outstanding Notes tendered and accepted for exchange. |

|||

Conditions to the Exchange Offer |

The exchange offer is subject to customary conditions, some of which we may waive. |

|||

11

Procedures for Tendering Outstanding Notes |

If you wish to accept the exchange offer, you must complete, sign and date the accompanying letter of transmittal in accordance with the instructions in the letter of transmittal, and deliver the letter of transmittal, along with the Outstanding Notes and any other required documentation, to the exchange agent. |

|||

By executing the letter of transmittal, you will represent to us that, among other things: |

||||

• |

any New Notes that you receive will be acquired in the ordinary course of your business; |

|||

• |

you are not participating, and you have no arrangement or understanding with any person to participate, in the distribution of the New Notes; |

|||

• |

you are not our "affiliate", as defined in Rule 405 of the Securities Act or a broker-dealer tendering Outstanding Notes acquired directly from us; and |

|||

• |

if you are not a broker-dealer, you will also be representing that you are not engaged in and do not intend to engage in a distribution of the New Notes. |

|||

Each broker-dealer receiving New Notes for its own account in exchange for Outstanding Notes must acknowledge that it will deliver a prospectus meeting the requirements of the Securities Act in connection with any resale of the New Notes. The letter of transmittal states that, by making this acknowledgement and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. A broker-dealer who acquired the Outstanding Notes for its own account as a result of market-making or other trading activities may use this prospectus for an offer to resell, resale or other transfer of the New Notes. |

||||

We will accept for exchange any and all Outstanding Notes which are properly tendered (and not withdrawn) in the exchange offer prior to the Expiration Date. The New Notes issued pursuant to the exchange offer will be delivered promptly following the Expiration Date. See "The Exchange Offer—Acceptance of Outstanding Notes for Exchange" beginning on page 30 of this prospectus. |

||||

Special Procedures for Beneficial Owners |

If you are a beneficial owner whose Outstanding Notes are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender such Outstanding Notes in the exchange offer, please contact the registered holder as soon as possible and instruct them to tender your Outstanding Notes on your behalf and comply with our instructions set forth elsewhere in this prospectus. |

|||

12

Guaranteed Delivery Procedures |

If you cannot meet the Expiration Date deadline, or you cannot deliver your Outstanding Notes, the letter of transmittal or any other documentation on time, then you must surrender your Outstanding Notes according to the guaranteed delivery procedures set forth under "The Exchange Offer—Procedures for Tendering Outstanding Notes—Guaranteed Delivery" beginning on page 33 of this prospectus. |

|||

Acceptance of Outstanding Notes and Delivery of New Notes |

Upon consummation of the exchange offer, we will accept any and all Outstanding Notes that are properly tendered in the exchange offer and not withdrawn prior to 5:00 p.m., New York City time, on the Expiration Date. The New Notes issued pursuant to the exchange offer will be delivered promptly after acceptance of the tendered Outstanding Notes. |

|||

U.S. Federal Income Tax Considerations |

Your exchange of Outstanding Notes for New Notes to be issued in the exchange offer will not result in any gain or loss to you for U.S. federal income tax purposes. |

|||

Use of Proceeds |

We will not receive any cash proceeds from the exchange offer. |

|||

Exchange Agent |

The Bank of New York. |

|||

Consequences of Failure to Exchange your Outstanding Notes |

Outstanding Notes that are not tendered, or that are tendered but not accepted, will continue to be subject to the restrictions on transfer that are described in the legend on those notes. In general, you may offer or sell your Outstanding Notes only if they are registered under, or offered or sold under an exemption from, the Securities Act and applicable state securities laws. We, however, will have no further obligation to register the Outstanding Notes. If you do not participate in the exchange offer, the liquidity of your Outstanding Notes could be adversely affected. |

|||

Consequences of Exchanging Your Outstanding Notes |

Based on interpretations of the staff of the SEC, we believe that you may offer for resale, resell or otherwise transfer the New Notes that we issue in the exchange offer without complying with the registration and prospectus delivery requirements of the Securities Act if you make the representations that appear above under the heading "—Procedures for Tendering Outstanding Notes." |

|||

If any of these conditions is not satisfied and you transfer any New Notes issued to you in the exchange offer without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We will not be responsible for or indemnify you against any liability you may incur. |

||||

13

Summary of the Terms of the Notes

The terms of the New Notes we are issuing in this exchange offer and the Outstanding Notes are identical in all material respects, except the New Notes offered in the exchange offer:

A brief description of the material terms of the Notes follows:

| Issuers | WH Holdings (Cayman Islands) Ltd., a Cayman Islands exempted limited liability company and its wholly-owned subsidiary WH Capital Corporation, a Nevada corporation. | |

Securities Offered |

$275,000,000 aggregate principal amount of 91/2% Notes due 2011. |

|

Maturity |

April 1, 2011. |

|

Interest |

The Notes will bear interest at the rate of 91/2% per year from March 8, 2004, payable semi-annually, in arrear, on April 1 and October 1 of each year, commencing on October 1, 2004. |

|

Ranking |

The Notes will be our general unsecured obligations, ranking: |

|

• equally with any of our existing and future senior indebtedness (other than Holdings' guarantee of Herbalife's obligations under its senior secured credit facilities, to which the Notes offered hereby will be contractually subordinated); and |

||

• senior to all of our future subordinated indebtedness. |

||

The Notes will be effectively subordinated to all existing and future indebtedness and other liabilities of our subsidiaries. |

||

As of March 31, 2004, our subsidiaries had total indebtedness of $243.2 million to which the Notes will be effectively subordinated in right of payment and that, among other things, limit our ability to access the value or cash flow of our subsidiaries. |

||

Guarantees |

Generally, our obligations under the Notes will not be guaranteed by any of our subsidiaries. Under certain circumstances, however, our subsidiaries may be required to guarantee our obligations under the Notes. See "Description of Notes—Limitations on Indebtedness." |

|

Optional Redemption |

We may redeem some or all of the Notes at any time and from time to time on or after April 1, 2008, at a redemption price equal to 100% of the principal amount plus a premium declining ratably to par, plus accrued and unpaid interest and liquidated damages, if any, to the redemption date. |

|

14

At any time prior to April 1, 2007, we may use the proceeds of certain equity offerings to redeem up to 40% of the aggregate principal amount of Notes originally issued under the indenture and all or a portion of any additional Notes issued after the date of the indenture, in each case at a redemption price equal to 109.50% of the principal amount, plus accrued and unpaid interest and liquidated damages, if any, to the redemption date. |

||

In addition, at any time and from time to time prior to April 1, 2008, we may redeem some or all of the Notes at a redemption price equal to 100% of the principal amount plus a make-whole premium, plus accrued and unpaid interest and liquidated damages, if any, to the redemption date. |

||

Change of Control |

Upon the occurrence of a change of control, we may be required to purchase the Notes at 101% of their principal amount plus accrued and unpaid interest, if any, to the purchase date. |

|

Certain Covenants |

The indenture governing the Notes contains covenants that will limit our and our subsidiaries' ability to, among other things: |

|

• pay dividends, redeem share capital or capital stock and make other restricted payments and investments; |

||

• incur additional debt or issue preferred shares; |

||

• allow the imposition of dividend or other distribution restrictions on our subsidiaries; |

||

• create liens on assets; |

||

• engage in transactions with affiliates; |

||

• guarantee other indebtedness of Holdings; and |

||

• merge, consolidate or sell all or substantially all of our assets and the assets of our subsidiaries. |

Federal Income Tax Consequences

See "United States Federal Income Tax Consequences" starting on page 153 of this prospectus.

Additional Information

Herbalife's principal executive offices are located at 1800 Century Park East, Los Angeles, California 90067. Herbalife's telephone number is (310) 410-9600.

The principal executive offices of Holdings and its subsidiaries are located c/o Whitney at 177 Broad Street, Stamford, Connecticut 06901. Their telephone number is (203) 973-1400.

Risk Factors

This investment involves risks. Before deciding to surrender your Outstanding Notes for New Notes pursuant to this exchange offer, you should carefully consider the matters set forth under the heading "Risk Factors" beginning on page 17 of this prospectus and all other information contained in this prospectus.

15

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL DATA

The following table sets forth certain of our historical financial data. We have derived the summary historical consolidated financial data as of December 31, 2002 and 2003 and for the year ended December 31, 2001, the seven month period ended July 31, 2002, the five month period ended December 31, 2002, and the year ended December 31, 2003, from our audited financial statements and the related notes included elsewhere in this prospectus. We have derived the summary historical consolidated financial data for the three months ended March 31, 2003 and as of and for the three months ended March 31, 2004 from the unaudited financial statements and related notes included elsewhere in this prospectus. The summary historical financial data set forth below are not necessarily indicative of the results of future operations and should be read in conjunction with our audited consolidated financial statements, the selected consolidated historical financial data and the unaudited financial statements and, in each case, the related notes included elsewhere in this prospectus, the discussion under the heading "Management's Discussion and Analysis of Financial Condition and Results of Operations," and the historical consolidated financial statements and accompanying notes included elsewhere in this prospectus.

We present EBITDA and adjusted EBITDA because management believes it provides useful information regarding our ability to service and/or incur debt and that it provides a more comparable measure of our profitability. However, such a measure is not in accordance with GAAP. You should not consider EBITDA in isolation from or as a substitute for net income, cash flows from operating activities and other consolidated income or cash flow statement data prepared in accordance with accounting principles generally accepted in the United States or as a measure of profitability or liquidity. Adjusted EBITDA is calculated by adding back to EBITDA buy-out transaction expenses and other non-recurring expenses relating to the Acquisition. Adjusted EBITDA, as presented, may not be comparable to similarly titled measures reported by other companies.

For purposes of the presentation below, the pre-Acquisition and post-Acquisition periods for 2002 have been combined in order to facilitate comparisons. The combined information is not necessarily indicative of what actual results would have been for the year ended December 31, 2002.

| |

Historical |

|||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year ended December 31, 2001 |

January 1 to July 31, 2002 |

August 1 to December 31, 2002 |

Year ended December 31, 2002 |

Year ended December 31, 2003 |

Three Months Ended March 31, 2003 |

Three Months Ended March 31, 2004 |

|||||||||||||||

| |

(dollars in thousands) |

|||||||||||||||||||||

| |

(predecessor) |

(predecessor) |

(successor) |

(predecessor and successor combined) |

(successor) |

(successor) |

(successor) |

|||||||||||||||

| Operations: | ||||||||||||||||||||||

| Net sales | $ | 1,020,130 | $ | 644,188 | $ | 449,524 | $ | 1,093,712 | $ | 1,159,433 | $ | 280,039 | $ | 324,053 | ||||||||

| Gross profit | 778,608 | 503,635 | 354,523 | 858,158 | 923,648 | 223,079 | 260,435 | |||||||||||||||

| Operating income(1) | 68,775 | 14,304 | 52,889 | 67,193 | 107,036 | 39,192 | 36,736 | |||||||||||||||

| Net income (loss) | 42,588 | 9,212 | 14,005 | 23,217 | 36,847 | 16,870 | (485 | ) | ||||||||||||||

Other Financial Data: |

||||||||||||||||||||||

| EBITDA(2) | 86,831 | 26,026 | 64,313 | 90,339 | 162,641 | 45,581 | 48,142 | |||||||||||||||

| Adjusted EBITDA(2) | $ | 86,831 | $ | 80,734 | $ | 70,496 | $ | 151,230 | $ | 167,733 | 45,923 | 48,142 | ||||||||||

| Adjusted EBITDA margin(3) | 8.5 | % | 12.5 | % | 15.7 | % | 13.8 | % | 14.5 | % | 16.4 | % | 14.9 | % | ||||||||

| Depreciation and amortization | $ | 18,056 | $ | 11,722 | $ | 11,424 | $ | 23,146 | $ | 55,605 | 6,389 | 11,406 | ||||||||||

| Capital expenditures(4) | 14,751 | 6,799 | 3,599 | 10,398 | 20,435 | 2,720 | 5,422 | |||||||||||||||

| Ratio of earnings to fixed charges(5) | 8.1 | 3.6 | 2.0 | 2.3 | 2.2 | 3.2 | 1.4 | |||||||||||||||

Balance Sheet Data: |

||||||||||||||||||||||

| Cash, cash equivalents and marketable securities(6) | $ | 201,181 | $ | 76,024 | $ | 156,380 | $ | 123,002 | ||||||||||||||

| Receivables, net | 27,609 | 29,026 | 31,977 | 33,775 | ||||||||||||||||||

| Inventories | 72,208 | 56,868 | 59,397 | 64,134 | ||||||||||||||||||

| Total working capital(7) | 177,813 | 7,186 | 1,521 | 18,789 | ||||||||||||||||||

| Total assets | 470,335 | 855,705 | 903,964 | 873,016 | ||||||||||||||||||

| Total debt | 10,612 | 340,759 | 325,294 | 510,622 | ||||||||||||||||||

| Shareholders' equity | 260,916 | 191,274 | 237,788 | 16,776 | ||||||||||||||||||

16

The following table represents a reconciliation of net income to EBITDA and adjusted EBITDA:

| |

Historical |

||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Year ended December 31, 2001 |

January 1 to July 31, 2002 |

August 1 to December 31, 2002 |

Year ended December 31, 2002 |

Year ended December 31, 2003 |

Three Months Ended March 31, 2003 |

Three Months Ended March 31, 2004 |

||||||||||||||||

| |

(dollars in thousands) |

||||||||||||||||||||||

| |

(predecessor) |

(predecessor) |

(successor) |

(predecessor and successor combined) |

(successor) |

(successor) |

(successor) |

||||||||||||||||

| Net Income | $ | 42,588 | $ | 9,212 | $ | 14,005 | $ | 23,217 | $ | 36,847 | $ | 16,870 | $ | (485 | ) | ||||||||

| Minority Interest | 725 | 189 | — | 189 | — | — | — | ||||||||||||||||

| Income Taxes | 28,875 | 6,267 | 14,986 | 21,253 | 28,721 | 12,374 | 9,849 | ||||||||||||||||

| Interest (Income) Expenses, Net | (3,413 | ) | (1,364 | ) | 23,898 | 22,534 | 41,468 | 9,948 | 27,372 | ||||||||||||||

| Depreciation and Amortization | 18,056 | 11,722 | 11,424 | 23,146 | 55,605 | 6,389 | 11,406 | ||||||||||||||||

| EBITDA | 86,831 | 26,026 | 64,313 | 90,339 | 162,641 | 45,581 | 48,142 | ||||||||||||||||

| Merger Transaction Expenses(a) | — | 54,708 | 6,183 | 60,891 | — | — | — | ||||||||||||||||

| Other(b) | — | — | — | — | 5,092 | 342 | — | ||||||||||||||||

| Adjusted EBITDA | $ | 86,831 | $ | 80,734 | $ | 70,496 | $ | 151,230 | $ | 167,733 | $ | 45,923 | $ | 48,142 | |||||||||

17

Investing in the Notes involves a high degree of risk. You should carefully consider the following risk factors in addition to the other information contained in this prospectus before deciding to surrender your Outstanding Notes for New Notes pursuant to this exchange offer. The risks described below are not the only ones we face. Other risks, including those that we do not currently consider material or may not currently anticipate, may impair our business.

Risks Related to our Business

Our failure to maintain our distributor relationships could adversely affect our business.

We distribute our products exclusively through independent distributors, and we depend upon them directly for substantially all of our sales. Accordingly, our success depends in significant part upon our ability to attract, retain and motivate a large base of distributors. The loss of a significant number of distributors could materially adversely affect sales of our products and could impair our ability to attract new distributors. Moreover, in our efforts to attract and retain distributors, we compete with other network marketing organizations, including those in the weight management product, dietary and nutritional supplement, and personal care and cosmetic product industries.

Regulatory matters governing our industry could have a significant negative effect on our business.

In both domestic and foreign markets, we are affected by extensive laws, governmental regulations, administrative determinations, court decisions and similar constraints. Such laws, regulations and other constraints may exist at the federal, state or local levels in the United States and at all levels of government in foreign jurisdictions.

Product Regulations.

The formulation, manufacturing, packaging, labeling, distribution, importation, sale and storage of our products are subject to extensive regulation by various federal agencies, including the Food and Drug Administration ("FDA"), the Federal Trade Commission (the "FTC"), the Consumer Product Safety Commission and the United States Department of Agriculture and by various agencies of the states, localities and foreign countries in which our products are manufactured, distributed and sold. Our failure or our distributors' failure to comply with those regulations or new regulations could lead to the imposition of significant penalties or claims and could materially adversely affect our business. In addition, the adoption of new regulations or changes in the interpretations of existing regulations may result in significant compliance costs or discontinuation of product sales and may adversely affect the marketing of our products, resulting in significant loss of sales revenues.

Good Manufacturing Practices.

On March 7, 2003, the FDA proposed a new regulation to require current good manufacturing practices in the manufacturing, packing and holding of dietary supplements. We are evaluating this proposal with respect to its potential impact upon the various contract manufacturers that we use to manufacture our products, and cannot assure you of the effect such proposals may have on our contract manufacturers or our business.

Product Claims, Advertising and Distributor Activities.

Our failure to comply with laws and regulations regarding product claims and advertising, including direct claims and advertising by us, as well as claims and advertising and other conduct by distributors for which we may be held responsible, may result in enforcement actions and the imposition of penalties or otherwise materially and adversely affect the distribution and sale of our products. Should

18

distributor activities in our existing markets be found to violate applicable governmental laws or regulations, it could result in governmental or private actions against us in markets where we operate. In response to complaints from local regulators in some of our markets, we imposed a ban in March 2002 on the inappropriate use by distributors of outdoor signage. We cannot assure you as to the effect such ban will have. Given the size of our distributor force, we cannot ensure that all distributors will comply with applicable legal requirements.

Network Marketing System.

Our network marketing system is subject to a number of federal and state regulations administered by the FTC and various state agencies as well as regulations in foreign markets administered by foreign agencies. Regulations applicable to network marketing organizations generally are directed at ensuring that product sales ultimately are made to consumers and that advancement within an organization is based on sales of the organization's products rather than investments in the organization or other non-retail sales related criteria. The regulatory requirements concerning network marketing systems do not include "bright line" rules and are inherently fact-based.

We are also subject to the risk of private party challenges to the legality of our network marketing system. The multi-level marketing programs of other companies have been successfully challenged in the past, and in a current lawsuit, allegations have been made challenging the legality of our network marketing system. An adverse judicial determination with respect to our network marketing system, or in proceedings not involving us directly but which challenge the legality of multi-level marketing systems, could have a material adverse effect on our business. We are subject to the risk that, in one or more markets, our marketing system could be found not to be in compliance with applicable law or regulations. The failure of our network marketing system to comply with such regulations could have a material adverse effect on our business in a particular market or in general.

Transfer Pricing and Similar Regulations.

In many countries, including the United States, we are subject to transfer pricing and other tax regulations designed to ensure that appropriate levels of income are reported as earned by our United States or local entities and are taxed accordingly. In addition, our operations are subject to regulations designed to ensure that appropriate levels of customs duties are assessed on the importation of our products. Herbalife currently is subject to pending or proposed audits that are at various levels of review, assessment or appeal in a number of jurisdictions involving transfer pricing issues, income taxes, value added taxes, withholding taxes and related interest and penalties in material amounts. In some circumstances, additional taxes, interest and penalties have been assessed, and we will be required to litigate to reverse the assessments. Ultimate resolution of these matters may take several years, and the outcome is uncertain.

Taxation Relating to Distributors.

Our distributors are subject to taxation, and in some instances, legislation or governmental agencies impose an obligation on us to collect taxes, such as value added taxes, and to maintain appropriate records. In addition, we are subject to the risk in some jurisdictions of being responsible for social security and similar taxes with respect to our distributors.

Other Regulations.

We are also subject to a variety of other regulations in various foreign markets, including regulations pertaining to employment and severance pay requirements, import/export regulations and antitrust issues. Our failure to comply, or assertions that we failed to comply, with these regulations could have a material adverse effect on our business in a particular market or in general.

19

To the extent we decide to commence or expand operations in additional countries, government regulations in those countries may prevent or delay entry into or expansion of operations in those markets. In addition, the ability to sustain satisfactory levels of sales in our existing markets is dependent in significant part on our ability to introduce additional products into these markets. Government regulations in both our domestic and international markets, however, can delay or prevent the introduction, or require the reformulation or withdrawal, of some of our products.

Adverse publicity associated with our products or our ingredients could adversely affect our business.

Because we are highly dependent upon consumers' perception of the safety and quality of our products and ingredients as well as similar products distributed by other companies, we could be adversely affected if any of our products or any similar products or ingredients distributed by other companies prove to be, or are asserted to be, harmful to consumers. In addition, because of our dependence upon consumer perceptions, any adverse publicity associated with illness or other adverse effects resulting from consumers' use or misuse of our products or any similar products distributed by other companies could have a material adverse impact on our business. Adverse publicity could also negatively affect our ability to attract, motivate and retain distributors.

The high level of competition in our industry could adversely affect our business.

The business of marketing weight management, inner nutrition and Outer Nutrition® products is highly competitive. These market segments include numerous manufacturers, distributors, marketers, retailers and physicians that actively compete for the business of consumers both in the United States and abroad. The market is highly sensitive to the introduction of new products or weight management plans, including various prescription drugs, which may rapidly capture a significant share of the market. While we own the proprietary rights to substantially all of our weight management and inner nutrition products, we cannot be sure that another company will not replicate one of our products. In addition, we anticipate that we will be subject to increasing competition in the future from sellers that utilize electronic commerce.

We are subject to significant competition for the recruitment of distributors from other network marketing organizations, including those that market weight management products, dietary and nutritional supplements, and personal care products as well as other types of products. Our ability to remain competitive depends, in significant part, on our success in recruiting and retaining distributors through an attractive compensation plan and other incentives. We cannot ensure that our programs for recruitment and retention of distributors will be successful.

Risks associated with our foreign operations.

A foreign government may impose trade or foreign exchange restrictions or increased tariffs, which could adversely affect our operations. We are also exposed to risks associated with foreign currency fluctuations. For instance, purchases from suppliers are generally made in U.S. dollars while sales to distributors are generally made in local currencies. Accordingly, strengthening of the U.S. dollar versus a foreign currency could have a negative impact on us. Although we engage in transactions to protect against risks associated with foreign currency fluctuations, we cannot be certain any hedging activity will effectively reduce our exchange rate exposure. Our operations in some markets also may be adversely affected by political, economic and social instability in foreign countries. As we continue to focus on expanding our existing international operations, these and other risks associated with international operations may increase. Approximately 76% of our net sales for the year ended December 31, 2003 were generated outside the United States.

20

A large portion of net sales is concentrated in a small number of countries.

Our earnings in future periods may be susceptible to various risks because of the concentration of net sales in a small number of countries. Of the 58 countries in which we operated as of March 31, 2004, the United States, Japan and Germany accounted for 19.8%, 9.2% and 6.9%, respectively, or 35.9% in the aggregate, of our total net sales. As a result, our performance is primarily dependent upon economic conditions and consumer demand for our products in these three countries.

One of our products constitutes a significant portion of our retail sales.

Our Formula 1 meal replacement product constitutes a significant portion of our retail sales, accounting for approximately 20% of net sales in 2003. If consumer demand for this product decreases significantly or we cease offering this product without a suitable replacement, our operations could be materially adversely affected.

Our ability to grow in the future will be more dependent on increased penetration of existing markets.

We have historically grown principally by entering into new markets. Because we have already succeeded in entering into the most attractive markets for our products and distribution system, an increasingly important part of our strategy for continued growth is to increase the number and range of our products available in existing markets. In addition, our growth will depend upon improved training and other activities that enhance distributor retention in our markets. We cannot assure you that our efforts to increase our market penetration and distributor retention in existing markets will be successful.

In addition, our success has been, and will continue to be, significantly dependent on our ability to manage growth through expansion and enhancement of our worldwide personnel and management, order processing and fulfillment, inventory and shipping systems and other aspects of operations. As we continue to expand our operations, the ability to manage this growth will represent an increasing challenge.

Product liability claims could hurt our business.

Our products consist of herbs, vitamins and minerals and other ingredients that are classified as foods or dietary supplements and are not subject to pre-market regulatory approval in the United States. We generally do not conduct or sponsor clinical studies for our products. As a marketer of dietary and nutritional supplements and other products that are ingested by consumers or applied to their bodies, we have been and may again be subjected to various product liability claims, including that: (i) the products contain contaminants; (ii) the products include inadequate instructions as to their uses; or (iii) the products include inadequate warnings concerning side effects and interactions with other substances. It is possible that widespread product liability claims and the resulting adverse publicity could negatively affect our business. In addition, our product liability insurance may fail to cover future product liability claims thereby requiring us to pay substantial monetary damages and adversely affecting our business (especially given the higher level of self-insurance we have accepted). Finally, we may become required to pay higher premiums and accept higher deductibles in order to secure adequate insurance coverage in the future.

We do not manufacture our own products so we must rely on independent third parties for the manufacture and supply of our products.

All of our products are manufactured by outside companies, except for a small amount of products manufactured in our own manufacturing facility in China. We cannot assure you that these outside manufacturers will continue to reliably supply products to us at the level of quality we require. In the event any of our third-party manufacturers were to become unable or unwilling to continue to provide

21

the products in required volumes and quality levels, we would be required to identify and obtain acceptable replacement manufacturing sources. There is no assurance that we will be able to obtain alternative manufacturing sources on a timely basis. An extended interruption in the supply of products would result in loss of sales. In addition, any actual or perceived degradation of product quality as a result of reliance on third party manufacturers may have an adverse effect on sales or result in increased product returns and buybacks.

Terrorist attacks or acts of war may seriously harm our business.

Terrorist attacks or acts of war may cause damage or disruption to us, our employees, our facilities and our customers, which could impact our revenues, costs and expenses, and financial condition. The terrorist attacks that took place in the United States on September 11, 2001 were unprecedented events that have created many economic and political uncertainties, some of which may materially adversely affect our business, results of operations, and financial condition. The potential for future terrorist attacks, the national and international responses to terrorist attacks, and other acts of war or hostility have created many economic and political uncertainties, which could materially adversely affect our business, results of operations, and financial condition in ways that we currently cannot predict.

A general economic downturn may reduce our revenues.

Worldwide economic conditions may affect demand for our products. Consumer purchases of our products may decline during recessionary periods and also may decline at other times when disposable income is lower.

A few of our shareholders collectively control us and have the power to cause the approval or rejection of all shareholder actions.

Affiliates of Whitney and Golden Gate own approximately 51% and 29%, respectively, of the voting power of our share capital as of March 31, 2004. Accordingly, the Equity Sponsors together currently have the power to cause the approval or rejection of any matter on which the shareholders may vote, including the Transactions. Certain shareholders are party to a shareholders' agreement that determines the composition of the Board of Directors. The Equity Sponsors' designees will constitute the majority of the Board of Directors. This control over corporate actions may delay, deter or prevent transactions that would result in a change of control. In addition, even if all shareholders other than the Equity Sponsors voted together as a group, they would not have the power to adopt any action or to block the adoption of any action favored by the Equity Sponsors if the Equity Sponsors act in concert. Moreover, the Equity Sponsors may have interests that are in addition to, or that vary from, yours.

Risks Related to the Notes

The market value of the New Notes could be materially adversely affected if only a limited number of New Notes are available for trading.

To the extent that a large amount of the Outstanding Notes are not tendered or are tendered and not accepted in the exchange offer, the trading market for the New Notes could be materially adversely affected. Generally, a limited amount, or "float," of a security could result in less demand to purchase such security and, as a result, could result in lower prices for such security. We cannot assure you that a sufficient number of Outstanding Notes will be exchanged for New Notes so that this does not occur.

There are consequences associated with failing to exchange the Outstanding Notes for the New Notes.

If you do not exchange your Outstanding Notes for New Notes in the exchange offer, you will still have the restrictions on transfer provided in the Outstanding Notes and the indenture. In general, the

22

Outstanding Notes may not be offered or sold unless registered or exempt from registration under the Securities Act, or in a transaction not subject to the Securities Act and applicable state securities laws. We do not plan to register the Outstanding Notes under the Securities Act.

Our substantial amount of consolidated debt could adversely affect our consolidated financial condition and prevent us from fulfilling our obligations under the Notes.

In connection with the consummation of the Transactions, we have incurred a substantial amount of debt. At March 31, 2004, our total debt was $510.6 million and our shareholders' equity was $16.4 million.

Our substantial amount of debt may have important consequences for us. For example, it may:

We are a holding company and the Notes are structurally subordinated to the debt of our subsidiaries.

We are a holding company and we conduct substantially all of our operations through our subsidiaries, primarily Herbalife. Our only material assets are our ownership interests in our subsidiaries. Our principal sources of cash are from external financings, dividends and advances from our subsidiaries and investments. The amount of dividends available to us from our subsidiaries depends largely upon each subsidiary's earnings and operating capital requirements. The terms of some of our subsidiaries' borrowing arrangements limit the transfer of funds to us, including Herbalife's senior subordinated notes and senior credit facilities. In addition, the ability of our subsidiaries to make any payments to us will depend on their business and tax considerations and legal restrictions. Our subsidiaries are separate and distinct legal entities and have no obligation, contingent or otherwise, to pay any amounts due pursuant to the Notes or to make any funds available therefor, whether by dividends, loans or other payments.

As a result of our holding company structure, the Notes will effectively rank junior to all existing and future debt, trade payables and other liabilities of our subsidiaries. Our right to receive any assets of any of our subsidiaries upon their liquidation or reorganization, and therefore the right of holders of the Notes to participate in those assets, will be subject to the prior claims of that subsidiary's creditors, including trade creditors. At March 31, 2004, in addition to trade debt and other liabilities, our subsidiaries had approximately $243.2 million of total indebtedness for borrowed money. In addition, the indenture governing the Notes permits, subject to specified limitations, our subsidiaries to incur additional debt.

23

Your right to receive payment on the Notes is junior to our secured obligations under our guarantee of our subsidiaries' senior credit facilities.

The Notes will be general unsecured obligations, junior in right of payment to all of our obligations under a guaranty of our subsidiaries' senior credit facilities. The Notes will not be secured by any of our assets, and as such will be effectively subordinated to any secured debt that we have now, including our guaranty of the borrowings under our subsidiaries' senior credit facilities, or may incur in the future to the extent of the value of the assets securing that debt.

In the event that we are declared bankrupt, become insolvent or are liquidated or reorganized, any debt that ranks ahead of the Notes will be entitled to be paid in full from our assets before any payment may be made with respect to the Notes. In any of the foregoing events, we cannot assure you that we would have sufficient assets to pay amounts due on the Notes. As a result, holders of the Notes may receive less, proportionally, than the holders of debt senior to the Notes. The subordination provisions of the indenture governing the Notes also provide that we can make no payment to you during the continuance of payment defaults on our senior debt, and payments to you may be suspended for a period of up to 179 days if a nonpayment default exists under our subsidiaries' senior credit facilities.

At March 31, 2004, the Outstanding Notes ranked junior to approximately $75.4 million of indebtedness under the senior credit facilities, all of which is secured.

To make payments on our debt, we will require a significant amount of cash; our ability to generate cash depends on many factors beyond our control.

Our ability to make payments on our debt, including the Notes, will depend on our ability to generate cash in the future. This, to some extent, is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control.

We cannot assure you that our subsidiaries' businesses will generate sufficient cash flow from operations or that future borrowings will be available to us in an amount sufficient to enable us to pay interest and principal on our debt or to fund our other liquidity needs. We may need to refinance all or a portion of our debt on or before maturity. We cannot assure you that we will be able to refinance any of our debt on commercially reasonable terms or at all.

We may not have access to the cash flow and other assets of our subsidiaries that may be needed to make payment on the Notes.

Our operations are conducted through our subsidiaries and our ability to make payment on the Notes is dependent on the earnings and the distribution of funds from our subsidiaries. However, none of our subsidiaries is obligated to make funds available to us for payment on the Notes. In addition, the terms of the agreements governing Herbalife's senior credit facilities and senior subordinated Notes significantly restrict our subsidiaries from paying dividends and otherwise transferring assets to us. Furthermore, Herbalife will be permitted under the terms of its senior credit facilities, senior subordinated notes and other indebtedness to incur additional indebtedness that may severely restrict or prohibit the making of distributions, the payment of dividends or the making of loans by our subsidiaries to us.

We cannot assure you that the agreements governing the current and future indebtedness of our subsidiaries will permit our subsidiaries to provide us with sufficient dividends, distributions or loans to fund scheduled interest and principal payments on the Notes when due. See "Description of Other Indebtedness."

24

The ability of some of our foreign subsidiaries to distribute cash may be restricted by local law.

Local laws governing some of our foreign subsidiaries may restrict the ability of those foreign subsidiaries to pay dividends and make distributions, loans or advances to us in some circumstances. For example, some foreign subsidiaries could be subject to restrictions on dividends or repatriations of earnings under applicable local law, monetary transfer restrictions and foreign currency exchange regulations in the jurisdictions in which these foreign subsidiaries operate. In any of the foregoing events, we cannot assure you that we would have sufficient assets to pay amounts due on the Notes.

The covenants in the Notes will limit, and the covenants in our subsidiaries' senior credit facilities limit, our and their discretion with respect to certain business matters.

The Notes will contain and our subsidiaries' senior credit facilities contain numerous financial and operating covenants that will restrict our and their ability to, among other things:

In addition, our subsidiaries' senior credit facilities require us to meet certain financial ratios and financial conditions, including minimum interest charge and fixed charge ratios and a maximum leverage ratio. Our and their ability to comply with these covenants may be affected by events beyond our control, including prevailing economic, financial and industry conditions. Failure to comply with these covenants could result in a default under the Notes and/or the senior credit facilities, causing all amounts thereunder to become due and payable.

Issuance of the Notes and the guarantees issued under certain circumstances by our domestic subsidiaries may be subject to fraudulent conveyance laws.

Under applicable provisions of the U.S. Bankruptcy Code or comparable provisions of state fraudulent transfer or conveyance laws, if at the time the issuer of the Notes incurred the debt evidenced by the Notes, or a domestic subsidiary guarantor incurred the debt evidenced by its guarantee, as the case may be, it either:

then, in each case, a court of competent jurisdiction could (i) avoid (i.e., cancel) in whole or in part, the Notes or the guarantee and direct the repayment of any amounts paid thereunder, (ii) subordinate

25

the Notes or the guarantee of such subsidiary guarantor, as the case may be, to our obligations to other existing and future creditors or (iii) take other actions detrimental to the noteholders.

A court would likely find that neither we nor any subsidiary guarantor received reasonably equivalent value or fair consideration for incurring our respective obligations under the Notes and guarantees unless we or the subsidiary benefited directly or indirectly from the Notes' issuance, including the application of the proceeds thereof. In other instances, courts have found that an issuer did not receive reasonably equivalent value or fair consideration if the proceeds of the issuance were paid to the issuer's shareholders, although we cannot predict how a court would rule in this case.

The test for determining solvency for purposes of the foregoing will vary depending on the law of the jurisdiction being applied. In general, a court would consider an entity insolvent either if the sum of its existing debts exceeds the fair value of all its property, or its assets' present fair saleable value is less than the amount required to pay the probable liability on its existing debts as they become due. For this analysis, "debts" includes contingent and unliquidated debts.

In the event that any of our subsidiaries are required to guarantee our obligations under the Notes, such guarantee will be limited in a manner intended to avoid it being deemed a fraudulent conveyance under applicable law.

We may not have the ability to raise the funds necessary to finance a change of control offer required by the indenture governing the Notes.